Chainlink Sees $120M in Exchange Outflows as Accumulation Trend Grows

1

0

Highlights:

- Chainlink (LINK) tokens worth $120 million have left exchanges in the past month.

- IntoTheBlock reported that the new trend signifies increased interest in the token.

- Lookonchain attributed the increased accumulation to a recent Chainlink non-circulating supply wallet action.

On April 22, IntoTheBlock, a renowned analytical intelligence platform, tweeted that Chainlink’s (LINK) exchange outflows have soared considerably. According to the on-chain firm, LINK, worth over $120 million, left trading platforms over the past 30 days.

IntoTheBlock stated that the above trend hinted at an ongoing accumulation trend, indicating strong faith in Chainlink’s appreciation potential. Findings like this could heighten crypto investors’ interest in Chainlink. Hence, the accumulation trend might persist, increasing the chances of an imminent LINK price rally.

Keep an eye on altcoin exchange flows

$LINK has seen consistent outflows from exchanges over the past month, hinting at ongoing accumulation. In total, net outflows surpass $120 million worth of LINK in the last 30 days. pic.twitter.com/XbU4qsGuWd

— IntoTheBlock (@intotheblock) April 22, 2025

Investors Probably Capitalized on Chainlink’s Earlier Price Dips

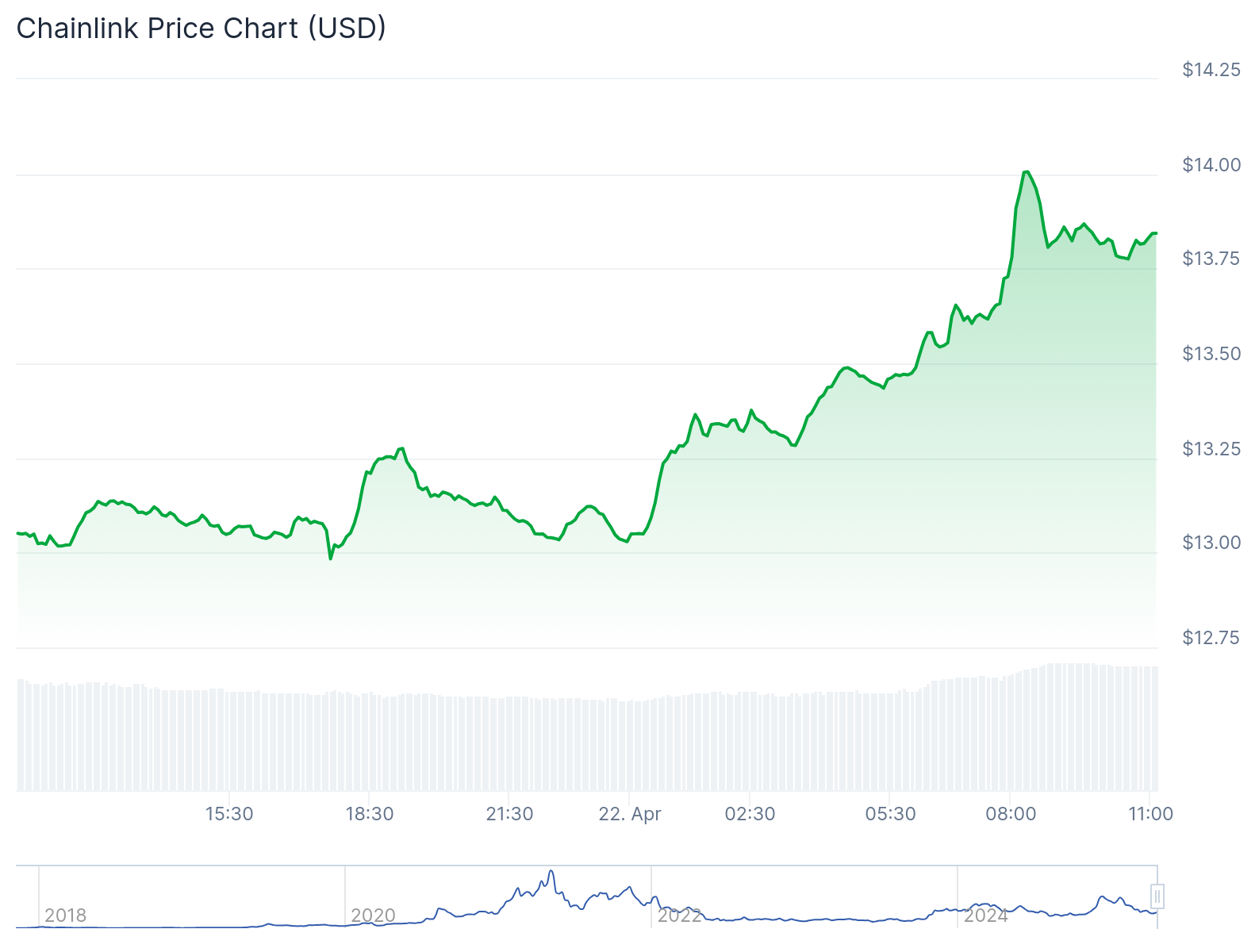

At the time of writing, the global crypto market is slightly 0.9% down, with a market capitalization of about $2.93 trillion. Meanwhile, LINK is up 4.3% in the past 24 hours, trading at approximately $13.83 and oscillating between $12.98 and $14.01. In the past seven days, LINK has spiked 11% and fluctuated between $12.03 and $13.78.

While LINK’s short-term interval metrics reflected declines, its other extended-period variables have struggled to recover. For context, LINK is down 4% month-to-date and 9.3% year-to-date. Earlier this month, LINK traded around $10.75 and remained below $11 for a few days before its recent recovery.

Other relevant statistics revealed that LINK ranks as the 14th most valuable cryptocurrency on CoinGecko, with a $8.8 billion market capitalization. LINK’s 24-hour trading volume spiked 19.42% to about $377.12 million.

Recent Tokens Unlock Also Contributed to the Accumulation Trend

On March 15, Lookonchain, a renowned crypto transactions tracker, reported that Chainlink’s non-circulating supply wallet unlocked and deposited 14.875 million LINK worth $216 million to Binance. “Before this, Chainlink had unlocked 10 times in total, and 9 of them saw price increases 30 days after unlocking,” the on-chain tracker added.

In a follow-up tweet on March 17, Lookonchain reported it tracked multiple fresh wallets withdrawing large amounts of LINK from Binance. The on-chain tracker attributed the marked withdrawals to the over 14 million unlocked tokens.

We've noticed multiple fresh wallets withdrawing large amounts of $LINK from #Binance.

This could be linked to the recent unlocking of 14.875M $LINK ($216M).https://t.co/i3rVb45iAB pic.twitter.com/GBBPwWvMLk

— Lookonchain (@lookonchain) March 17, 2025

Profitable Chainlink Holders Remain Below 50%

On IntoTheBlock’s official website, Chainlink’s Statistical summary shows that only 44% of the token holders are profitable at LINK’s current price. However, 4% are neither losing nor gaining, while the remaining 53% are incurring losses. The concentration by large holders’ metric showed that 66% of LINK holders are whales, suggesting that whales’ actions could significantly dictate the token’s price movements.

In its holders’ statistics by time held metric, 78% of LINK holders have owned the token for over a year. 20% have held LINK for over a month but less than a year, while 3% have owned the token for less than a month.

In the last seven days, transactions involving over $100,000 worth of LINK soared to about $446.74 million. Meanwhile, netflows for the past seven days read a negative value worth $28.61 million. The negative value implies that more LINK tokens left exchanges.

Chainlink Targets $20 Amid Increasing Momentum

On April 21, Crypto2Community reported that a LINK price breakout was imminent. According to the analysis, an upward price movement appears likely because the pattern formed through a falling wedge increased the chances of LINK hitting $20 in the next few days.

In addition, Coinglass derivatives data showed that LINK’s price experienced significant spikes in trading volume as open interests continued to rise. The surge in open interest also qualified as one of the token’s price appreciation catalysts.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.