Solana Outpaces Ethereum? Grayscale Says It’s Now the Most Active Blockchain

0

0

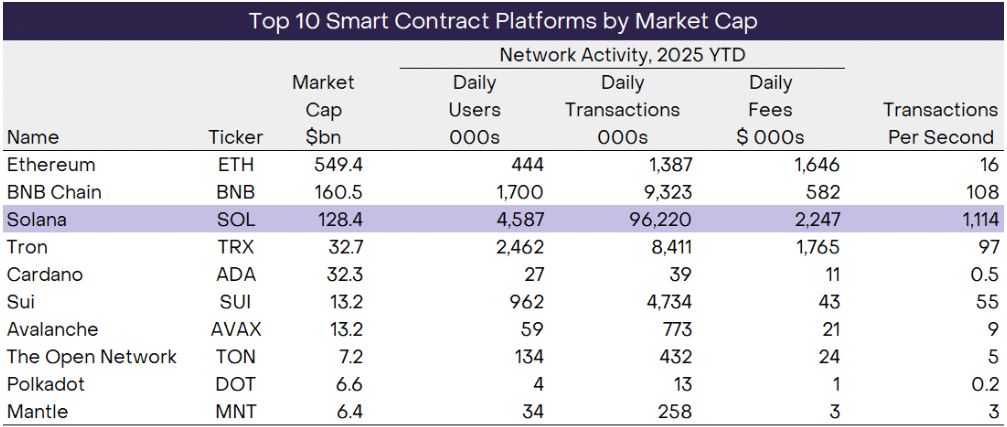

This article was first published on The Bit Journal. Grayscale Research’s latest analysis identifies Solana (SOL) as the most active blockchain network within the Solana ecosystem, leading the cryptocurrency industry in user participation, transaction volume, and network fee generation. The report underscores Solana’s growing dominance across the blockchain landscape, as it continues to outpace competitors in all key indicators of real network activity.

The report highlights that the three indicators are the major metrics of the actual network demand, which proves the expanding popularity of the Solana ecosystem in the general crypto world.

Solana Ecosystem Strengthens After FTX Collapse

Having a market capitalization of more than 100 billion dollars, Solana is now the fifth-largest cryptocurrency by market value (not including stablecoins) and the third-volume traded asset.

In spite of the reverse in the wake of the FTX collapse, SOL has a revitalized performance, providing holders with an estimated 7 percent staking returns per year, and it will become one of the most robust tokens in 2025. Such an impressive recovery has enabled the Solana ecosystem to make more users and developers than ever before.

Grayscale Highlights Solana’s Expanding On-Chain Activity

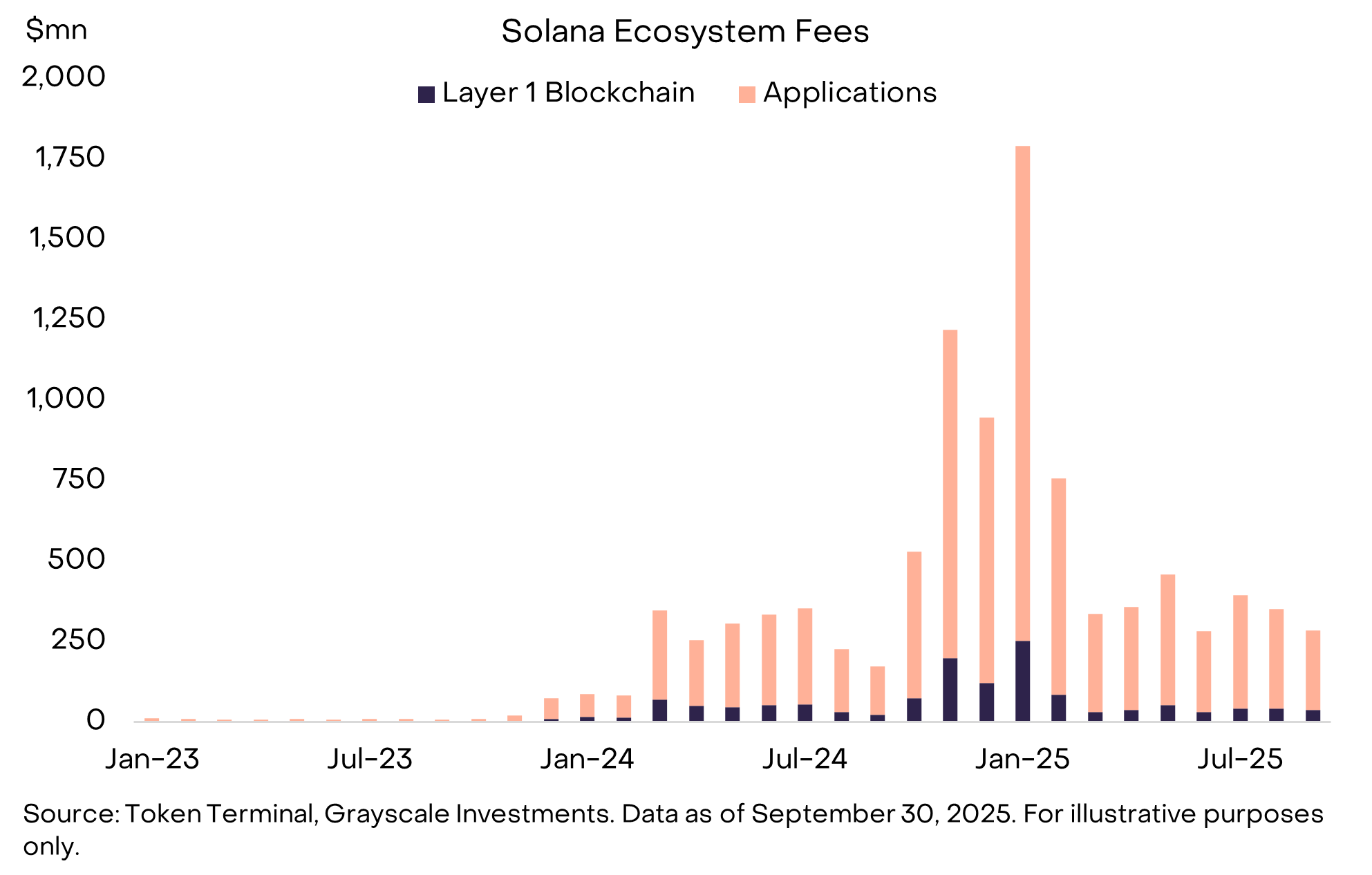

The report by Grayscale attributes the success of Solana due to its wide-ranging and vibrant on-chain activity. Solana is currently supporting over 500 decentralized applications (dApps), spanning diverse industries, such as decentralized finance (DeFi), social media, gaming, and infrastructure.

It is also important to note that the leading DeFi applications such as Raydium and Jupiter have been instrumental in the development of the Solana ecosystem and have added more than 1.2 trillion of trade volume this year alone.

The report states that the Solana network brings an estimated $425 million of fees each month, which is more than half a billion annually, but the numbers vary depending on the network usage. Outside of the financial domain, initiatives such as Pump.fun and Helium show how the Solana ecosystem can be applied to consumer-facing and real-world apps such as telecommunications and digital collectibles.

Grayscale Highlights Solana’s Developer Momentum

Speed and cost efficiency is one of the key strengths of Solana. Solana ecosystem transactions are priced at fractions of a cent and are essentially settled within seconds, which is a much smoother experience than multi-layer networks such as Ethereum.

This design simplicity has seen Solana become the favorite platform among developers and users in need of high-performance decentralized solutions.

The developer community of Solana ecosystem is growing at a speed behind the scenes. According to Grayscale, the blockchain currently has more than 1,000 full-time developers, the second only to the ecosystem of Ethereum. This level of developer interest demonstrates the increasing impact of the Solana ecosystem on the decentralized innovation and Web3 development.

Grayscale Declares Solana Crypto’s Financial Bazaar

To summarize the progress of Solana, Grayscale Research referred to Solana as the financial bazaar of crypto a busy, permissionless network that brings together millions of users, traders, and builders to define the next phase of blockchain technology.

Since the Solana ecosystem is still in its maturity phase, analysts posit that its scalability, effectiveness, and developer activity could entrench it as one of the main pillars of Web3 infrastructure in the coming years.

Conclusion

The Grayscale report underscores Solana’s remarkable evolution into a powerhouse of blockchain activity. With its scalability, cost efficiency, and expanding developer base, the Solana ecosystem is well-positioned to remain a cornerstone of Web3 innovation and decentralized finance in the years ahead.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

- Grayscale Research identifies Solana as the most active blockchain, leading in users, transaction volume, and network fees.

- Solana supports over 500 decentralized applications (dApps) spanning DeFi, gaming, and infrastructure sectors.

- The Solana ecosystem holds a market capitalization of $100 billion, ranking fifth among cryptocurrencies.

- The network generates over $5 billion in annual fees, showcasing strong on-chain activity.

- Backed by 1,000+ full-time developers, Solana has become a permissionless hub for blockchain innovation and Web3 development.

Glossary of Key Terms

Solana Ecosystem: A network of apps, developers, and users built on the Solana blockchain.

Grayscale Research: A crypto investment firm known for in-depth blockchain analysis and reports.

Decentralized Applications (dApps): Apps running on blockchain networks without centralized control.

DeFi (Decentralized Finance): Blockchain-based financial services like trading, lending, and staking.

FTX Collapse: The 2022 failure of FTX, which briefly impacted Solana’s growth.

On-Chain Activity: All transactions and actions directly recorded on the blockchain.

Staking Yields: Rewards earned by locking tokens to support the network.

Web3: A decentralized internet built on blockchain technology.

Permissionless Network: A blockchain open to anyone for use or development.

Crypto’s Financial Bazaar: Grayscale’s term for Solana’s active, open blockchain market.

Frequently Asked Questions Solana Ecosystem

1. Why is Solana so active?

It leads in users, transaction volume, and network fees, showing strong blockchain demand.

2. What makes Solana unique?

It powers 500+ apps with fast, low-cost, scalable transactions.

3. How does Solana differ from Ethereum?

Solana offers quicker, cheaper transactions with simpler architecture.

4. What drives Solana’s growth?

Active developers, diverse projects, and strong on-chain activity.

Read More: Solana Outpaces Ethereum? Grayscale Says It’s Now the Most Active Blockchain">Solana Outpaces Ethereum? Grayscale Says It’s Now the Most Active Blockchain

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.