Bitcoin Miner Marathon Digital Transfers 1,318 BTC Worth $87M, Is a Sell-Off Coming

0

0

The post Bitcoin Miner Marathon Digital Transfers 1,318 BTC Worth $87M, Is a Sell-Off Coming appeared first on Coinpedia Fintech News

Bitcoin miner Marathon Digital Holdings has transferred nearly $87 million worth of Bitcoin to major crypto service firms, sparking concerns about fresh selling pressure.

The move comes as Bitcoin trades around $64,800 after a sharp drop, adding to fears that miners may be increasing sell-offs.

Marathon Digital Bitcoin Transfer Signals Possible Selling

On February 6, Marathon Digital Holdings moved a total of 1,318 BTC valued near $87 million to institutional platforms, including Two Prime, BitGo, and Galaxy Digital.

These are well-known institutional platforms that provide custody, trading, and liquidity services. When a mining company sends coins to such firms, it often signals preparation for structured selling, collateral use, or treasury rebalancing.

However, the transfers happened within roughly a 10-hour window while Bitcoin traded around the mid-$60,000 range after a sharp daily drop.

Marathon Current Bitcoin Holdings

Despite the transfer, Marathon still holds about 52,850 BTC worth around 3.42 billion, keeping it among the top corporate Bitcoin holders worldwide. This shows the company is adjusting part of its treasury, not exiting its position.

Still, the timing adds to short-term caution. Bitcoin is already down nearly 10% in 24 hours, and broader sentiment is fragile. When miner flows rise during a falling market, traders tend to expect more volatility.

Miner & Whale Continue to Sell Bitcoin

One major pressure is coming from Bitcoin miners. The average mining cost has risen above $87,000, while Bitcoin trades near $65,402, forcing many miners to sell at a loss. CryptoQuant data shows miner reserves have dropped to 1.806 million BTC, confirming rising sell-offs.

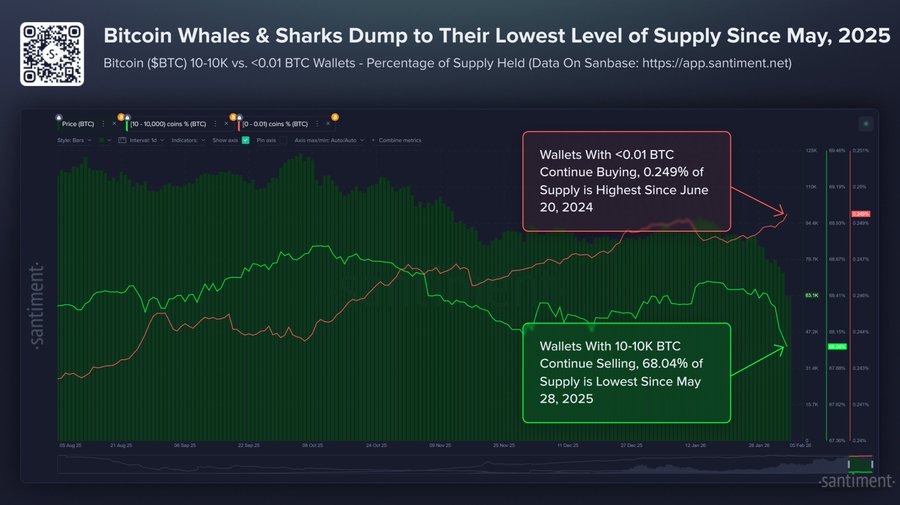

Meanwhile, selling is not limited to miners. Santiment data reveals that Bitcoin whales and large holders are also reducing positions.

Wallets holding between 10 and 10,000 BTC now control just 68.04% of total supply, a nine-month low. These large holders have sold about 81,068 BTC in the last eight days alone.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.