Bitcoin Price Prediction July: Analysts Target $110K to $116K Amid ETF Boom

0

0

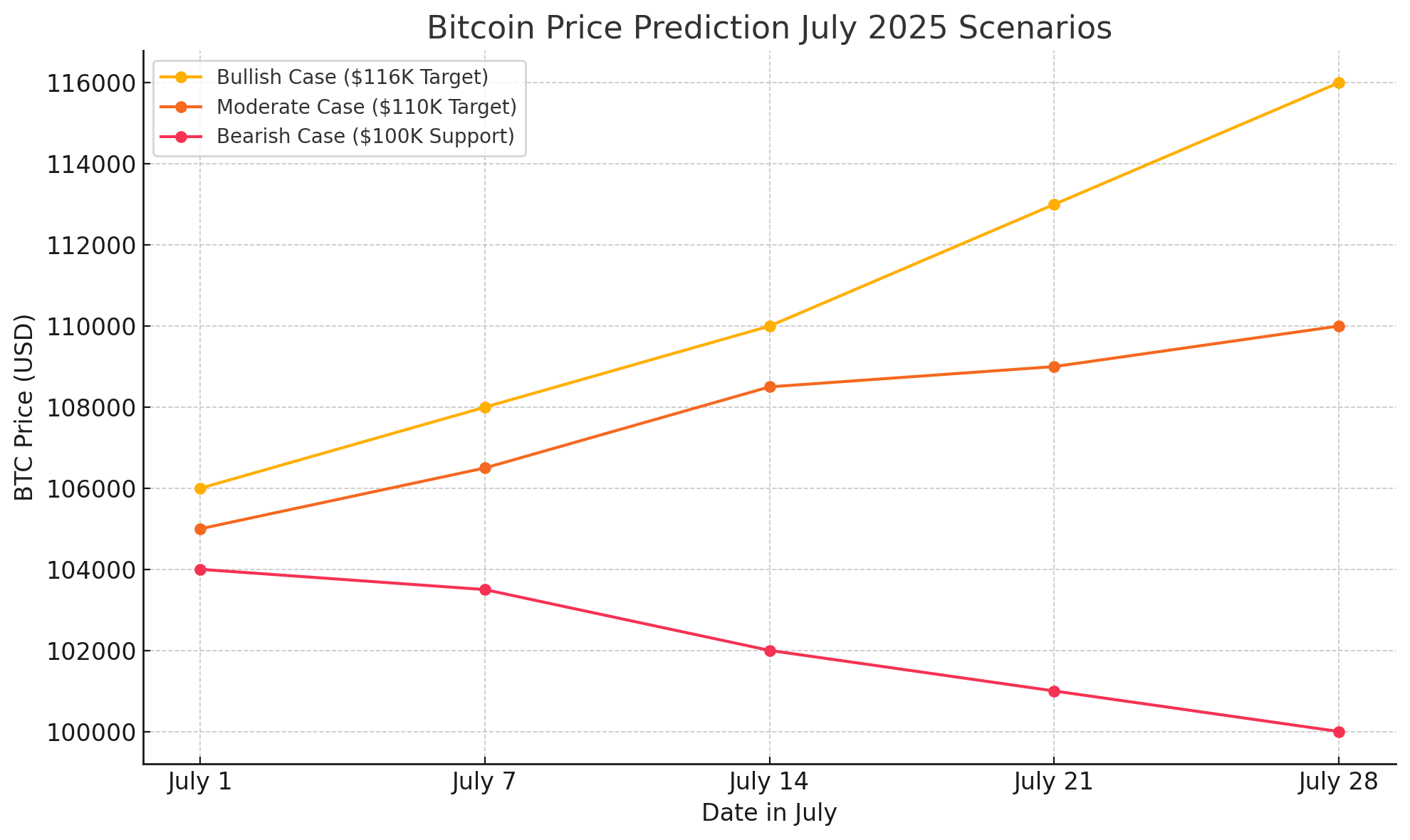

Bitcoin price prediction July headlines intensified this week as analysts weighed surging U.S.-spot-ETF demand, shifting Federal Reserve rhetoric and a deepening supply squeeze on exchanges. Cointelegraph’s “perfect storm” thesis even floated a Bitcoin price prediction July target of $116,000, just 6 % above current levels but enough to refresh all-time highs.

Bitcoin Price Prediction July: Three Catalysts Driving the Latest Bull Case

-

ETF tail-winds. Net inflows into spot Bitcoin exchange-traded funds have topped $10 billion since May 1, according to both Cointelegraph and Reuters filings data, outpacing flows into most equity funds over the same span. This steady institutional bid anchors the most optimistic Bitcoin price prediction July narratives.

-

Policy crossroads at the Fed. Soft U.S. payroll estimates have traders betting the Federal Reserve will be forced to cut as early as September, with a slim chance of an emergency move in late July. Lower real rates historically lift risk assets—fuel for every bullish Bitcoin price prediction July scenario now circulating in trading chat rooms.

-

Vanishing exchange supply. Centralized platforms have recorded 98 straight days of net BTC withdrawals, echoing the pre-2021 bull-run supply crunch. Combined with ETF absorption, circulating float is the tightest it has been in four years, reinforcing a price-squeeze argument behind the headline Bitcoin price prediction July of six-figure territory.

Bitcoin Technicals Still Matter

BeInCrypto flags a falling-wedge breakout theory that targets $110,000–$111,000 if bulls clear $108,800 resistance, with a robust accumulation zone just above $100,000 providing downside cushioning. That setup aligns with a moderate Bitcoin price prediction July thesis that sees range-expansion rather than vertical melt-up.

TradingNews, meanwhile, notes the market’s first significant ETF net-outflow day in 15 sessions and warns of miner-driven selling pressure if $105,000 fails, defining a short-term bear risk to every Bitcoin price prediction July roadmap.

Broader Forecasts Stretch the Imagination

Standard Chartered continues to champion a $200,000 year-end objective, citing ETF inflows and supply-demand imbalance. Global X ETFs echoes that view, telling The Australian a 45 % rally to about $200 K could materialize within twelve months as Bitcoin cements “digital-gold” status. Those longer arcs lend credibility to an aggressive Bitcoin price prediction July ceiling near $116 K because they imply successive legs higher rather than a singular blow-off top.

Risks Lurk Beneath the Surface

-

ETF sentiment fickle. Reuters data show hedge-fund rebalancing after early-year basis-trade windfalls, a reminder that inflows can reverse if macro winds shift.

-

Rate-cut disappointment. Should June payrolls beat expectations, rate-cut bets will fade, dulling the monetary-tail-wind pillar of the prevailing Bitcoin price prediction July optimism.

-

Regulatory curveballs. The SEC still reviews multiple crypto-related filings, including a Solana spot ETF, which could steal liquidity from Bitcoin if approved or spook markets if delayed.

Key Levels and Probabilities

| Zone | Bias | Rationale |

|---|---|---|

| $108,800–$110,000 | Breakout trigger | Confluence of wedge resistance and prior highs; close above confirms bullish Bitcoin price prediction July targets. |

| $105,000 | Line in sand | TradingNews cites this as miner break-even; breach could accelerate liquidations. |

| $100,000 | Structural support | Glassnode data (via CryptoSlate) show robust hodler bids here, anchoring downside risk. |

All major research desks now frame July as a momentum month in which ETF flows, Fed policy clarity and tightening free float could coalesce. The consensus base case hovers near $110 K, while the upper-quartile Bitcoin price prediction July, backed by 10x Research’s “perfect storm”, pegs $116 K as plausible. Failures at $105 K, on the other hand, would defer the rally and force reassessment of any headline-grabbing Bitcoin price prediction July forecast.

For now, the tape favors the bulls: liquidity is migrating on-chain, institutional allocations continue, and macro data tilt dovish. Whether that cocktail delivers the seventh consecutive monthly gain, or ends in another whipsaw will define the accuracy of every Bitcoin price prediction July plastered across the crypto press.

Frequently Asked Questions (FAQs)

What is the current Bitcoin price prediction for July 2025?

Analysts forecast a possible Bitcoin surge to $110K to $116K in July 2025, driven by ETF inflows, Fed policy shifts, and tightening exchange supply.

Can Bitcoin reach a new all-time high in July?

Yes, if Bitcoin breaks key resistance levels near $108,800, it could reach new highs above $116K, supported by institutional demand and macro tailwinds.

What could stop Bitcoin from rising in July?

Key risks include ETF outflows, stronger-than-expected U.S. jobs data that delays Fed rate cuts, and a breakdown below the $105K support level.

Glossary of Key Terms

Bitcoin price prediction July

A keyword phrase used to describe analyst forecasts and price expectations for Bitcoin in the month of July

Spot Bitcoin ETF

An exchange-traded fund that holds actual Bitcoin, allowing institutional and retail investors to gain exposure without directly owning BTC

Federal Reserve

The central banking system of the United States influences interest rates and liquidity, affecting risk asset markets like Bitcoin

Exchange supply

The total amount of Bitcoin held on centralized trading platforms; a lower supply often indicates investor accumulation and reduced sell pressure

Falling wedge pattern

A bullish technical analysis pattern that typically signals a breakout after a downward consolidation phase

Resistance level

A price point where selling pressure is expected to be strong, potentially preventing an asset from moving higher.

Sources/References

Read More: Bitcoin Price Prediction July: Analysts Target $110K to $116K Amid ETF Boom">Bitcoin Price Prediction July: Analysts Target $110K to $116K Amid ETF Boom

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.