Chainlink Price Eyes $47 as Holder Accumulation Soars Amid Positive Funding Rate

0

0

Highlights:

- Chainlink price has defended the $20 support zone, as analysts foresee a rally to $47.

- Chainlink has revealed a collaboration with the world’s largest financial organization, igniting a bullish outlook.

- On-chain metrics and the positive funding rate suggest a potential upside in Chainlink price soon.

The Chainlink price has defended the $20 support zone, currently at $21, a 0.08% increase. The daily trading volume has notably soared 33% to $715 million, indicating growing investor confidence. Meanwhile, Chainlink has recorded a new achievement in blockchain and cryptocurrency. This includes partnerships with companies like SWIFT, DTCC, and Euroclear, among others.

We are excited to announce a major industry milestone in a global corporate actions initiative led by Chainlink in collaboration with 24 of the world’s largest financial organizations, including Swift (@swiftcommunity), DTCC (@The_DTCC), and Euroclear (@EuroclearGroup).… pic.twitter.com/NkymfGWNqE

— Chainlink (@chainlink) September 29, 2025

The project will contribute to building the infrastructure for blockchain-based corporate actions. This will ensure security and accuracy in executing financial transactions. Chainlink has explained that its platform’s growth will rely on the integration of blockchain with Artificial Intelligence (AI) to solve complex data problems. Furthermore, the collaboration will also incorporate ISO 20022 messaging, which is crucial for seamless cross-platform communication.

The various development partnerships and collaborations underscore Chainlink’s enhanced real-world utility, institutional credibility, and broader adoption. This provides a positive and bullish outlook for its native token in the long term.

Chainlink Holder Accumulation and Funding Rate Insights

According to Santiment’s Supply Distribution data, it gives an optimistic perspective on Chainlink price after recording a rise in the number of whales. The metric indicates that whales holding between 1 million and 10 million LINK tokens (yellow line) have accumulated 3.7 million tokens between September 24 and Sep 30. In the meantime, wallets holding between 100,000 and 1 million LINK tokens (red line) shed another 3.38 million tokens.

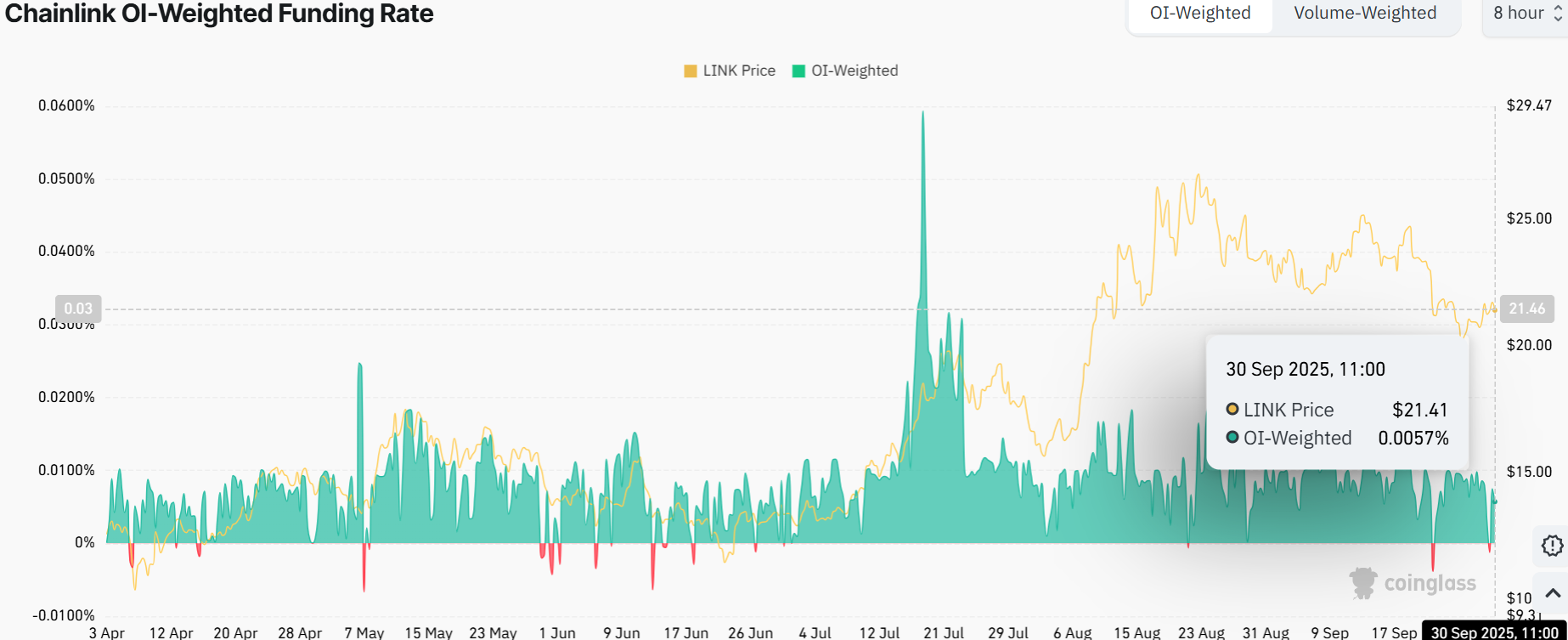

On the other hand, the funding rate weighted on Chainlink’s open interest makes for an interesting part of the analysis. The current OI-weighted funding rate is presently at 0.0057%. This indicates that the market is active, while the funding rate remains stable or positive.

Chainlink Price Forecast: Is a Rally to $47 Imminent?

The 1-day LINK/USDT chart indicates that the token has successfully defended the $20 support zone. LINK is currently trading well within a falling wedge as he bulls seem to be getting ready for a breakout. The bulls have immediate support at $16, as they target to overcome the resistance at $23.41.

The Relative Strength Index (RSI) at 43.20 sits in neutral territory. Meanwhile, the Moving Average Convergence Divergence (MACD) indicates a bearish crossover, with the MACD line remaining below the signal line (orange). The histogram bars are consolidating around the same height, meaning the trend’s still in the early stages and could use more fuel.

Meanwhile, the recent collaboration with the largest financial organizations could mark the beginning of a larger initiative. In the short term, Chainlink’s price prediction suggests a potential upside may be possible. According to Ali Martinez, with Chainlink price defending the $20 support zone, a rally to $47 could be plausible.

If Chainlink $LINK defends $20 support, the next target could be $47. pic.twitter.com/GUTAuMdJyH

— Ali (@ali_charts) September 30, 2025

However, traders will want to watch those resistance levels that could act as speed bumps. The low of $16 support zone is a solid floor if the bears prove too strong in the market. Over the next week, traders will want to keep an eye out for shifts in community sentiment and volume trends.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.