LINK price drops over 8% after a Chainlink oracle update glitch

0

0

Chainlink (LINK), a leading player in the decentralised oracle sector, has come under intense scrutiny following a recent technical mishap that has caused market disruption.

A glitch in the Chainlink oracle update system triggered a series of rapid losses totalling over $532,000 for a user within a mere three-minute window.

As a result, LINK’s price dropped sharply by 9.93% in just 24 hours, falling from nearly $15.91 to as low as $14.33 according to Coingecko data, amid heightened market anxiety.

This plunge intensified concerns surrounding the reliability of Chainlink’s oracles, which are trusted by numerous DeFi platforms to provide accurate, real-time data feeds.

The glitch also reignited debate around the platform’s pricing model, particularly its reliance on volume-weighted average price (VWAP) calculations in thinly traded markets.

What really happened?

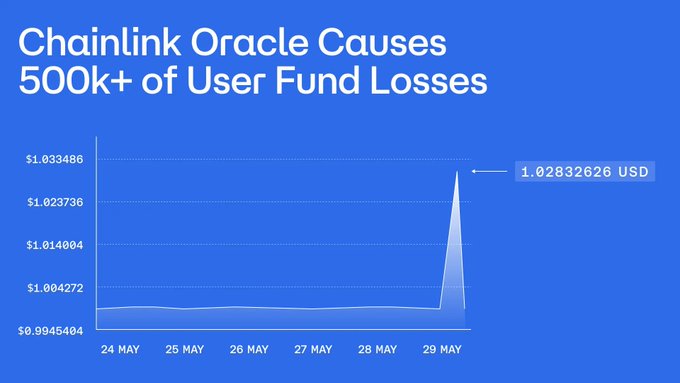

Chainlink’s VWAP mechanism aggregates prices across multiple venues, but in this case, a few large trades in an illiquid pool on Curve caused a temporary price distortion in deUSD.

This distortion occurred when an MEV bot executed a $210,000 USDT-for-deUSD swap on Curve, pushing deUSD’s price up to $1.03.

This unexpected price movement spilled over to Avalanche, where a user on Euler was liquidated for over $500,000 due to the inflated deUSD valuation feeding into the Chainlink oracle.

Despite the incident, Chainlink advocate Zach Rynes, also known as “ChainLink God,” defended the protocol’s data methodology, noting that the affected asset had already been flagged as “high market risk” due to its low liquidity.

This is an unfair analysis Omer, I know you have a competing product to shill, but this post is engagement bait for the uninformed What we saw is that a series of trades on the deUSD/USD Curve liquidity pool, representing ~50% of daily trading volume, temporarily pushed the

However, others in the industry, such as Chaos Labs founder Omer Goldberg, have criticised the system, arguing that VWAP is susceptible to manipulation in illiquid markets.

Goldberg suggested that Chainlink consider integrating caps for stablecoin prices or adopt algorithms that are more resilient to outliers to prevent similar events in the future.

LINK whale activity on the rise

The oracle controversy comes at a time when Chainlink is also experiencing intense market volatility, with the broader crypto space suffering over $693 million in liquidations.

Interestingly, despite the sell-off, on-chain data revealed a massive 299% surge in whale activity around LINK, with $101.4 million worth of large transactions recorded in just 24 hours.

This sharp spike in whale moves has led some analysts to speculate about the potential for a short squeeze, especially as liquidation heatmaps now show higher risk concentrated in short positions.

Historically, such setups have often preceded quick rebounds, particularly when the market reaches oversold conditions following a wave of long liquidations.

Chainlink price outlook

Chainlink’s price is now hovering around $14.54, with critical support sitting at $13.58 and resistance capped at the $16 mark.

If bulls manage to regain $16, a retest of $17.40 could follow, though it remains uncertain whether the momentum will be strong enough to breach that level.

A sustained move past $17.40 could open the door to a more significant recovery, with $19.80 seen as a medium-term target by some technical analysts.

On the other hand, a breakdown below $13.86 may prompt a move toward $12.70, where further downside risk could materialise.

Chainlink’s position remains precarious, caught between mounting pressure to enhance its oracle design and growing expectations for a price rebound driven by leveraged shorts.

Meanwhile, Coinbase’s decision to integrate Chainlink’s proof-of-reserve mechanism to verify over $4.6 billion in cbBTC reserves offers a bright spot in an otherwise difficult week.

This move highlights the continued institutional trust in Chainlink’s infrastructure, even as it faces criticism and scrutiny from within the DeFi community.

With the Federal Reserve’s core PCE inflation data pending, market participants remain cautious, watching both macro and technical indicators for clues on the next major move.

Although LINK’s technicals suggest oversold conditions, only a decisive reclaim of key resistance zones can shift sentiment decisively back in favour of the bulls.

The post LINK price drops over 8% after a Chainlink oracle update glitch appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.