XRP Price Skyrockets 8% as Whale Activities Spike- Is $3 Plausible?

0

0

Highlights:

- XRP price has increased 8% to $2.41 before slightly retracing to $2.38.

- This comes following Ripple’s settlement agreement with the SEC.

- XRP derivative data signal mixed reaction, as the bulls target $3

The cross-border payment token (XRP) has surged above the consolidation channel, increasing 8% in the past 24 hours to 2.41, before slightly retracing to $2.38. The bulls are showing immense strength, as XRP’s trading volume has spiked 43% to $7.05B. Meanwhile, the crypto market has seen an explosive surge, led by Bitcoin, which is currently exchanging hands at $103K. Other major altcoins such as Ethereum and Solana have also gone ballistic by 20% and 11%, respectively.

What is Driving the XRP Price Surge?

The recent surge in XRP price is bolstered by the SEC’s official release settlement agreement, concluding the case against XRP. Neither side disputed that Ripple would only be required to pay an initial $50 million of the total $125 million fine levied by the SEC on the payment firm.

On the other hand, Pharmaceutical distributor, Wellgistics Health, is set to integrate XRP as a treasury and payments asset in $50 million financing deal. The platform is aiming to cut banking delays, FX costs, and boost supply chain efficiency.

JUST IN:

Pharmaceutical distributor, Wellgistics Health, set to integrate $XRP as a treasury and payments asset in $50 million financing deal. pic.twitter.com/PtyN7Z6mtg

— Whale Insider (@WhaleInsider) May 9, 2025

Notably, the whale activity in the XRP market has surged in the past month. According to popular analyst, Ali Martinez, whales have accumulated over 880 million XRP in the past month, indicating increased investor activity. With the developing activities and the market sentiment boasting a bullish outlook, can XRP hit $3?

Whales have accumulated over 880 million $XRP in the past month! pic.twitter.com/SQWf2U1yZB

— Ali (@ali_charts) May 8, 2025

XRP Price Outlook

A quick look at the XRP daily chart shows a bullish grip as the bulls have entirely taken the reins. This is evident as they have flipped the 50-day and 200-day MAs into support, aiming for further upside. If the support levels hold, the XRP price could target $2.57, $2.75, and potentially $3 resistance levels.

A zoomed-out view of the technical indicators suggests further upside. To start with, the Relative Strength Index has hit 64, signaling intense buying activities. If the buying appetite soars, the RSI could hurtle towards the 70-region, bolstering the bullish thesis.

On the other hand, traders and investors are at liberty to buy more XRP, reinforced by the bullish MACD indicator. Moreover, the green histograms and their position in the positive region show a buy signal.

XRP Derivatives Data

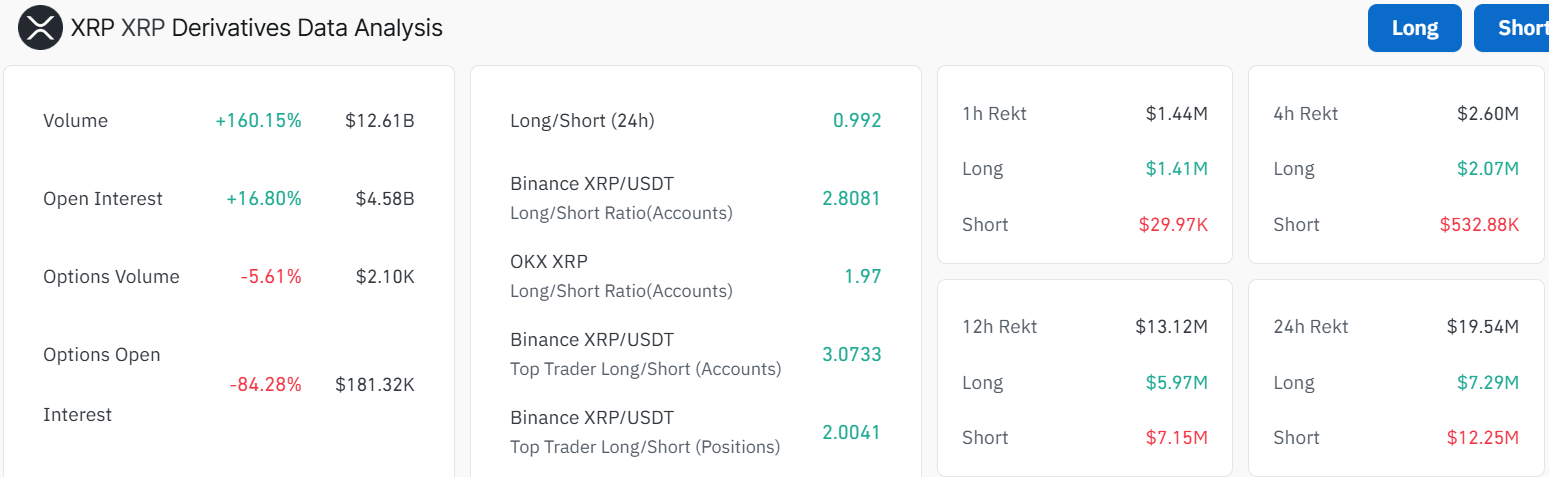

According to Coinglass data, the XRP derivatives have seen a sharp increase in volume by 160% to $12.61B. Notably, the open interest has spiked 16% to $4.58B. This recent increase indicates a short-term response from retail and institutional traders, as new money is flowing into the XRP market.

However, both the options volume and open interest have dropped by 5% and 84%, respectively. This shows a drop in the overall market activity and could result in a period of consolidation in the XRP market.

Meanwhile, the positive technical indicators indicates potential surge towards the $3 mark. In case of early profiteering, the XRP price may drop. In such a case, the $2.27 support area will eb in line to absorb the potential selling pressure. If this level gives way, further downside towards $2.23, 2.16, and 2.13 would be imminent.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.