Is OKX Solvent? The True State of Its BTC, ETH, XRP Reserves

0

0

Popular crypto exchange OKX has revealed staggering figures regarding its latest monthly proof-of-reserves audit.

The report highlights a notable surge in Bitcoin (BTC), Ethereum (ETH), and XRP reserves.

Also, the report reveals the OKX balance and user balance reserve ratio of the top leading cryptocurrencies, as well as some stablecoins and memecoins.

Bitcoin and Ethereum Take the Spotlight

A snapshot of OKX crypto proof of reserves shows a spike in Bitcoin and Ethereum user holdings as of April 7.

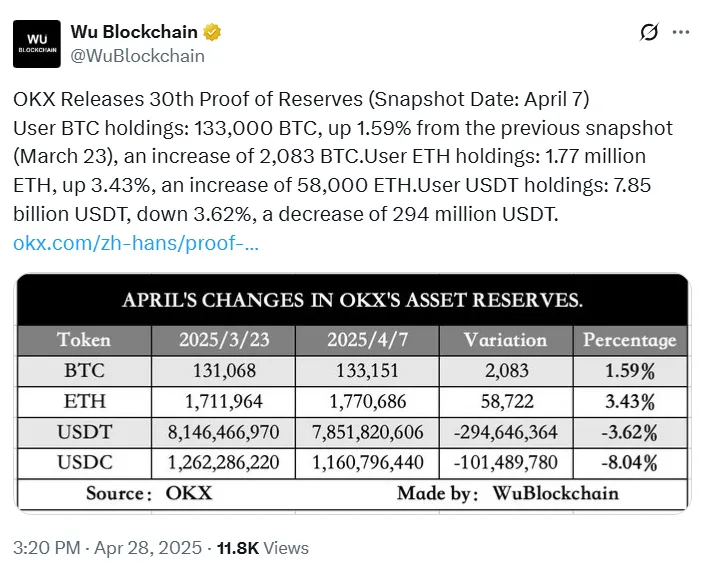

According to the data shared by WuBlockchain and verified on the product page, OKX reported adding 2,083 BTC to its reserves over the past month alone.

This brings the total to an impressive 133,151 coins, up from the 131,068 BTC in the March 23 snapshot.

Similarly, the Ethereum balance on OKX also surged from the previous 1,711,964 ETH to 1,770,686.

Therefore, the crypto exchange reported an additional 58,722 ETH added to its reserves over the past month.

In contrast, users’ holdings in the Tether (USDT) and Circle’s USDC stablecoins dramatically plunged against the previous month.

Users’ USDT holdings decreased by 3.62% from the 8,146,466,970 USDT recorded last month to 7,851,820,606.

In total, user USDT holdings in OKX dropped by 294.6 million tokens.

Also, users’ USDC holdings on OKX Crypto plummeted by 8.04%, reducing their holdings by 101,489,780 USDC.

In last month’s OKX reserve snapshot, USDC holdings were 1,262,286,220 tokens, which dropped to 1,160,796,440 units in the current month.

Exchanges and Liquidity: How is OKX Crypto Exchange Faring

Meanwhile, the OKX Crypto dominance is well-reported in its reserve ratios for significant cryptocurrencies.

XRP holdings totaled 199,215,660 units, far outstripping the 181,344,878 units belonging to its users. This OKX balance and user balance reserve ratio totaled 110%.

Market participants also observed a similar trend for Bitcoin and Ethereum. User BTC holdings are 133,151 units, with actual BTC held in OKX’s wallets standing at 139,082.

For Ethereum, user holdings are 1,770,686 ETH, while those of OKX comes in at 1,850,333 ETH. This trend ensures complete coverage of user funds with surplus.

Despite the decline in USDT holdings, the token’s coverage ratio increased by 3.8% and is now at 104%. This comes with a reserve holding of 8.15 million tokens.

With a reserve ratio of 101%, the exchange posted 1.85 million USDC in its wallets to counterbalance its users’ 1.7 million USDC.

With these, OKX crypto exchange has proven to its users that it can redeem all their withdrawal requests regardless of the trend.

Growing Competition among Crypto Trading Platforms

It is worth noting that Binance Exchange pioneered the release of reserve assets, a tradition it still dearly holds to this day.

Releasing reserve attestations became important following the collapse of the FTX Derivatives Exchange in December 2022.

While some exchanges are not consistent, Binance and OKX Crypto have stood out.

The recent Binance Proof-of-Reserve report showed a low BTC, SOL, and XRP ratio in February.

Binance liquidated more than half of its reserve, which dipped from $14 billion to just $6 billion.

However, Binance also remains the leading exchange by trading volume, currently at $15.7 million.

However, the exchange is facing rising competition from other platforms, including Bybit, Coinbase, Upbit, and OKX.

These exchanges have trading volumes of $3 million, $2.8 million, $2.8 million, and $3.1 million.

The post Is OKX Solvent? The True State of Its BTC, ETH, XRP Reserves appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.