Altcoin Open Interest Hits Highs, Traders Expect Choppy Week Ahead

0

0

According to recent data, Altcoin Open Interest has climbed to unprecedented levels, drawing traders’ attention and sparking debate about where the market heads next.

As Altcoin Open Interest moves closer to Bitcoin’s open interest, recently around $83 billion, it shows investors are shifting money and risk into altcoins. With the Federal Reserve preparing its policy decision this week, the stage looks set for heightened volatility.

The Scale of the Surge

Figures from multiple platforms show how steep the rise has been. Altcoin Futures Open Interest touched about $61.7 billion in late August 2025 after jumping nearly $9.2 billion in a single day. Earlier that month, altcoin open interest stood at around $47 billion, already pushing close to Bitcoin’s levels.

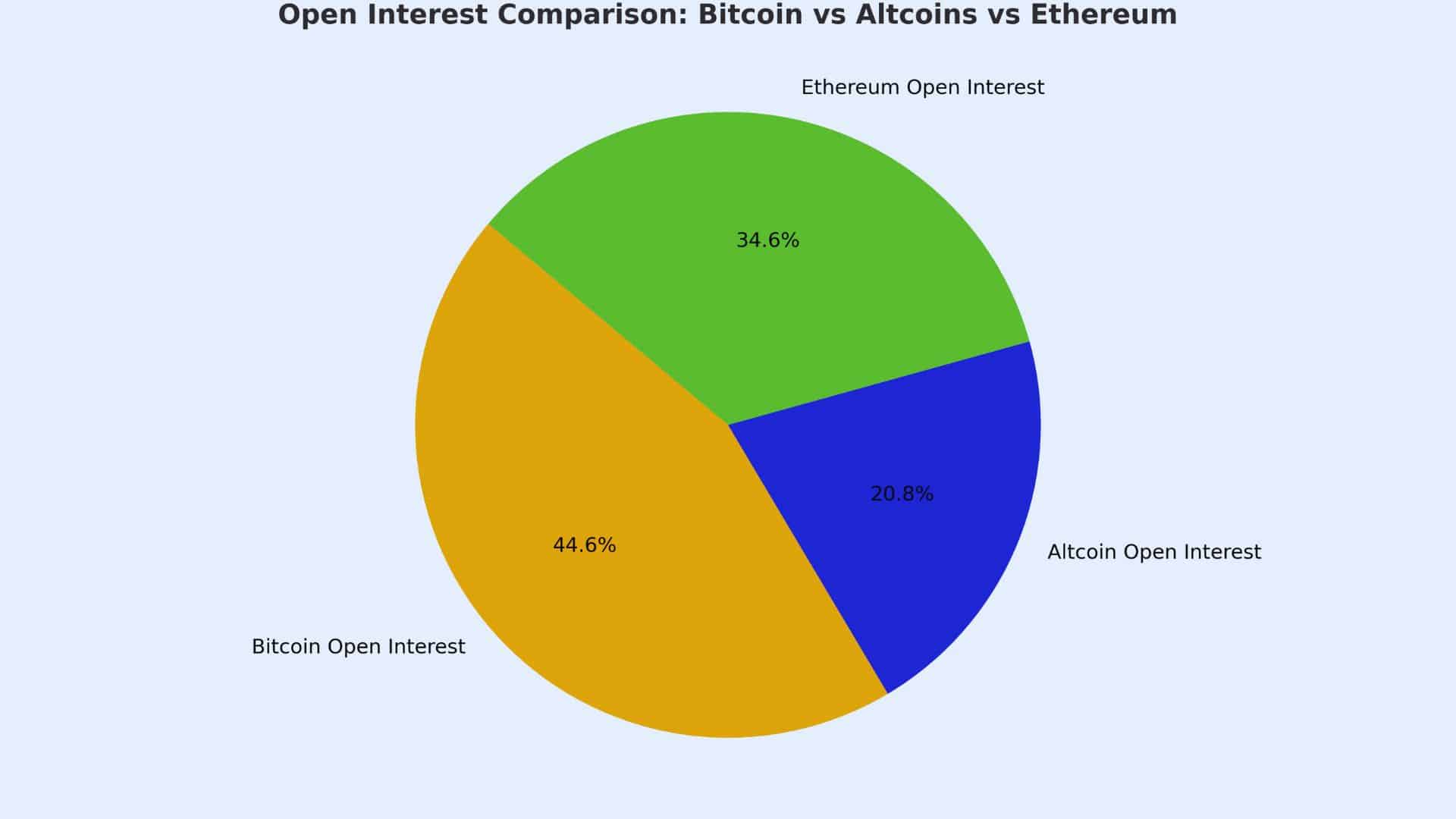

More recently, it has been reported around $38–38.6 billion, compared with Bitcoin’s ~$83 billion and Ethereum’s ~$64.3 billion. These numbers highlight how much capital has flowed into leveraged bets on altcoins.

Also Read: Altcoins Rebound Signals Renewed Confidence: XRP Open Interest Hits Record Highs

Why Traders Are Piling In

The surge in Altcoin Open Interest is not accidental. Traders are chasing bigger returns in altcoins while Bitcoin trades with lower volatility. Altcoin Futures Open Interest is being fueled by higher leverage, with some contracts running at extreme multiples. That leverage makes it easier to open large positions but also makes markets fragile.

Another driver is capital rotation. Bitcoin’s dominance has slipped from about 65% earlier this year to around 57-59%, suggesting money is moving into alternative assets.

On top of that, hopes of easier monetary policy have encouraged traders to position early in riskier coins. With the Fed in focus, many are betting on a dovish signal to lift prices further.

Risks on the Horizon

The surge in Altcoin Open Interest comes with rising risks. Heavy leverage means even a small shock, such as hawkish Fed news, could trigger mass liquidations. Bitcoin’s volatility has eased while Altcoin Futures Open Interest keeps climbing, often seen as the calm before the storm.

If Bitcoin stays flat while altcoin interest rises, it may signal exhaustion and spark sharp pullbacks in recent high performers.

What to Monitor

| Factor | Why It Matters |

|---|---|

| Bitcoin vs Altcoin Open Interest | Shows whether traders are shifting too far into risky bets |

| Funding rates | High costs signal overcrowded positions |

| Leverage levels | Excessive leverage makes liquidations more likely |

| Macro events like Fed decisions | Often act as catalysts for sharp moves |

Traders keeping an eye on these signals may be able to manage risk better and spot turning points earlier.

Conclusion

Altcoin Open Interest has climbed to stretched levels, with Altcoin Futures Open Interest touching $61.7 billion. Traders now face both opportunity and risk.

With Bitcoin open interest around $83 billion and Ethereum at $64.3 billion, the Fed’s upcoming policy move could spark the next wave of swings. The market is primed for movement, and smart risk management is just as important as chasing gains.

Also Read: SEC Ends “Regulation by Lawsuit” With Project Crypto: What It Means for Bitcoin and Altcoins

Summary

Altcoin Open Interest has soared, narrowing the gap with Bitcoin’s open interest of about $83 billion. Ethereum futures open interest has also hit a new high near $64.3 billion. With Altcoin Futures Open Interest topping $61.7 billion, leveraged positions are climbing fast, raising both opportunity and risk.

Analysts warn that divergence between Bitcoin and altcoin interest could spark liquidations, especially as the Federal Reserve’s policy decision looms as a key market catalyst.

Glossary of Key Terms

Altcoin Open Interest: Value of all active contracts in altcoin derivatives markets.

Leverage: Borrowed funds that increase the size of a trade.

Liquidation: Forced closing of a leveraged position when losses exceed margin.

Bitcoin Dominance: Share of total market capitalization held by Bitcoin.

FAQs about Altcoin Open Interest

Q1: Why does Altcoin Open Interest matter?

It shows how much capital is tied up in trades. A rise often signals bigger price moves ahead.

Q2: What is Altcoin Futures Open Interest?

It refers to open positions in futures contracts specifically, a key measure of speculation.

Q3: Can this trigger an altseason?

High open interest sets the stage but needs sustained flows and bullish momentum to push altcoins broadly higher.

Q4: How does the Fed affect crypto?

Interest rate decisions shape liquidity and risk appetite, which directly impact leveraged positions.

Read More: Altcoin Open Interest Hits Highs, Traders Expect Choppy Week Ahead">Altcoin Open Interest Hits Highs, Traders Expect Choppy Week Ahead

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.