Yellow Network’s Trustless Trading and Token Launch – Interview with Alexis Serkia

0

0

During the 2025 edition of the Paris Blockchain Week, BeInCrypto sat down with Alexis Yellow, CEO of Yellow, a crypto project working on an entirely new paradigm based on Satoshi’s initial vision for Bitcoin.

He talks about the upcoming Yellow Tokens, a new smart contract mechanism, and making crypto projects more utility-driven.

Alexis, can you introduce yourself?I’m Alexis, a software engineer by background. I worked at the European Space Center early in my career, but my crypto journey started quite unexpectedly.

Back in 2013, an old friend from school reached out—he was working at Goldman Sachs and told me about a project that needed help. He said, “There are 12 people in Silicon Valley printing fake money.” That project turned out to be Ripple.

Ripple ended up being our first client, and that experience really helped me grasp the potential of crypto.

Despite the skepticism surrounding the space, I saw real innovation. Ripple’s CTO was a Bitcoin Core contributor, and Vitalik Buterin was involved with the team before Ethereum.

Actually, Buterin was planning to join Ripple. He was especially excited about their consensus mechanism, which inspired me, too.

So, we started in 2013 by doing market-making and tackling challenges in crypto liquidity and infrastructure.

One thing that always stuck with me was Satoshi’s idea: We need systems where trust isn’t a prerequisite. That idea shaped a lot of my thinking.

Around 2018–2019, I decided to start Yellow. We later merged with a French exchange technology company called OpenWare. Combining my market experience with their tech, we launched Yellow Network.

So, it’s a trading infrastructure designed to let institutions, like Société Générale, trade directly with major players like Binance without needing to trust them.

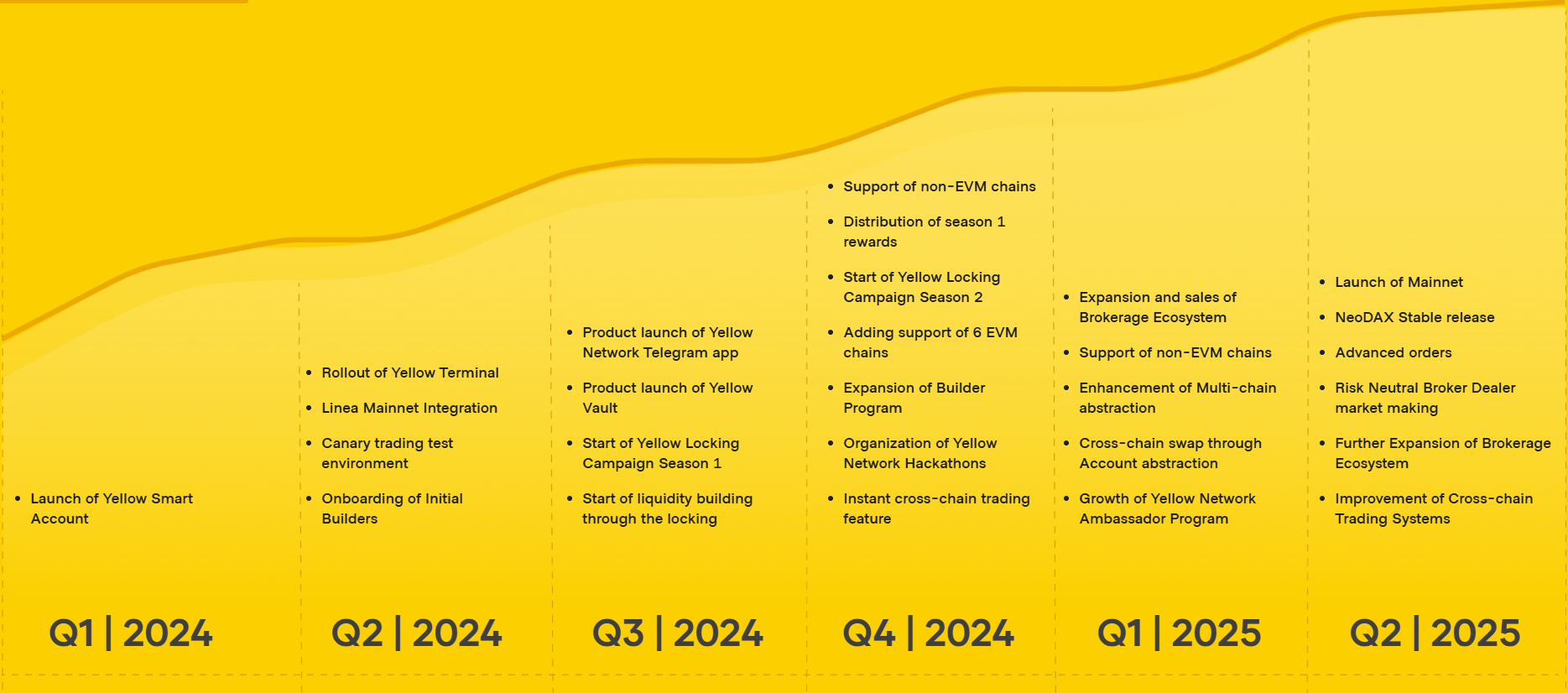

Yellow Network Roadmap. Source: Yellow Group

Trading with exchanges like Binance without trusting them, do you mean trust as a counterparty?

Yellow Network Roadmap. Source: Yellow Group

Trading with exchanges like Binance without trusting them, do you mean trust as a counterparty?

Exactly that’s at the core of Satoshi’s vision. At Yellow, we’re working on a different model of trustlessness using state channels, which represent a new paradigm compared to traditional blockchain systems like Bitcoin or Ethereum.

In those systems, you have tens of thousands of nodes, say, around 30,000, validating each transaction. It’s a powerful model for security, each validator has a financial incentive to be honest, and there’s no way to roll back a confirmed transaction.

The same applies to staking networks. But that structure just doesn’t work for high-frequency trading. You can’t have 30,000 nodes verifying every microsecond trade. It’s simply too slow and inefficient.

For example, some networks try to solve this by reducing the number of validators to 21, but that compromises the level of trust and decentralization. Our approach is fundamentally different. The Lightning Network inspires it, but we’ve taken it in a new direction.

With the Lightning Network, you can move money instantly by opening a state channel. At Yellow Network, we use similar state channels but instead of transferring funds directly, we transfer profit and loss in real time.

For instance, if you buy a Bitcoin for $100,000 and it rises 5%, the $5,000 profit is immediately transferred to your wallet. The trade is settled instantly, peer-to-peer, with cryptographic proof.

To ensure security and fairness, we’ve built a smart contract called ClearSync. If a counterparty refuses to settle, as we saw with the HyperLiquid issue recently, ClearSync can step in and arbitrate the trade.

It verifies the claim and, if valid, ensures the rightful party receives what they’re owed. So, it’s a trustless system that still allows for the speed and flexibility traders need.

It’s not using flash trading?No, it’s peer-to-peer trading. Nothing is faster or more efficient than a direct state channel between two parties. Profit is transferred instantly. That’s the core of this new paradigm: trustless trading, where settlement happens in real time.

Let’s say we’re trading and the connection drops, no problem. If I made a profit, it’s already secured. I might not receive the asset, like Bitcoin, but my profit in dollars is locked in. There’s no need to trust the other party to settle correctly.

Is it effective profit or a claim to profit?It’s effective profit, denominated in dollars or whatever currency is locked as collateral. Here’s how it works – two parties lock in $20,000 to trade Bitcoin. That amount represents the maximum they’re willing to risk.

If the trade results in a $5,000 profit for one side, that amount is instantly settled, even if the other party refuses to finalize the trade.

If both agree to settle, I send you $100,000, you send me one Bitcoin, and both our collaterals unlock.

Can you switch to stablecoin?Absolutely. In fact, we’re working with stablecoin issuers to create partnerships and potential investments in Yellow.

Can you give us an idea of the size of the Yellow Group? How many people are there? How many transactions do you process ?We haven’t officially launched. Before the war in Ukraine, we had a large team of over 100 people. Many have since relocated, mostly to Poland, but we still have staff in Ukraine. Right now, we’re about 50 people globally.

Meanwhile, you can track activity on our analytics site, BundleBear. On Polygon, we’re already the fourth most active app. On Linea, a new protocol by Consensys, we’re number one with over 229,000 users despite not being live yet.

We can see on your website that you are offering your technology so that you can list any token without going through a CEX or a DEX. Is that part of the project?Exactly. The Yellow Wallet is like a Layer 3; it lets users interact with any chain seamlessly. It now supports cross-chain swaps, like moving tokens from Polygon to Binance Smart Chain, with zero fees. It’s designed to remove friction from cross-chain trading.

Do you charge for your services?No, not for the state channels themselves. We don’t monetize trades directly. The Yellow token plays a security role, a “necessary evil,” like ETH or BTC.

Your security deposit gets burned if you behave badly and refuse to settle. It ensures honesty in a peer-to-peer environment. Think of it like a miner losing their reward for trying to cheat.

How do you make money from the usage of your service?The token economy is the foundation. Just like ETH or BTC derive value from usage and network participation, the Yellow token does too.

It’s needed to place security deposits in the network, and over time, its utility and adoption by industry players will drive its value.

If someone cheats, their token gets burned—creating deflationary pressure and reinforcing good behavior.

Is the token already traded?Not yet, but we’re planning to launch in the next couple of months. We’ll mint 10 billion Yellow tokens; ideally, that number stays close to that.

If too many tokens get burned, it could indicate issues in the system. It’s a built-in signal to monitor the health and integrity of the network.

Are you going to start it with an airdrop or something of the sort?No, we’re focused on utility-based distribution. Most tokens will be sold directly in the markets where they’re used. Ethereum didn’t launch with an airdrop. Neither did Bitcoin.

This is a B2B infrastructure project—just like Ethereum and Ripple. While the network is open to everyone, our core users are businesses and institutional players.

That said, the beauty of crypto is that the ecosystem is open. Anyone who believes in the project can get involved and benefit from the network effect, without needing to be a developer or an insider.

Anything important that we left out?Yes, very few cryptocurrencies are used in the real world today. Bitcoin has proven its value as a store of wealth.

Ethereum demonstrated its utility during the ICO boom. USDT fills a vital gap in places where dollars are hard to access.

We believe Yellow can become the fourth pillar. It’s solving a real need in crypto markets: scalable, trustless, high-frequency trading. And we’re making it open source so the whole industry can benefit.

I think this approach, state channels for speed and smart contracts for resolution, will redefine how trading infrastructure works. It’s ideal for gaming and other fast-paced applications where blockchains never truly fit.

Blockchain isn’t always the answer, especially if you’re using 30,000 nodes to validate a game move. That’s just not efficient.

With Yellow, the trading side is handled through cryptographic state channels not full decentralization. But if something goes wrong, we still fall back to a smart contract to arbitrate. That’s the balance we’re bringing.

Also, we’re working on a new ERC standard for this. In the next 3–4 years, I expect that 10–20% of new crypto projects will adopt this architecture.

Overall, We’re not just building a product, we’re introducing a new philosophy for how decentralized systems can operate more efficiently.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.