Bitcoin Accumulation Rises Despite Price Weakness— Is A Bullish Divergence in the Making?

0

0

The post Bitcoin Accumulation Rises Despite Price Weakness— Is A Bullish Divergence in the Making? appeared first on Coinpedia Fintech News

Bitcoin price is recovering after a strong bearish attempt to slash the prices below $100K. The selling pressure has been mounting over the token ever since the price failed to enter the pivotal resistance zone between $106K and $107K. As a result, the price developed weakness, causing a 5% drop from the local highs. However, the BTC price has begun to rise, but this appears to be a short-term gain as the local support below $100K still remains active.

Now the question arises, why does Bitcoin appear to be fragile even in times when the accumulation is peaking?

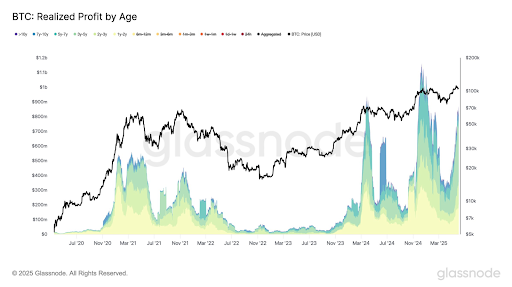

The BTC price has shown significant volatility since the start of the year, which has pushed it to new highs twice. Meanwhile, the realized profit of Bitcoin surged past $3 billion in the first few days of the year but dropped close to $250 million as the price dropped below $75,000 from the first ATH at $109,588. However, the profits have again begun to climb since the start of May, reaching close to $1.5 billion, which suggests the accumulation could have resumed.

As per the data from Glassnode, the accumulation trend score shows most wallet cohorts shifting from strong distribution towards modest buying. It suggests that every coin sold still finds a buyer. Meanwhile, the recent sell-side was dominated by 1-year+ holders sitting on sizable profits and willing to exit, even at a discount. However, the buy-side has lost urgency, and hence, demand remains, but there’s less willingness to chase prices higher. As a result, the token experienced absorption without a breakout, due to which a rotation phase is still under pressure.

What’s Next for the Bitcoin (BTC) Price Rally?

Despite the accumulation trend, Bitcoin’s price structure continues to exhibit bearish characteristics. The crypto has formed lower highs and lows on the daily and weekly charts, signaling that short-term momentum remains weak. Therefore, the Bitcoin price is believed to test the local support that lies below $100K in the coming days.

As seen in the above chart, the BTC price is stuck within a descending parallel channel after breaking down from a rising parallel channel. Besides, the RSI is constantly forming lower lows and highs, hinting towards the dominance of the bears. Therefore, the price is expected to test the local support at $99,737 and trigger a rebound to $104,400 initially and later enter the rising channel to mark new highs.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.