Uniswap (UNI) hits $2.94 trillion in swap volume, surpassing Canada’s GDP

0

0

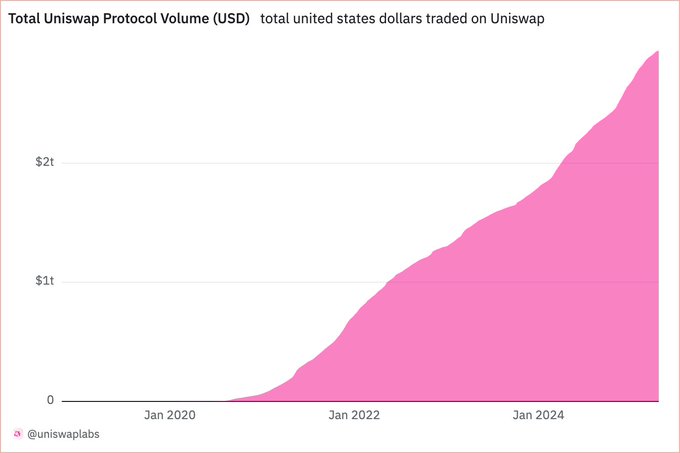

Uniswap (UNI) has seen staggering growth since its 2018 launch.

According to the latest update, the decentralized trading protocol has processed over $2.94 trillion in swap volume.

The amount has grabbed the crypto community’s attention as it has outpaced Canada’s gross domestic product (GDP).

Uniswap trillion-dollar growth

Every time an individual trades one coin for another on Uniswap (like SOL for USD Coin), the transaction adds to the protocol’s swap volume.

User growth in the past seven years and multiple transactions involving thousands of asset pairs propelled Uniswap’s trading volume to surpass the G7 nation’s GDP.

The DeFi boom between 2020 summer and late 2022 saw the figure surpass the $1 trillion mark.

Surge in UNI adoption, new users, and the ever-growing interest in decentralized systems propelled the momentum.

On the other hand, Canada’s GDP was around $2.142 trillion in 2023.

While protocol volume and GDP aren’t directly akin, the symbolic comparison remains powerful.

The figure reflects the significance of decentralized systems in the global financial landscape.

Uniswap’s achievement grabbed attention since it has no central control (no offices, and no CEO).

That’s unlike traditional finance, where decision-making remains massively centralized.

Uniswap’s growth underscores the shifting trends where individuals seek control over their finances.

People want 24/7 access, transparency, and unlimited liquidity.

Uniswap’s milestone goes against skeptics who dismiss digital assets as speculative assets.

The massive volume underscores how decentralized systems can scale, handle trillions, and gain trust without intermediaries.

UNI price outlook

Uniswap’s native token is trading in green today.

It changes hands at $5.94 after gaining over 6% in the past 24 hours.

The rising daily trading volume signals renewed interest in UNI at current prices.

The prevailing broad-based recoveries saw UNI breaking out of a descending wedge pattern, just above $5.255.

That positions the altcoin for continued gains in the near term.

Analyst CW predicted extended gains to $15 for UNI.

That would mean an over 150% increase from the current price.

A descending wedge is an optimistic setup that often highlights possible reversals or upside continuations.

The pattern emerges when the asset price hovers between down-sloping and converging trendlines.

Despite the downward trajectory, a falling wedge signals bullish reversals, especially after extended price dips.

That’s because price squeeze within a wedge weakens selling pressure amid buyer resurgence.

The asses record sharp upswings after breaking beyond the pattern’s upper trendline resistance – as UNI has done.

The prevailing crypto market recovery supports Uniswap’s upside trajectory.

The post Uniswap (UNI) hits $2.94 trillion in swap volume, surpassing Canada’s GDP appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.