HSBC Launches Tokenization Platform for Gold Markets

2

0

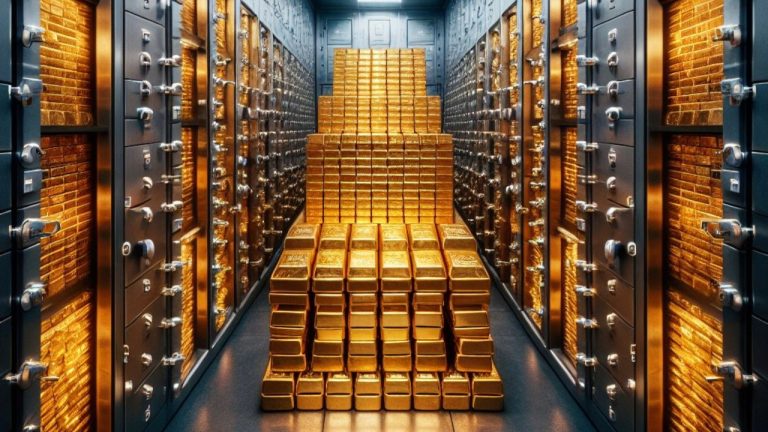

HSBC announced the launch of a platform that will allow the tokenization of gold bullion, with a stated potential market reach of $525 billion. Mark Williamson, HSBC’s global head of FX and commodities partnerships and propositions, stated that these gold tokens will be tradable using HSBC’s platform, with the bank handling custody of the gold bars in its London vaults.

HSBC Enters Gold Tokenization Era

HSBC, one of the world’s largest financial institutions, has started using tokenization technology to modernize the precious metals trading industry. The bank announced it is launching a gold tokenization platform to simplify the trading of gold, to allow traders to have better control of the bullion they own, according to statements from Mark Williamson, HSBC’s global head of FX and commodities partnerships and propositions.

The gold bars in the platform will be tokenized, and the owners will have the chance to track their bullion via the serial number and the vault where it is located, making finding these bars “quicker and less cumbersome,” Williamson said. Currently, such records are kept manually and are sometimes outdated, given the nature of the over-the-counter gold markets.

Williamson also stated that HSBC projects to use this system, which uses tokens representing 0.001 troy ounces of gold, for markets of other precious metals as well.

While Williamson stated that the tokenization system could allow retail users to invest directly in gold fractions when regulations allow it, HSBC is currently only focusing on the institutional market, which has a potential reach of around $525 billion in the greater London area.

Previous Attempts

HSBC is not the first institution that has entered the gold tokenization market. In 2016, Paxos partnered with Euroclear to offer an on-chain settlement service for tokenized gold that dissolved a year later. However, Paxos still has a tokenized gold offering in the form of pax gold, a token that represents one fine troy ounce of gold held in the vaults of the London Bullion Market Association (LBMA).

Tether, the stablecoin company behind the issuance of USDT, also offers a gold token, XAUT. Nonetheless, what makes HSBC’s announcement significant is the sheer size of the bullion market that passes through its platforms, being one of the largest precious metals brokers in the world and also only one of four gold clearing institutions in the London market.

What do you think about the entrance of HSBC to the gold tokenization market? Tell us in the comments section below.

2

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.