Top Proof of Stake Coins in 2025 Ranked by Market Cap and Investor Growth

0

0

The narrative in crypto has shifted decisively: energy-waste mining is fading, staking is in. In 2025, the spotlight is on Top Proof of Stake (PoS) coins, those that combine legitimacy, utility, and growth potential. It’s not about hype, it’s about fundamentals.

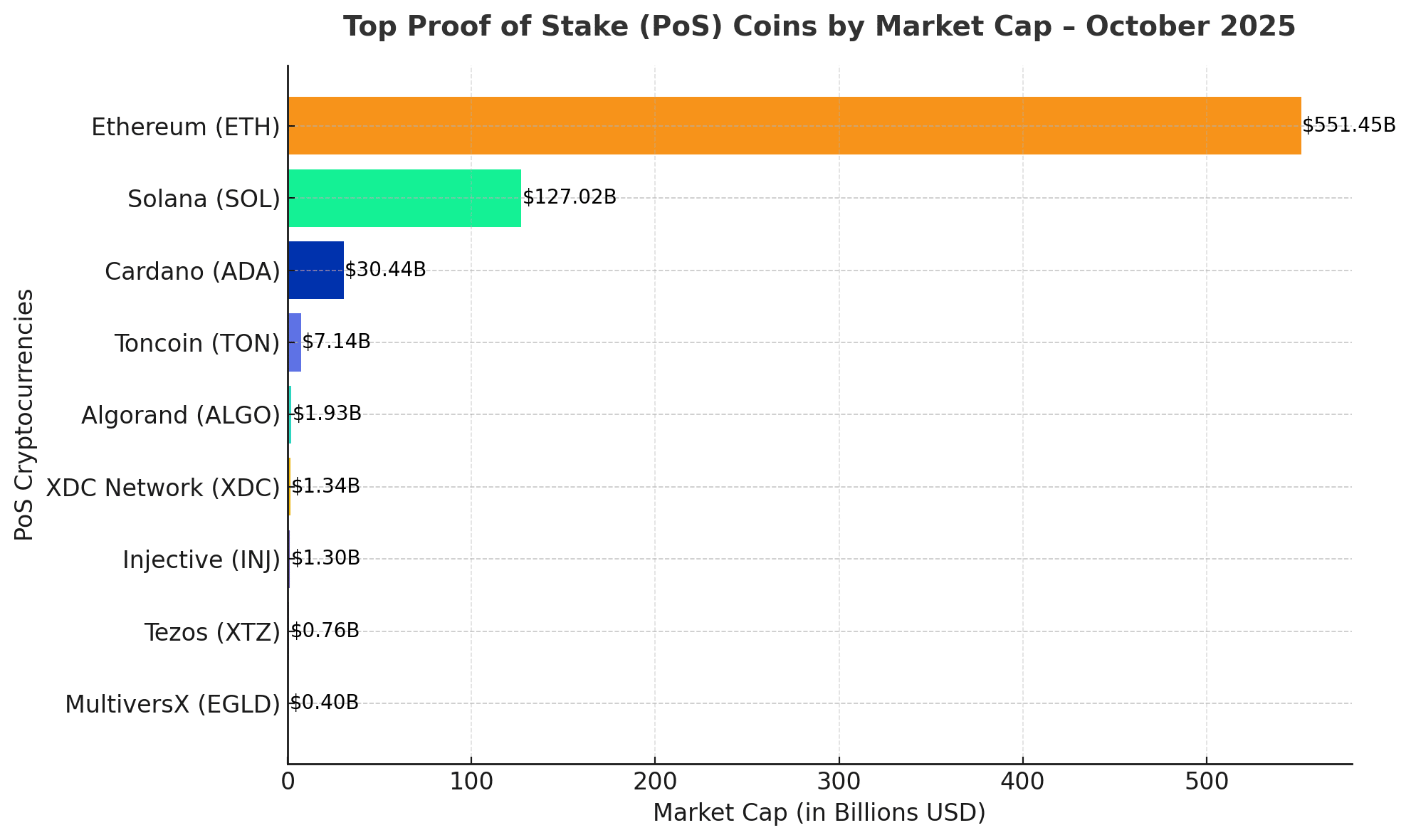

One recent deep dive named Ethereum, Solana, Cardano, Toncoin, Injective, XDC, Tezos, and MultiversX as standout PoS names by market cap. Ethereum, in particular, still towers: with over $540 billion valuation, it remains the benchmark top Proof of Stake coins to beat.

But capital doesn’t sit still. Solana’s speed, Cardano’s research grounds, and the nimble moves of Toncoin and Injective are pulling in attention, especially from traders looking for asymmetric upside.

Why These Top Proof of Stake Coins Matter Now

First, metrics are no longer optional, they’re table stakes. The best top Proof of Stake coins aren’t just well backed by capital. They also show strong staking ratios, healthy net inflows, and aligned validator decentralization.

Take Ethereum. Tens of millions of ETH are staked, and liquid staking instruments allow capital to stay mobile. That flexibility is a major advantage that many newer PoS chains struggle to match.

Look at XDC or Algorand, their market caps are modest compared to Ethereum or Solana, but their staking incentives and nimbleness may appeal to speculators.

Then there’s the technical angle: validators must behave, or risk getting slashed. Projects with robust slashing policies and frequent audits tend to build more trust. Meanwhile, projects pushing concentration of stake risk losing decentralization, critics warn top Proof of Stake coins must tread carefully there.

Ethereum (ETH): The King of Proof of Stake Still Reigns

Ethereum remains the undisputed heavyweight among the top proof-of-stake coins. With a market cap of $551.45 billion and trading around $4,568.64, the network continues to anchor the staking ecosystem. Roughly 120.7 million ETH are in circulation, with more than 10 million staked across validators.

Its flexibility is unmatched: through liquid-staking platforms, users can lock ETH while trading derivatives such as stETH. That dual utility keeps Ethereum not just relevant, but indispensable to the broader blockchain economy.

Solana (SOL): The Speed Demon of the PoS Era

Second in line is Solana, valued at $127.02 billion, trading near $232.86 with a 24-hour volume of $6.03 billion and 545 million SOL circulating. Solana’s secret weapon is raw speed, sub-second block times and minimal fees.

After recovering from earlier outages, its DeFi and NFT sectors have exploded again. One developer wrote on X, “Solana stopped trying to out-Ethereum Ethereum, it’s now defining its own internet.” That attitude reflects why Solana’s inclusion among the top Proof of Stake coins isn’t just technical; it’s cultural.

Cardano (ADA): Research-Driven and Relentlessly Patient

Cardano keeps proving that slow doesn’t mean stagnant. With a market cap of $30.44 billion and a price of $0.849884, it continues to balance deep academic roots with community-driven growth. About 35.8 billion ADA circulate, making it one of the most decentralized staking bases in crypto.

Founder Charles Hoskinson often reminds the community that “real innovation takes time.” Cardano’s methodical rollout of sidechains and scaling upgrades suggests that its long game is only beginning to pay off.

Toncoin (TON): Messaging Meets Crypto Adoption

Toncoin, once a Telegram side project, now boasts a market cap of $7.14 billion and a price near $2.83, with more than 2.5 billion TON circulating. It thrives on simplicity, users can send crypto straight through Telegram chats.

That ease of use is what sets Toncoin apart among the top Proof of Stake coins. Adoption is growing not through speculation, but through everyday utility, quietly merging Web 3.0 with messaging at scale.

Algorand (ALGO): Green Tech with a Quiet Edge

At $1.93 billion market cap and $0.219063 per token, Algorand still commands respect for sustainability. Nearly 8.8 billion ALGO circulate, supported by carbon-neutral consensus and instant finality.

While it faces fierce competition, Algorand’s work on central-bank digital-currency pilots and asset tokenization keeps it in the institutional conversation. Among the top Proof of Stake coins, it’s the quiet professional, less flashy, more foundational.

XDC Network (XDC): Bridging TradFi and Blockchain

XDC Network has carved a niche as finance’s connective tissue. Trading around $0.07525 with a market cap of $1.336 billion, it operates a hybrid chain serving both private and public transactions. Roughly 17.7 billion XDC are in circulation.

Its enterprise integrations in trade finance and digital-bond pilots make XDC a pragmatic inclusion among the top Proof of Stake coins. It may lack social-media buzz, but institutions are quietly paying attention.

Injective (INJ): The DeFi Builder’s Playground

With a market cap of $1.299 billion, Injective trades near $13.00 and handles $176 million in daily volume across 100 million tokens. Purpose-built for decentralized finance, Injective’s interoperability lets developers create exchanges and derivatives without friction.

Investors often call it “the infrastructure coin you forget to check, until it outperforms.” That stealth momentum makes it one of the more strategic top Proof of Stake coins for long-term builders.

Tezos (XTZ): The Self-Amending Survivor

Tezos continues its steady march with a market cap of $756.86 million and a price of $0.713401, circulating over 1.06 billion XTZ. Its self-amending governance prevents hard forks, a technical marvel that keeps the network resilient.

Though its ecosystem is smaller today, Tezos remains a preferred platform for eco-friendly NFT projects and digital-art creators, reinforcing its place in the top Proof of Stake coins legacy list.

MultiversX (EGLD): Big Dreams, Compact Numbers

Formerly Elrond, MultiversX is valued at $400.54 million, priced around $13.97, with 28.6 million EGLD circulating. Its sharded architecture delivers thousands of transactions per second, setting the stage for large-scale dApps and gaming ecosystems.

While modest in market cap, its tech ambitions remain bold. MultiversX shows that in the race of top Proof of Stake coins, innovation can matter as much as market size.

The Metric Toolbox: What Signals to Watch

To really assess top Proof of Stake coins, not everything is in plain sight. Here are the key indicators professionals watch:

1. Staking ratio and net flow

This is the percentage of total supply locked in staking. A high ratio signals confidence, but also less liquid supply. Net inflow over 7–30 days can reveal momentum shifts.

2. Validator distribution and decentralization

If a few entities control most of the validating nodes, risk is centralization. The best PoS networks distribute control broadly.

3. Reward rate vs risk

High APRs might attract capital, until slashing or downtime bites. Good networks balance yield and security.

4. Transaction activity and on-chain usage

A top Proof of Stake coin must show real utility. Smart contract use, token transfers, and DeFi volume matter more than just market cap.

5. Governance & upgrade path

Chains that allow real stakeholder influence (voting, proposals) tend to evolve more resiliently. If upgrade paths look like vaporware, that’s a red flag.

Diverging Opinions and Institutional Views

Even within the top Proof of Stake coins group, opinions diverge sharply. Some firms see Ethereum as already “priced in” and point to midcaps as carry trades. Others argue that PoS coins beyond ETH are too nascent to trust with large allocations.

In X (formerly Twitter), a well-known crypto allocator wrote, “ETH is table stakes, if your portfolio lacks one of the next-tier PoS coins, you’re missing optionality.” That kind of stance reflects confidence in rotation toward midcaps.

On the cautious side, voices warn: many top Proof of Stake coins haven’t faced serious stress tests. A network outage or exploit could evaporate hype overnight.

What Could Shift the Landscape

Over the next months, the fate of top Proof of Stake coins might hinge on a few catalysts:

-

Regulatory clarity on staking rewards and taxation

-

Institutional capital entering via staking-enabled funds

-

Network upgrades (sharding, rollups, interop)

-

Security audits and stress tests proving resilience

Ethereum’s dominance is strong, but cracks are possible if scaling or regulatory headwinds hit. That opens windows for challengers.

Conclusion

The phrase top Proof of Stake coins no longer feels speculative; it’s strategic. These blockchains blend capital, tech, and governance. Ethereum leads, but the race is loosening. Evaluating them means going deeper than rankings: stakeholder health, validator dynamics, real usage, and governance. When fundamentals matter more than hype, that’s when real value emerges.

In watching these coins, investors aren’t chasing a trend, they’re watching a paradigm shift.

Frequently Asked Questions

Q1. Why do top Proof of Stake coins matter more now?

Because staking is replacing mining as the dominant consensus model, it’s more energy-efficient and opens fresh capital flows.

Q2. Can a small PoS coin become a top one fast?

Yes, if its metrics, adoption, and security all scale. But the path is steep and fraught.

Q3. Is staking always safer than holding?

Not necessarily. Risks include slashing, protocol bugs, and liquidity lockups. Always vet the chain’s rules.

Q4. How does one compare two Proof of Stake coins today?

Look at staking ratio, active usage, validator decentralization, reward scheme, and upgrade roadmap.

Glossary of Key Terms

Proof of Stake (PoS): A consensus protocol where validators lock funds (stake) to secure and validate the network.

Staking Ratio: The share of total token supply committed to staking.

Slashing: A penalty mechanism that reduces stake for bad behavior (e.g. downtime, double signing).

Validator Decentralization: A measure of how many independent participants control block validation.

Net Staking Flow: The amount of capital staking (or unstaking) over a period, indicating momentum or reversal.

Liquid Staking: Mechanism where staked funds remain tradable or usable (e.g., derivatives).

Governance: Mechanism by which token holders vote on protocol changes.

Read More: Top Proof of Stake Coins in 2025 Ranked by Market Cap and Investor Growth">Top Proof of Stake Coins in 2025 Ranked by Market Cap and Investor Growth

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.