Chainlink Whale Dumps 356K LINK—Can Price Still Hit $45?

0

0

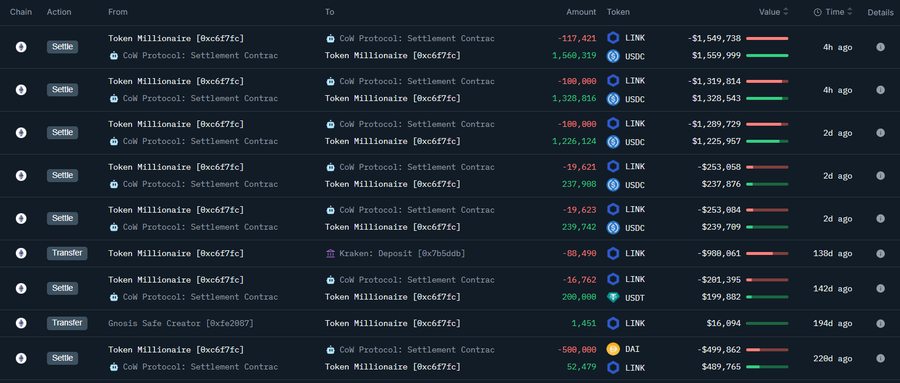

NAIROBI (CoinChapter.com)— Chainlink (LINK) faced renewed market pressure as a whale offloaded 356,665 tokens worth $4.59 million, raising fresh concerns over future price direction.

On Mar. 13, analyst Onchain Lens reported via X that a whale sold 356,665 LINK tokens. The transaction totaled $4.59 million in USD Coin (USDC), executed at an average price of approximately $12.87 per token over the past 48 hours. This sizeable selloff signaled caution among traders, reflecting possible diminished confidence in Chainlink’s near-term performance.

Whale-driven sales often pressure prices, prompting investors to reassess their positions. Yet, LINK’s market performance remained resilient. Despite bearish pressure, LINK traded at $13.15 at the day’s close, marking intraday gains of roughly 2%. Over the past 24 hours, Chainlink fluctuated between lows of $12.82 and highs of $13.77.

Crypto Market Shrugs Off Whale Anxiety

The broader cryptocurrency market offered LINK some relief, following the release of the latest U.S. Consumer Price Index (CPI) figures. Data showed inflation easing moderately, reducing immediate pressure on risk-sensitive assets, including cryptocurrencies.

Bitcoin (BTC) and major altcoins benefited, halting recent downward momentum. Chainlink rose alongside them, touching an intraday high of $13.77 before settling near $13.15 by market close.

Yet, despite intraday gains of 2%, market participants remain cautious. Onchain Lens, commenting on the whale’s LINK dump on X, highlighted that the sale could indicate a widespread panic sentiment, prompting a careful reassessment of riskier assets by investors.

Chainlink Price Targets: Analysts Eye Crucial Levels

LINK currently faces substantial resistance at key technical levels. Analyst TradingJip pinpointed a critical Fibonacci retracement level at $19.519. According to his recent analysis on X, LINK needs to surpass this crucial resistance to confirm a bullish “higher low” scenario.

TradeDevils cautioned that $19.519 could remain a substantial barrier, with a “decent chance” of retesting this level. If Chainlink successfully breaks above, investors may see current price movements as indicative of a confirmed “higher low,” potentially signaling bullish momentum.

Traders Assess Potential For $45 LINK Amid Selloff

Despite the whale-induced uncertainty, Chainlink’s short-term performance displayed resilience. LINK rose 2% intraday, hitting a high of $13.77 before settling around $13.15 at day’s end. Although the token experienced volatility, traders speculate if LINK could rise toward the optimistic target of $45.

On X, analyst Bitcoin Buddha noted LINK’s resilience in price action despite recent whale-induced selling pressure. He suggested the current recovery, if sustained, could see LINK reaching a new all-time high (ATH). However, that scenario would depend on trader sentiment, and whether or not they exert their influence through sizeable transactions. Undoubtedly, traders will be closely watching key price thresholds like $19.519 for further directional cues.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.