Injective launches Nvidia GPU derivative market

0

0

Injective introduces Nvidia GPU derivative market

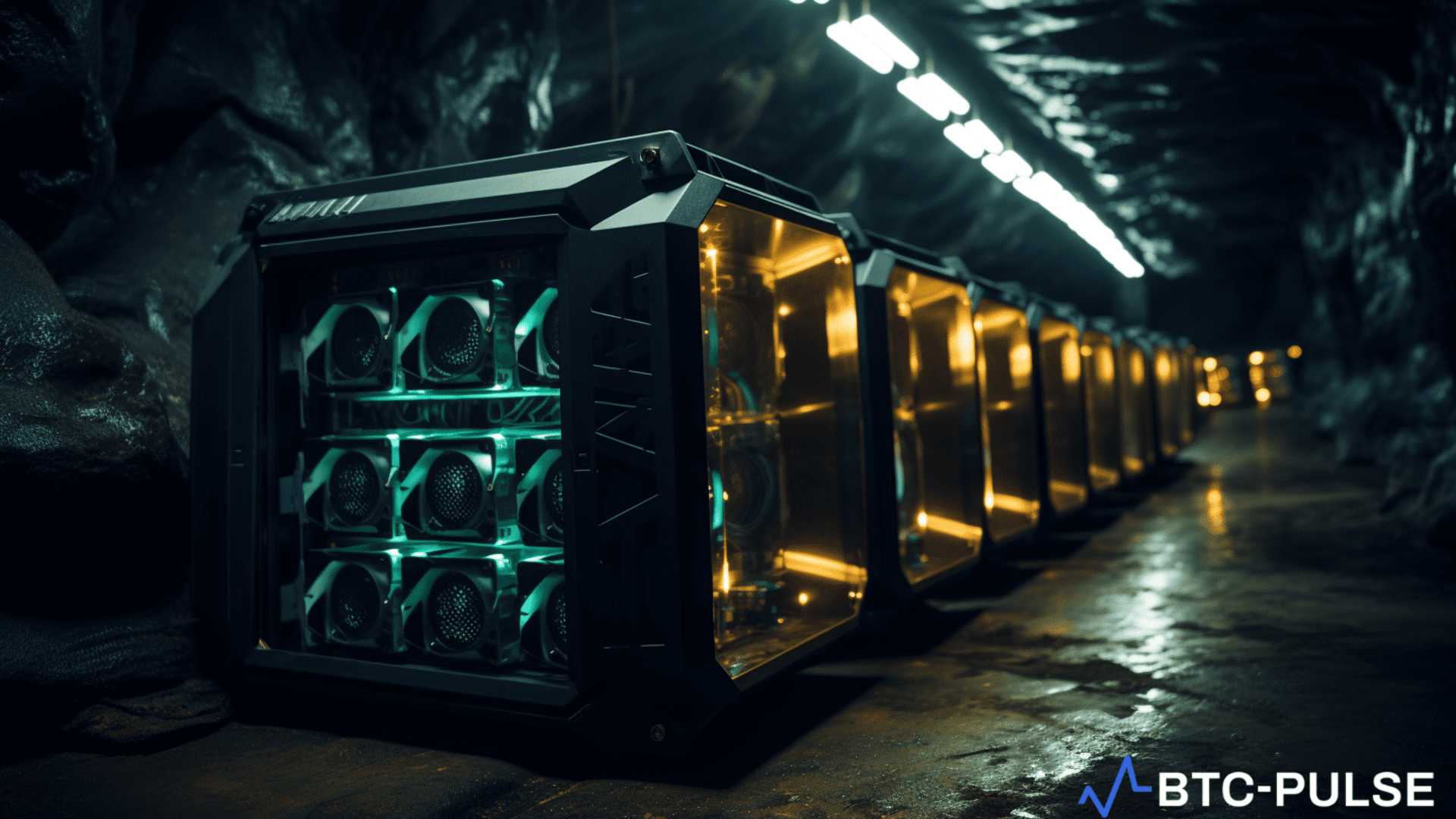

Injective has launched the first-ever onchain derivatives market for Nvidia’s H100 GPUs in partnership with Squaretower. The platform allows traders to speculate on the rental prices of these high-demand chips, marking a milestone in blending artificial intelligence and decentralized finance.

Squaretower provides real-time rental price updates

Powered by Squaretower, the new marketplace delivers hourly updates of H100 rental rates from top compute providers. Squaretower, available on Helix exchange, turns AI compute into tradable assets, enabling around-the-clock trading of GPU pricing.

Tokenizing AI infrastructure

According to Injective, bringing GPU pricing onchain transforms real-world infrastructure into liquid markets. This financial instrument introduces new avenues for speculation, hedging, and innovation in DeFi.

Injective expands tokenized assets push

The Nvidia GPU market launch continues Injective’s strategy of tokenizing real-world assets. Recent initiatives include iBuild, the iAgent SDK for AI-powered onchain agents, and tokenized stocks of companies such as Nvidia, Meta, and Robinhood. The platform also offers commodities like gold, silver, and forex markets.

Recent milestones for Injective

In July, Injective unveiled SBET, the first onchain digital asset treasury. The filing of the Canary Capital Staked INJ ETF further highlights its growing influence in bridging traditional finance with blockchain innovation.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.