Here’s is What Open Interest Predicts Will Happen to XRP

0

0

XRP slipped lower on Wednesday following a dwindling trading volume. The altcoin retraced from $2.45 to $2.32, losing over 4%.

However, it prints a green candle early into Thursday. The third largest cryptocurrency dipped below a short-term support during the previous session: the $2.38 mark. It edges closer to returning above it.

Nonetheless, price uncertainty increased following the halt to XRP’s bullish start on Monday. Fundamentals are silent or less effective, increasing the difficulty of predicting the next price action.

One such development is news of Ripple dropping its case against the SEC, with the regulators reciprocating the gesture. Stuart Alderoty took to X on Wednesday to give “what should be” his last “update on SEC v Ripple ever.”

The crypto project’s Chief Legal Officer stated that the regulators agreed to drop its appeal without conditions last week. The project decided to drop its cross-appeal and received a goodwill gesture from the agency: it asked the Court to lift the standard injunction imposed earlier at the SEC’s request.

XRP is not a security and is free to offer its services to anyone. However, some investors are not convinced about the settlement. Most wanted a decisive victory with the court ruling in Ripple’s favor. They are appalled that the project will pay $125 million in fines.

Other investors were satisfied with the case closure. Some questioned what the SEC gained from the case. Others recount the benefits that the agreement will have for the broader market. Nonetheless, it remains glaring that most investors were not impressed.

Dwindling Open Interest Leaves Prices Stagnant

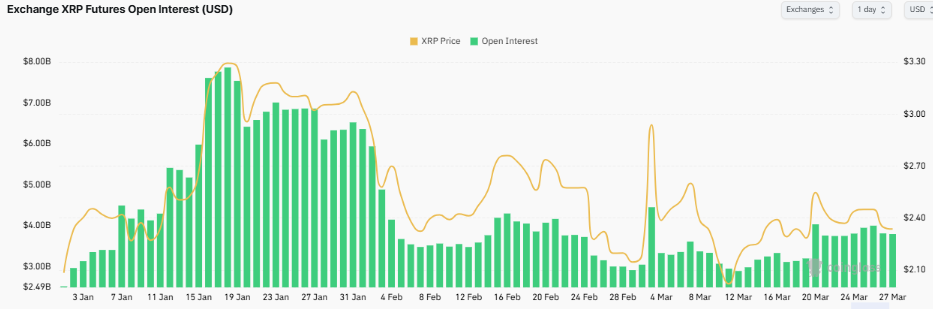

Data from Coinglass sheds light on another reason for the low price performance. Open interest has significantly declined over the last three months. The chart below shows the decline in this metric and how it affects price.

For example, prices soared in January as open interest climbed. It spiked on March 4, causing prices to edge closer to $3. When the metric dipped, prices plummeted. The same trend is playing out at the time of writing.

Interest is almost stagnant, resulting in XRP remaining rangebound. Fundamentals surrounding the project and crypto market suggest that the trend may continue.

XRP May Retest $2.20

The altcoin’s previous price movement indicates that it lost critical support. At the time of writing, it trades below $2.38. Prices held up above this level for most of the last seven days. Reclaiming this level is essential, as failure may result in a slip below $2.20.

The relative strength index shows no signs of an impending breakout, remaining in an almost straight line over the last seven days. The metric slightly declined during the previous intraday session as selling pressure spiked.

Other indicators, like the moving average convergence divergence (MACD) and MAs, print bearish signals. MACD shows the 12-day EMA on the decline, starting a negative convergence. Further price declines may cause an interception, signaling further dips.

The 50-day MA is in a downtrend as price trends downward. The more significant implication of the dip is that it may result in death, heralding the bear market, as the CryptoQuant CEO previously stated.

In the short term, the Fibonacci retracement level further implies a slip below the highlighted support. XRP may slip below $2.

The post Here’s is What Open Interest Predicts Will Happen to XRP appeared first on Cointab.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.