Robert Kiyosaki Predicts a Chaotic Stock Market Crash | US Crypto News

0

0

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts say about Bitcoin’s battle for the mic and who the top “orange piller” is. Meanwhile, amid discussions about Bitcoin’s rising stars, a renowned investor has sounded the alarm about a doomsday in financial markets.

Crypto News of the Day: Max Keiser Praises Saylor and LeClair as Bitcoin’s Top Voices

Bitcoin maximalist Max Keiser has defended Strategy (formerly MicroStrategy) executive chairman, saying that Michael Saylor best represents the Bitcoin ethos on major platforms like The Joe Rogan Experience.

“Michael Saylor has shown extraordinary Orange Pilling ability… No one’s even close, except Dylan LeClair,” Keiser replied to investor Brandon Bedford.

The statement came after Saylor publicly requested an appearance on Joe Rogan’s podcast to discuss Bitcoin’s rising global relevance. The relevance extends to Bitcoin serving as a hedge against traditional finance (TradFi) and US treasury risks, as indicated in a recent US CryptoNews publication.

Bedford’s take, however, suggested otherwise, claiming that Saylor does not feature in the top 10 among Bitcoin’s most preferred voices.

According to Bedford, voices like Caitlin Long could attract better audiences. She cites her Custodia Bank saga as a perfect fit for Rogan’s anti-establishment style.

“The Custodia story is a perfect fit for Joe Rogan’s natural distrust of the state. And then a very natural segue into the orange rabbit hole,” Bedform explained.

The analyst sees this as a natural entry point to explore Bitcoin’s deeper value proposition.

It is worth noting that in naming Dylan LeClair, Keiser spotlights one of Bitcoin’s sharpest young macro minds. LeClair is a prominent analyst and co-founder of 21st Paradigm and serves as director of Bitcoin strategy at Metaplanet, Inc., the colloquial MicroStrategy of Asia.

Metaplanet recently became the 10th largest public Bitcoin holder following a $117 million BTC purchase. This came as it progressively accelerates its Bitcoin focus, steered by LeClair, known for his data-driven takes on Bitcoin’s intersection with macroeconomics, energy policy, and market structure.

“BTC Rating is better than a Credit Rating,” LeClair wrote recently.

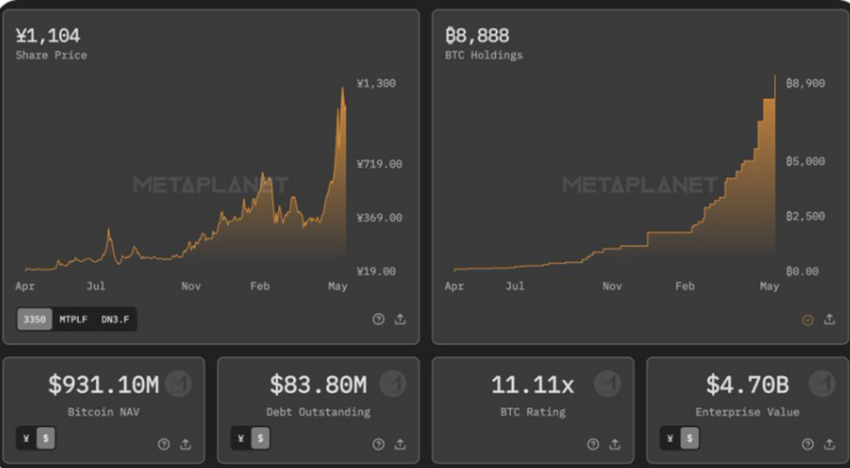

Metaplanet Bitcoin holdings. Source: Dylan LeClair on X

Metaplanet Bitcoin holdings. Source: Dylan LeClair on X

This post highlights Metaplanet’s Bitcoin strategy, showing 8,888 BTC holdings worth $4.7 billion, a ¥1,1604 share price, and a ¥931.1 million Bitcoin Market Value.

With a 1111x Bitcoin Rating, it reflects a premium over NAV, indicating strong market confidence in Bitcoin as a treasury asset amid growing institutional interest in Japan.

While not as high-profile as Saylor, LeClair’s grounded, articulate commentary has made him a sought-after speaker and panelist in Bitcoin conferences.

Meanwhile, the man at the center of the debate, Michael Saylor, continues to double down, in what Max Keiser christened ‘Saylorization’ in a recent US Crypto News publication.

On June 1, Saylor’s MicroStrategy purchased 705 BTC for approximately $75.1 million at an average price of $106,495 per Bitcoin. This brings the firm’s total Bitcoin holdings to 580,955 BTC, valued at over $40.68 billion with a cost basis of nearly $70,023.

The firm also reported a 16.9% YTD yield on its Bitcoin strategy, reinforcing the Saylorization thesis of corporate treasury policy.

Robert Kiyosaki Forecasts Biggest Crash in History, Pushes Bitcoin and Silver

In a parallel narrative on X (Twitter), Robert Kiyosaki, author of Rich Dad Poor Dad, issued yet another dramatic warning.

“As predicted in my book Rich Dad’s Prophecy (2013), the biggest crash in history is coming… this summer,” he noted.

Kiyosaki claims the stock, bond, and real estate markets are poised to implode, devastating traditional investors, particularly baby boomers.

However, he urged followers to seize the opportunity in hard assets like gold, silver, and Bitcoin, calling silver at $35 “the biggest bargain today.”

Kiyosaki’s forecasts, however, come with caveats. Since 2008, he has predicted financial meltdowns nearly every year, usually to coincide with new books or promotional efforts. While he correctly foresaw the 2008 crash, most of his subsequent predictions have not materialized.

The S&P 500 has gained over 280% since 2011, despite multiple warnings. Critics argue his alarmist style lacks consistent evidence, though he remains influential among hard-money advocates.

“Is this dude washed [irrelevant or outdated] now or nah?” one user quipped.

Still, Kiyosaki’s skepticism of TradFi is resonating again. As cited in a recent US Crypto News publication, he recently stated that no one wants US bonds. This aligns with broader concerns about declining Treasury demand, rising interest costs, and global de-dollarization.

Mainstream economists project modest growth with intermittent volatility through 2025. However, Kiyosaki’s pessimistic tone may nonetheless push more retail investors toward alternative assets.

“What is coming could be something we’ve never seen. My company is one of the few manufacturers of Silver and Gold in the USA and this is going to be a wild year/decade ahead,” wrote Josh Philip Phair, Founder & CEO of Scottsdale Mint Co-Founder & CEO of The Wyoming Reserve Opportunity Zone Fund Corporation.

Chart of the Day

Bitcoin holders by portfolio size. Source: Bitcoin Treasuries

Bitcoin holders by portfolio size. Source: Bitcoin Treasuries

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.