0

1

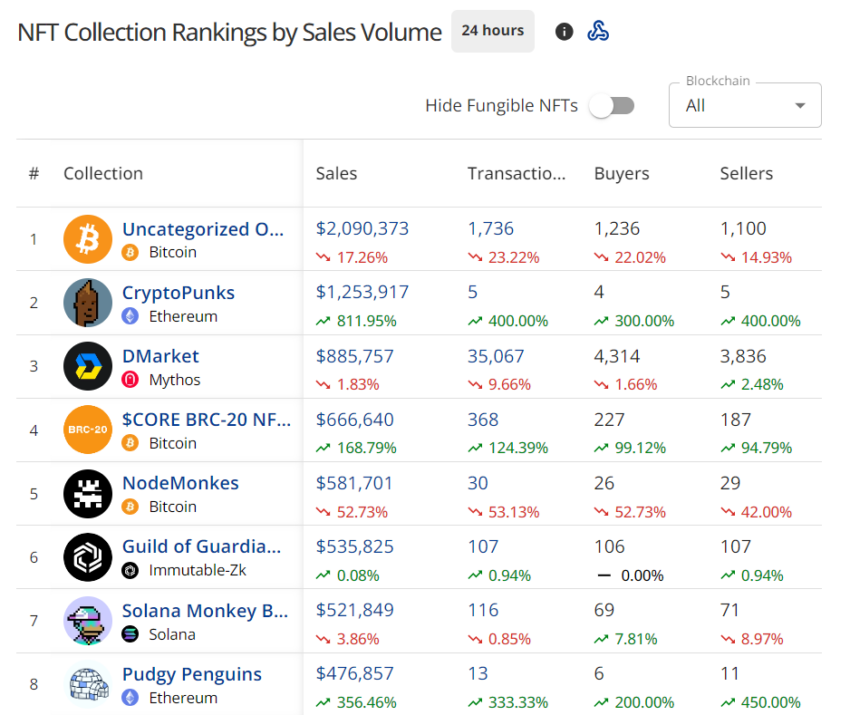

In the non-fungible tokens (NFTs) market, CryptoPunks and Pudgy Penguins, Ethereum (ETH)-based NFT collectibles, have emerged as leaders in sales over the past 24 hours.

CryptoPunks and Pudgy Penguins’ recent performance significantly outpaces Bitcoin Ordinals. These NFTs in Bitcoin’s blockchain appear to be losing momentum.

CryptoSlam data highlights CryptoPunks’ sales at $1.25 million. This figure is a remarkable 811.95% increase in the last 24 hours.

The sale of CryptoPunks #741 largely drove this surge. The latest data shows that CryptoPunks #741 is valued at $792,046.

Pudgy Penguins also saw a substantial rise. Its sales reached $476,857, marking a 356.46% gain over the same period. Interestingly, Pudgy Penguins’ achievements extend beyond the digital space.

Read more: What are CryptoPunks? The Complete Guide

NFT Collection Rankings by Sales Volume. Source: CryptoSlam

NFT Collection Rankings by Sales Volume. Source: CryptoSlam

Recently, Luca Netz, Pudgy Penguins CEO, announced that over 1 million Pudgy Toys, the plushies version of Pudgy Penguins, have been sold in the last 12 months. This milestone comes as the NFT project continues to expand worldwide.

“Who would’ve thought that the Consumer Crypto revolution was going to be led by fat, flightless birds,” Luca Netz wrote on his X (Twitter).

Pudgy Penguins’ retail strategy shows a successful digital-to-physical market crossover. Their launch in US stores like Target is part of this strategy. It also aims to increase its consumer base substantially.

The toys at Target come from the community Penguins collection. The licensing for these toys leverages their NFT platform, OverpassIP.

Each toy includes “a birth certificate” with a QR code. This code connects to Pudgy World, thus enhancing buyer interaction.

On the other hand, Bitcoin Ordinals are seeing a decline in interest. As Ethereum’s blockchain recorded a 46.71% increase in NFT sales, reaching $5.95 million, Bitcoin’s Ordinals saw sales dip by 20% to $5.07 million.

This development is particularly noteworthy given that in the previous month, Bitcoin NFTs outperformed Ethereum NFTs. A report from DappRadar shows that Runestone, one of the largest Bitcoin Ordinals inscriptions, gained significant popularity during the month.

Runestone became the NFT collection with the most trading volume in April. It also surpassed Bored Ape Yacht Club (BAYC), a popular Ethereum-based NFT collectible, for the first time.

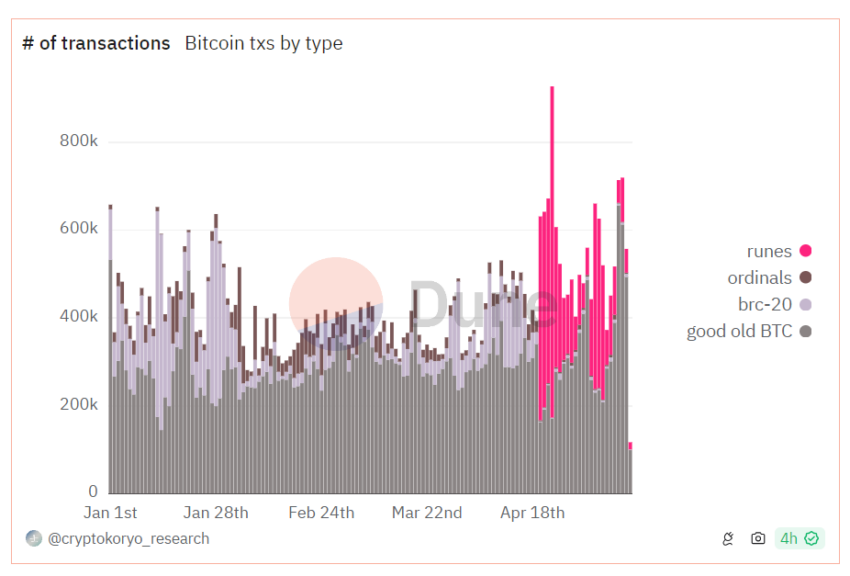

Behind the success are Runes’ mechanisms that leverage Bitcoin’s existing UTXO model to minimize data added to the blockchain. Such a mechanism enables Runes to potentially reduce transaction fees compared to Ordinals.

Read more: Top 5 BRC-20 Platforms To Trade Ordinals in 2024

Numbers of Transactions in the Bitcoin blockchain by Type. Source: Dune Analytics

Numbers of Transactions in the Bitcoin blockchain by Type. Source: Dune Analytics

However, the Runes hype cooled down shortly after the Bitcoin halving happened. Dune Analytics data shows a significant fall in Runes transactions. They dropped by almost 4,590%, from 753,814 on April 24 to 16,066 by May 13.

0

1

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.