Solana Price Drops 8% Amid Geopolitical Tensions and Market Volatility – Can Bulls Rebound to $160?

0

0

Highlights:

- The price of Solana has dropped 8% to $144 in the past 24 hours.

- Its daily trading volume has surged 37% to $6.11B, indicating increased market activity.

- SOL technical indicators indicate intense selling pressure, tilting the odds in favor of the bears.

The Solana price has decreased by 8% to the $144 mark in the past 24 hours, due to the Israel-Iran war. SOL’s daily trading volume has, however, soared 37% to $6.11B, signaling intense market activity.

The situation between Iran and Israel has taken a step further, where Tehran is being bombed and nuclear sites are being attacked. The markets are now considered volatile, and a rise in oil prices has been observed due to geopolitical tensions. Bitcoin, which had been ranging between the $108K level, has dipped below the $104K level, and the market has liquidated more than $ 1 billion.

War has broken out between Iran and Israel.

Tehran bombed. Nuclear sites hit. U.S. troops targeted in Iraq.

Iran vows revenge.Oil spiking. $BTC dumped below 104K. Over $1B liquidated.$DXY hits lowest since 2022

This is not noise it’s a global reset in motion. pic.twitter.com/szHjXLkebs

— Kyledoops (@kyledoops) June 13, 2025

The U.S. Dollar Index (DXY) is also at its lowest since 2022. There is a rapid shift in the market, suggesting a potential global reset, as cryptocurrencies, including Solana, are struggling to regain their footing.

Solana Price Battles for Direction After 8% Drop

The Solana price has tanked about 8% to the $144 mark, as the bulls lose support in the market. Currently, SOL is trading well within a falling parallel channel, as the bears regain dominance. The bears have established strong resistance at $160 and $174, aligning with the 50-day and 200-day moving averages.

The Relative Strength Index (RSI) stands at 38.53, thereby indicating that SOL is getting close to being oversold. This suggests that the bearish sentiment is intensifying, and the altcoin may decline further if the RSI falls into the 30-undervalued zone. The Moving Average Convergence Divergence (MACD) is bearish as well. This can be seen as the MACD line dropped below the orange signal line, indicating intense selling pressure.

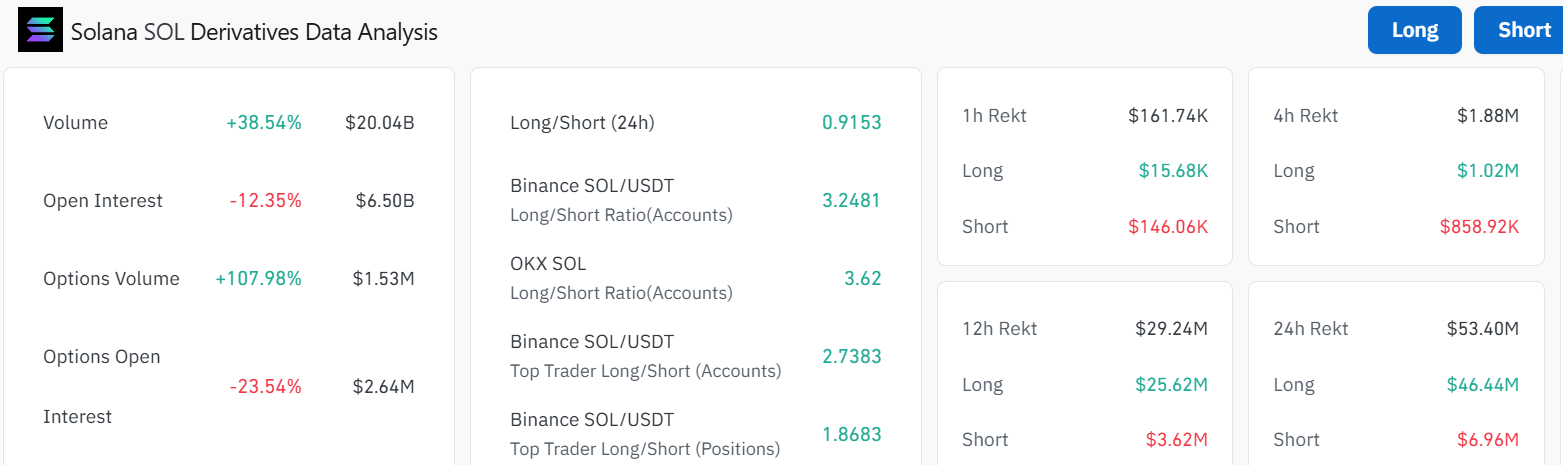

Conversely, the Solana derivatives market is also signaling a more turbulent outlook, with the volume increasing by more than 38.5% to $20.04 billion. However, the open interest has declined by 12.35%. On the other hand, the volume of options has increased significantly, indicating a growing interest among investors.

The long/short ratio of 0.91 suggests that more traders are taking a long position on SOL, yet it may also indicate market exhaustion. Meanwhile, traders need to be cautious, as the market is sending mixed signals.

Can SOL Rebound Above $160?

With the recent geopolitical tensions, the cryptocurrency market has declined, as major altcoins such as Solana have lost significant support zones. Furthermore, if the current downward momentum persists, the Solana price may decline further to lower levels. In such a case, the $141 support zone will be in line to absorb the potential selling pressure. A breach below this mark will call for panic sell-offs towards the $136 and $131 support zones.

On the other side of the fence, if the Solana bulls gain strength at this level, the Solana price could rebound to the upside. They may target the $152 and $160 resistance levels. Only a breach above the $160 barrier may trigger a short-term rally in the Solana market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.