ETH price Narrative May Change Soon, Data Shows

0

0

ETH price just concluded the last week of April with sideways motion indicating a stalemate between the bulls and bears.

This outcome suggests it has been experiencing a demand cool down after its previous recovery. But the bears were also on the sidelines.

The sideways movement in ETH price action may be translated as a sign of weak demand in the short term. However, recent market data revealed key insights about its potential price action in the mid to long term.

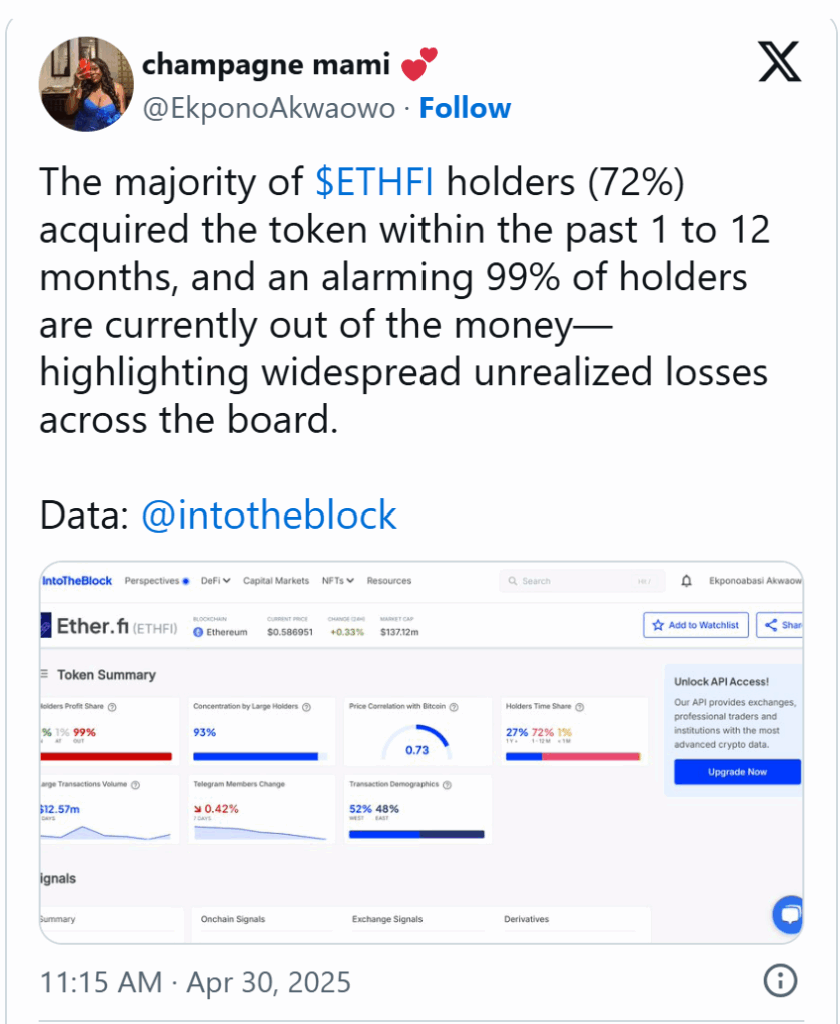

Data from IntoTheBlock revealed that 72% of the ETH in circulation was acquired in the last 12 months. This suggests that most buyers have been providing liquidity to long term holders that offloaded in the last 5 months.

The data also revealed that 99% of the buyers that purchased ETH in the last 12 months were at a loss.

An outcome that dampened sentiment around ETH and could be one of the reasons behind waning institutional interest in Q1 2025.

Will Institutional Resurgence Support ETH Price Recovery?

April was an extremely volatile month for the markets, and that outcome had a negative impact on institutional sentiment.

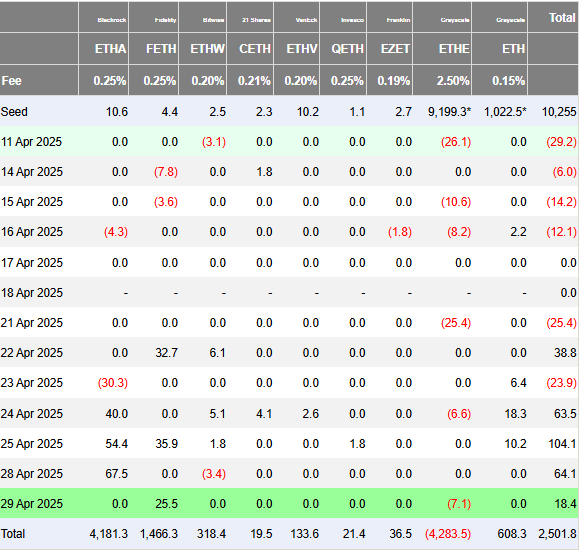

Especially in the first half of the month, during which ETH price experienced significant downside, aided by heavy institutional outflows.

The last 7 business days of April saw a significant return in institutional liquidity. The outcome suggested that the discounted prices and shifting macro-economic conditions were back in favor of accumulation and institutions did not want to be left behind.

Roughly $250.1 million worth of intuitional flows into Ethereum ETFs was observed in the last 4 business days. A noteworthy shift compared to previous weeks of continuous outflows.

More positive flow observations were observed beyond the ETFs scope. For example, ETH exchange reserves have been on an uptrend for the most part in April. However, exchange reserves pivoted in favor of the downside in the last 6 days.

The pivot confirmed that demand was once again making a comeback, thus allowing more ETH to flow out of exchanges than the amount flowing in.

The convergence of the two observations (exchange reserves pivoting and positive ETF flows) suggests that a demand wave could be building up likely in favor of a bullish outlook in May. However, this will only be the case if macro conditions will be favorable.

Following the Smart Money: ETH Whales Have Been Accumulating

Meanwhile, 93% of ETH holdings were concentrated in whale addresses as per recent data. An important observation which confirms that whales have been stacking at discounted prices.

The observation was important because whale activity has historically been observed to surge under special conditions. For example, when prices are severely discounted and market sentiment is weak.

The market conditions in Q1 and the first half of April accurately fit the bill and align with observed whale accumulation.

A classic case of coins flowing in favor of long term holders. This suggests that whales are confident about ETH’s long term prospects, hence their aggressive accumulation.

Investors have also been keeping a keen eye on Bitcoin dominance which has been ticking higher and closer to new highs.

This is because new highs are historically followed by some pullback, which usually points to more liquidity flowing into altcoins.

ETH price action was still heavily discounted from its December 2024 top at the time of observation.

The discount, combined with strong whale activity and returning institutional demand could make ETH more appealing and thus cannel more liquidity into it.

In other words, ETH price bullish prospects may pave the way for a stronger comeback in May if conditions allow.

The post ETH price Narrative May Change Soon, Data Shows appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.