ARK Invest: Global M2 to Bitcoin Supply Ratio Reaches 12-Year High

0

0

BitcoinWorld

ARK Invest: Global M2 to Bitcoin Supply Ratio Reaches 12-Year High

Table of Contents

Table of Contents

-

What Did ARK Invest Reveal?

-

Why Does the M2 to Bitcoin Ratio Matter?

-

What Could This Mean for Investors?

-

FAQs

Introduction

Introduction

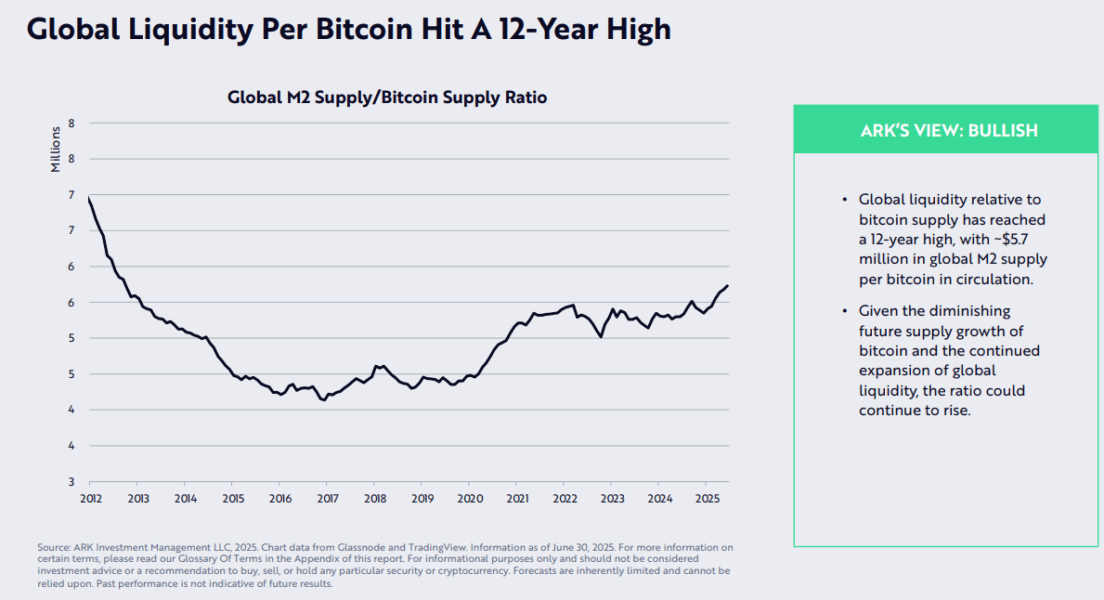

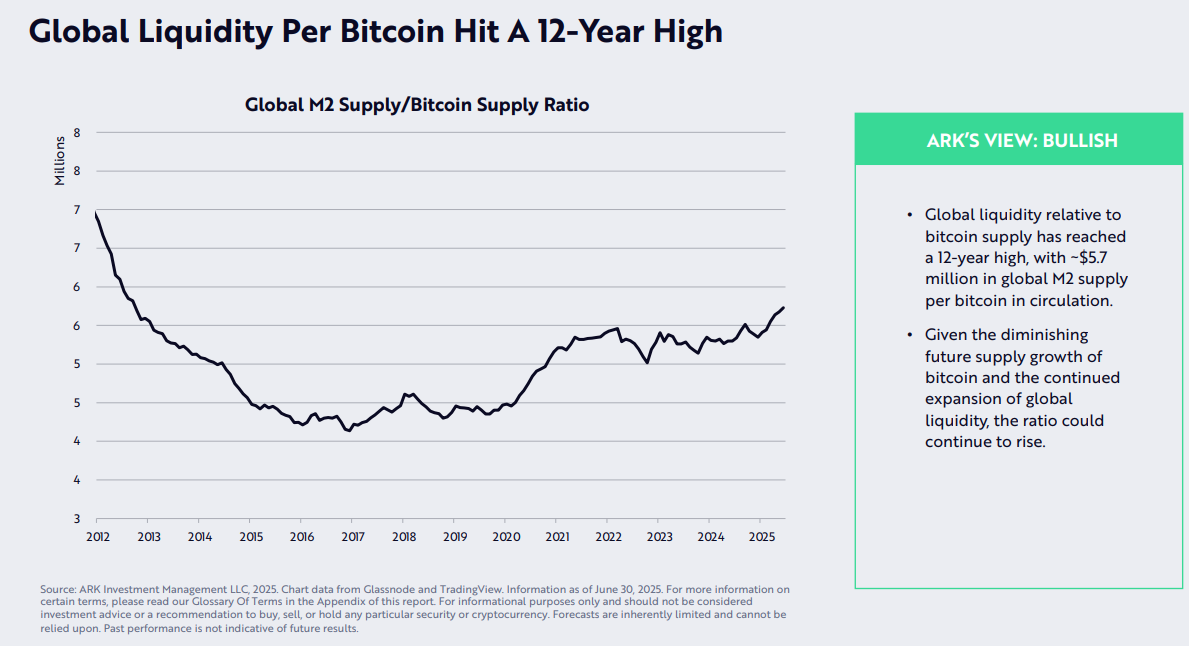

In its June 2025 Bitcoin Monthly Report, global asset manager ARK Invest has revealed a striking milestone for Bitcoin’s scarcity narrative. The ratio of global M2 money supply to Bitcoin supply has reached its highest point in 12 years — highlighting how Bitcoin’s fixed supply continues to contrast with expanding global liquidity.

What Did ARK Invest Reveal?

What Did ARK Invest Reveal?

According to ARK Invest’s official report (source), each Bitcoin now represents about $5.7 million of global M2 money supply. This is the highest ratio seen since Bitcoin’s early years.

Key details from the report:

-

Record Ratio: The global M2 supply is growing, while Bitcoin’s issuance rate keeps dropping due to its halving cycle.

-

Future Outlook: ARK expects this ratio to keep climbing as Bitcoin’s supply growth shrinks further.

-

Scarcity Signal: With less new Bitcoin entering circulation, its role as a hedge against fiat currency dilution strengthens.

Why Does the M2 to Bitcoin Ratio Matter?

Why Does the M2 to Bitcoin Ratio Matter?

Many investors track the M2-to-Bitcoin ratio to understand Bitcoin’s relative scarcity against global liquidity:

-

M2 Supply: Represents cash, checking deposits, and easily convertible near-money — a core measure of global money supply.

-

Bitcoin’s Cap: Unlike fiat currencies, Bitcoin’s total supply is capped at 21 million coins, with the last Bitcoin expected to be mined around 2140.

-

Implication: Rising M2 + fixed Bitcoin = each Bitcoin theoretically absorbs more global liquidity over time.

As Cathie Wood, CEO of ARK Invest, has often stated, Bitcoin could act as a hedge against monetary debasement when central banks expand liquidity (source).

What Could This Mean for Investors?

What Could This Mean for Investors?

Here are three takeaways for Bitcoin investors and analysts: Potential Store of Value: A higher M2 ratio supports the thesis that Bitcoin’s scarcity could protect wealth long-term.

Potential Store of Value: A higher M2 ratio supports the thesis that Bitcoin’s scarcity could protect wealth long-term. Macro Hedge: Some view Bitcoin as an alternative to gold when fiat supply expands aggressively.

Macro Hedge: Some view Bitcoin as an alternative to gold when fiat supply expands aggressively. Caution Required: Volatility remains — investors should balance enthusiasm with prudent risk management.

Caution Required: Volatility remains — investors should balance enthusiasm with prudent risk management.

For related trends, see [Link to related internal page].

FAQs

FAQs

Q1: Who is ARK Invest?

ARK Invest is a global investment firm founded by Cathie Wood, known for its focus on disruptive innovation and in-depth research reports.

Q2: What is the M2 money supply?

M2 includes physical cash, checking accounts, and easily liquid assets — it’s a standard measure of how much money circulates in an economy.

Q3: How does Bitcoin’s supply limit work?

Bitcoin’s supply is hard-coded to a maximum of 21 million coins. New coins are released through mining rewards, which halve approximately every four years.

This post ARK Invest: Global M2 to Bitcoin Supply Ratio Reaches 12-Year High first appeared on BitcoinWorld and is written by Keshav Aggarwal

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.