[LIVE]With ETH Pumping And BTC Maintaining, What’s The Best Crypto To Buy Now?

0

0

On 22 August 2025, the altcoin king managed to breach its previous all-time high (ATH) of $4,885, achieved in November 2021. The new ATH now stands at $4,866. Is it the best crypto to buy now? Industry insiders certainly think so.

The market projection for ETH is rapidly turning bullish. Standard Chartered has revised its year-end 2025 price target to $7,500, up from $4,000. Further, it predicted that ETH will reach $25,000 by 2028.

ETH surged by more than 15% on 22 August 2025 after Federal Reserve Chair Jerome Powell hinted at an upcoming rate cut, prompting investors to turn up the ante.

As of this writing, ETH’s price has decreased slightly, trading around the $4,770 level.

According to crypto analytics and trading platforms like Hyblock, this rally in ETH is fundamentally different from its earlier peaks. Hyblock maintains that in this case, the price action is being driven by genuine demand rather than early investors offloading supply and stalling momentum.

Now that the ETF inflow is accelerating and the treasury is beginning to adopt ETH, paired with the tailwinds from the GENIUS Act, the altcoin might be entering a phase of extreme bullishness.

THE WHALE PLAYBOOK

One Bitcoin OG keeps moving BTC into ETH.

Latest shift: 4,000 $BTC ($460M).Totals so far:

– 179,448 $ETH bought ($806M)

– Avg price $4,490

– Still long with 135,265 ETH ($581M)He’s not speculating, he’s building conviction.

The only question:

What does… pic.twitter.com/HNNHM5IUqg— Merlijn The Trader (@MerlijnTrader) August 24, 2025

ETH ETFs on 21 August 2025, recorded $287.6 M in inflows after witnessing four straight days of outflow. Supported by the inflows, the total ETF holdings have pushed past $12.12 B as the feels a renewed institutional confidence.

Meanwhile, corporate treasuries are accumulating quietly in the background. BitMine, SharpLink, BTCS and GaneSquare have collectively added around $1.6B in ETH over the last month, pushing total corporate reserves to $29.75B.

EXPLORE: Top 20 Crypto to Buy in 2025

BTC Maintaining At $114k. Is It Still The Best Crypto To Buy Now? Or Is An Altcoin Season Coming?

While BTC saw a bump up to the $117k level on 22 August 2025, it has since then slid back down to the $114k zone and is maintaining. This downside in performance has coincided with ETH’s rally, leading to it breaching its ATH.

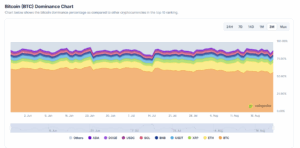

BTC is facing an outflow problem. BTC’s share of the crypto market capitalisation has fallen below 60% for the first time in four months. As of this writing, its market dominance sits at 56.6%, according to CoinGecko’s data.

At its peak this year, BTC commanded 66% of the total crypto market capitalisation.

Waning BTC performance signals a clear shift in investor behaviour. They are rotating capital into altcoins, particularly into large-cap assets like ETH, chasing a higher yield potential.

BTC created a CME price gap on 23 August 2025 after shedding roughly 1.87% since the session’s open. Such gaps have historically been filled pretty quickly, which means that BTC could potentially rebound towards $117k in the near term.

$BTC has formed a $2000 CME Gap

I’ve got a cautious read on this gap. Its size is notably larger than prior ones, which suggests it could take longer to fill.

Be careful if you are trying to target this on the LTF. pic.twitter.com/Cmng2FdLEO

— Killa (@KillaXBT) August 23, 2025

The RSI is in a neutral territory but trending downward. Meanwhile, the MACD shows a bearish divergence. Both technical indicators suggest a waning of momentum. Furthermore, a drop in trading volume suggests a weakening of buying pressure.

Interestingly, recent price action shows hammer-like candles with long wicks forming near the $112k support zone, suggesting that buyers are defending this position.

If BTC holds above the 112k level and manages to breach the $117k level decisively, bullish momentum will carry it forward, where upside targets could emerge at $120.9k and $124.5k, aligning with the upper Fibonacci retracement zone.

#Bitcoin is holding $112K support after hammer candles signaled buyer defense. A break above $117K could unlock targets at $120.9K–$124.4K, with $130K in play.

pic.twitter.com/zgjCHY14F4

— Arslan Ali (@forex_arslan) August 24, 2025

On the downside, a break below $112k could see BTC test $108.7k with a deeper support at $105.2k.

EXPLORE: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Maelstrom CEO Arthur Hays Predicts Ethereum To Hit $20,000

Maelstrom’s CEO, Arthur Hays, has fixed his Ethereum price target range between $10,000 and $20,000 by the end of the current bull cycle. His prediction hinges on several macro and crypto native factors.

Arthur Hayes just admitted he bought back ETH because “the chart says it’s going higher.”

He sees Ethereum running up to $20K this cycle.

He’s overweight $ETH

pic.twitter.com/Yd3q1t0aCe

— SamAlτcoin.eth

(@SamAltcoin_eth) August 21, 2025

One key factor for Hays’s prediction is his belief that the Trump administration will adopt major quantitative easing, a monetary policy that allows for new money to be created that is then used to purchase financial assets.

Hays expressed his thoughts on the Crypto Banter podcast to Ran Neuner, stating, “We have from the middle of 2026 until Trump leaves office for them to go absolutely insane with how much they’re going to print.”

World Liberty Token Causes Aave To Drop Over 8%

The price of Aave fell sharply by 8% on 23 August 2025, following social media rumours about a token allocation deal with World Liberty Financial (WLFI), a decentralised financial (DeFi) platform linked to members of President Trump.

Blockchain reporter Colin Wu said, “The WLFI team told WuBlockchain that the claim that ‘Aave will receive 7% of the total WLFI token supply’ is false and fake news.”

The WLFI team told WuBlockchain that the claim that "Aave will receive 7% of the total WLFI token supply" is false and fake news. Previously, a community member claimed that, according to a previously released proposal, AaveDAO would receive 20% of the protocol fees generated by…

— Wu Blockchain (@WuBlockchain) August 23, 2025

Wu on his X was referencing a community proposal from October 2024 that suggested Aave’s DAO would receive 7% of WLFI’s token supply and 20% of protocol revenues from WLFI’s deployment from Aave v3.

While WLFI denied these claims, Aave’s founder, Stani Kulechov, referred to the proposal as “the art of the deal” and implied the terms were still valid.

Following this, Aave dropped from $385 to $339, later rebounding to $352.

This controversy comes amid renewed interest in DeFi, with TVL (total value locked) climbing past $167 billion.

The post [LIVE]With ETH Pumping And BTC Maintaining, What’s The Best Crypto To Buy Now? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.