BTC Pricing Alert: Bitcoin Rebounds as Trump’s Trade War Comments Ignite Market Rally – Bybit x Block Scholes Report

0

0

DUBAI, UAE, April 28, 2025 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, has released its latest weekly crypto derivatives analytics report in partnership with Block Scholes. The report highlights a shift in market sentiment following upbeat remarks from US President Trump on trade negotiations with China, which coincided with a broad rally in both crypto and equity markets.

Earlier last week, Bitcoin showed signs of decoupling from US equities. Following the announcement of a 145% tariff on Chinese goods and comments from Trump, BTC climbed by more than 7% from April 21, 2025, alongside broader risk assets. Short-tenor implied volatility rose, and put-call skew turned upward by 5%, indicating that traders had been positioning for further gains at the time.

Key Highlights:

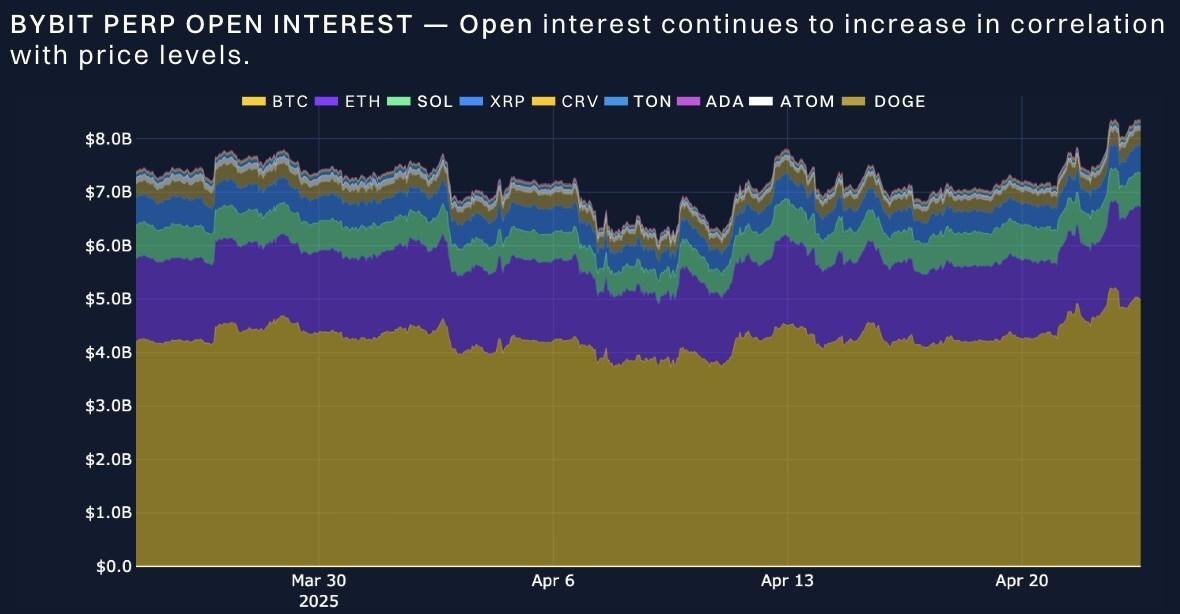

Perpetual open interest rises across tokens

Perpetual futures open interest climbed significantly by 20% last week, particularly for ETH. Trading volumes also increased, with April 7, 2025 recording the highest daily volume for the month. The spike followed Trump’s comment: “Forget markets for a second, we have all the advantages.”

BTC option open interest shows a mixed picture; put-call skew in short tenor sends positive signals

President Trump’s recent willingness to negotiate a trade deal with China’s President Xi triggered a relief rally across asset classes, including crypto. Bitcoin had already risen 7% since Apr 21, 2025 prior to Trump’s comments. Despite this rally, open interest in puts has outpaced calls, with options volume remaining relatively balanced.

It’s unclear if the demand for puts reflects a hedge against downside risks, or a bet against the upward movement. Meanwhile, perpetual funding rates are providing limited insight into sentiment. However, the recovery of the put-call skew at short tenors indicates that traders are seeking upside exposure to the rally — and are willing to pay for it.

ETH outperforms BTC by 1% in the past week, signals rebound expectations

ETH led last week’s rally in spot markets — a rare occurrence in past relief rallies. Options data shows ETH calls nearly double puts in open interest, with calls also dominating volume. This suggests traders expect ETH to close its recent performance gap with BTC and competing chains like SUI and SOL. ETH’s term structure also inverted again, reflecting expectations of near-term price action.

Access the Full Report

For detailed insights, readers may download the full report.

#Bybit / #TheCryptoArk /#BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.