Ethereum Price Eyes New ATH as Long Term Holders Shift From ‘Capitulation’ to ‘Belief’

0

0

Highlights:

- Ethereum price soars 0.74% to $4291 as its trading volume spikes 27%.

- Crypto analyst says ETH long-term holders have moved from capitulation to belief, boosting confidence.

- Technical indicators point to further upside as bulls aim for a new ATH.

The crypto market has seen a slight drop; however, Ethereum is showing strength, with a 0.74% surge to $4291. The daily trading volume has notably soared 27% to $45.78 billion, indicating growing investor confidence. Meanwhile, in the past 4 months, Ethereum long-term holders have moved on in their cycle by shifting into a state of confidence, following a period of giving in. Evidence of this can be seen using the Long-Term Holder NUPL (Net Unrealized Profit/Loss), as per Ali Martinez.

Long-term #Ethereum $ETH holders have gone from "capitulation" to "belief" in the last four months! pic.twitter.com/7cvOVbxIah

— Ali (@ali_charts) August 12, 2025

According to the graph, the Ethereum holders, who were previously in a situation of loss, have reversed it and are currently enjoying profits. This trend exhibits a growing confidence among Ethereum investors. This is a clear sign of a high possibility of upward movement in the market following the long-term value proposition of Ethereum.

Ethereum Price Boasts a Bullish Outlook as Derivatives Market Is Positive

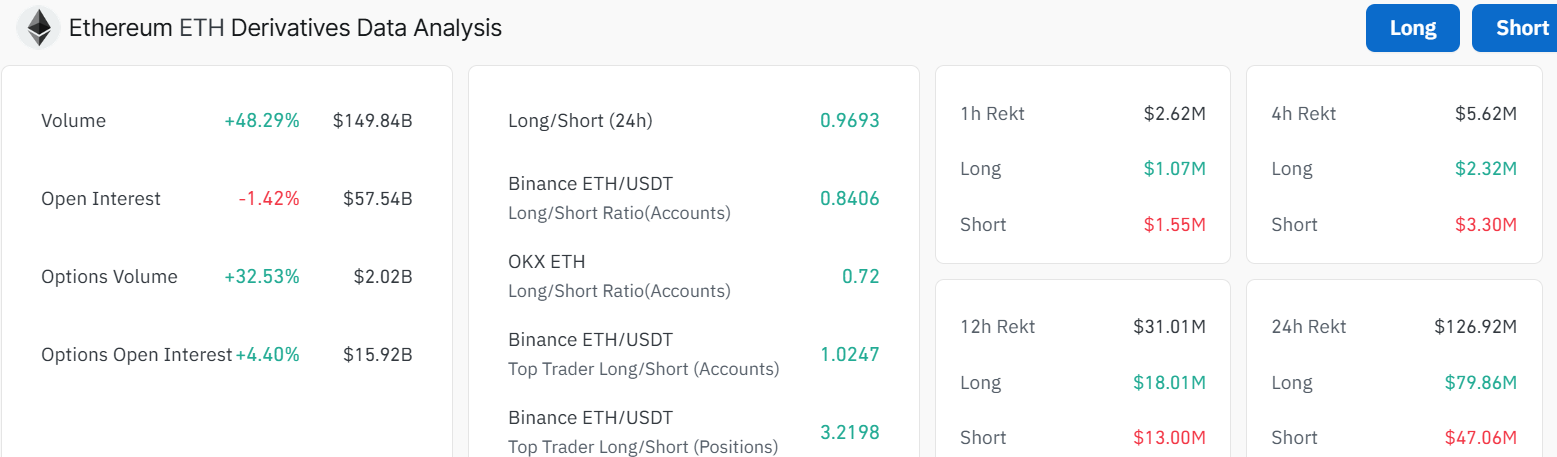

In the view of the derivatives market, over the last 24 hours, Ethereum has experienced a 48.29% increase in volume to $149.84 billion. The open interest reflects a slight 1.42% decrease to $57.54 billion. The options activity in Ethereum has been rising too, by 32.53% and the open interest has been growing by 4.40% which looks like rising interest in derivatives on Ethereum. These indicators represent increased trading volume in the markets, and it is a good indicator towards showing the bullish trend in Ethereum.

The Ethereum price has been in a strong bullish trend since early April 2025, trading within a rising channel pattern and recently breaking toward the upper boundary. Ethereum’s price has surged above both the 50-day Simple Moving Average (SMA) at $3,272 and the 200-day SMA at $2,529, confirming a strong uptrend. The current level at $4,291 has also surpassed the key resistance level of $3,955, with upside momentum still intact.

On the other hand, the Relative Strength Index (RSI) is at 72.76, signalling overbought conditions. This could trigger short-term pullbacks, but also confirm intense buying pressure. Moreover, the Moving Average Convergence Divergence (MACD) shows a wide bullish spread. This is evident as the blue MACD line sits well above the orange signal line, supporting continued upward momentum.

ETH Targets New ATH

ETH has maintained strong momentum, moving past $3,500 and now trading around $4291. The move has been supported by strong buying pressure and the fact that the price is well above the 50-day and 200-day moving averages, two important indicators of trend strength.

If Ethereum breaks through the $4,800 resistance level, it could pave the way for a push toward its all-time highs or even new record prices. On the other hand, if the rally loses steam, the nearest support lies around $3,980, with a stronger floor at $3,500. These levels could act as buying zones if the price dips. Overall, Ethereum’s trend is still firmly bullish. However, the key test now will be whether the bulls have enough strength to push the Ethereum price beyond $4,800 and into the next phase of its uptrend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.