Tron Price Declines Amid Dwindling TVL and Negative Funding Rate as Bears Target $0.27

0

0

Highlights:

- Tron price roams in the red, as the market-wide sell-off tightens, currently trading at $0.28.

- The TRX Defi TVL has dropped, indicating decreasing user interest.

- The technical outlook portrays a bearish outlook as bears target $0.27 mark.

Tron price remains in red and is trading at $0.28, marking a 1.14% drop over the past 24 hours. The bears seem to be back to it after TRX was rejected last week at a critical point of resistance around $0.30. On-chain and derivative metrics are also showing weakness, which is continuing to accelerate the downside bias. This further increases the chances of the Tron price continuing with its corrective action in the next few days.

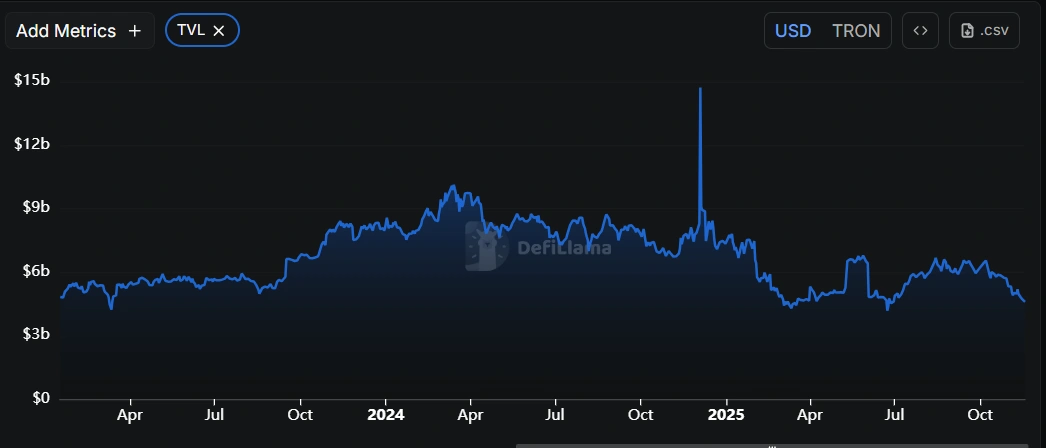

According to the DefiLlama data, the TVL of Tron fell to $4.61 billion on Tuesday and has been gradually decreasing since the beginning of October. Declining TVL is a pointer to a decreasing activity and loss of user interest in the Tron ecosystem. This means that the number of actors depositing or communicating with protocols based on TRX is going down, which may cause a further drop in Tron price.

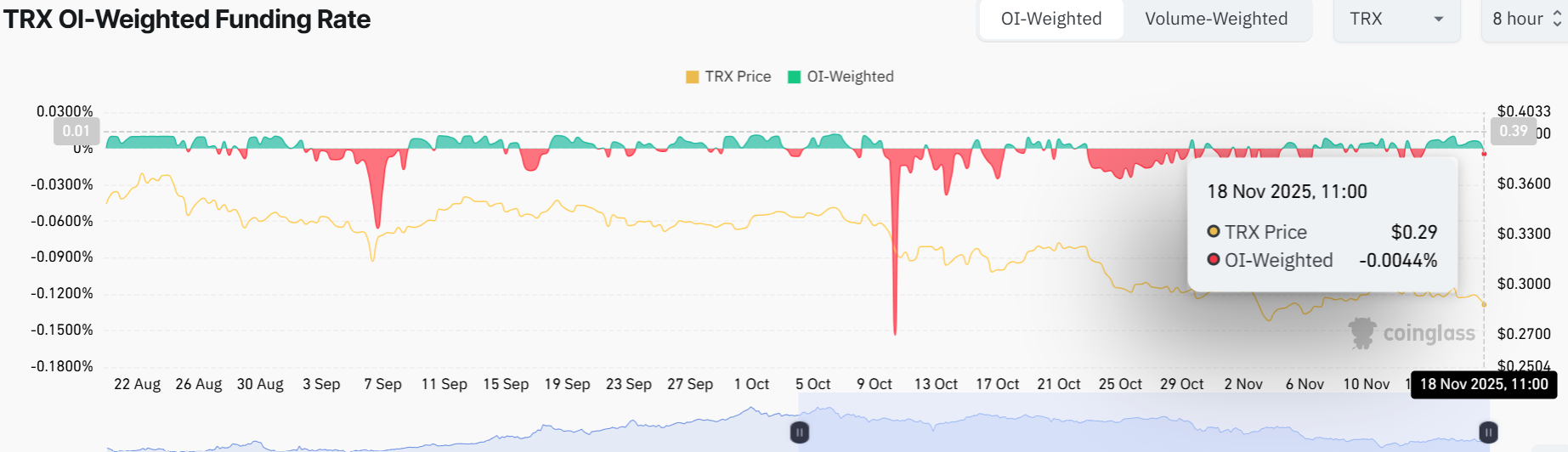

Tron derivatives data have a negative sentiment, further reinforcing the bearish thesis.. The data of the OI-Weighted Funding Rate provided by Coinglass indicates that the number of traders who bet that the price of TRX will fall is greater than those who expect the price to rise.

The measure has already changed to a negative rate and is at -0.0044% on Tuesday, which means shorts are paying longs, and the market is bearish towards the Tron price.

Tron Price Risks Further Downside Towards $0.27

Meanwhile, the 1-day chart outlook shows that Tron price has been in a prolonged downward movement, within a descending parallel channel. This shows some bearish sentiment in the market, as the 50-day ($0.3098) and 200-day ($0.3073) SMAs act as immediate resistance zones. Moreover, TRX is showing a looming death cross, which will be evident if the long-term MA crosses above the short-term.

The Relative Strength Index (RSI) sits below the 50-mean level at 40.67. This indicates that the bearish grip is prevailing in the market, and if the bulls fail to demonstrate strength, the RSI may decline towards oversold territory. Moreover, the RSI Divergence further reinforces the bearish grip. Notably, the MACD is below the neutral level, with the orange line sitting above the blue MACD line. This shows a bearish crossover, cautioning traders of further downside.

The Tron price portrays bearish momentum, with the sellers having the upper hand. If the current momentum continues, the TRX price could drop further towards the $ 0.27 support zone. Conversely, if the bulls gain momentum, bolstered by the recent spike in volume, the token may rise. In such a case, the bulls may flip above the resistance zones, towards $0.32.

A breach above this level may call for more upside, opening the doors for a rally to $0.34-$0.37 ATH by the end of the year. In the meantime, the traders should be cautious as the overall crypto market is showing a wide sell-off.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.