BONK price breakout: double-bottom pattern and ETF buzz fuel bullish outlook

0

0

After a prolonged consolidation phase, the BONK price is showing the early signs of a bullish reversal supported by technical indicators, ETF speculation, and rising momentum within the Solana ecosystem.

BONK is currently attempting to reclaim key resistance levels that could set the stage for a larger rally.

Technical setup hints at breakout potential

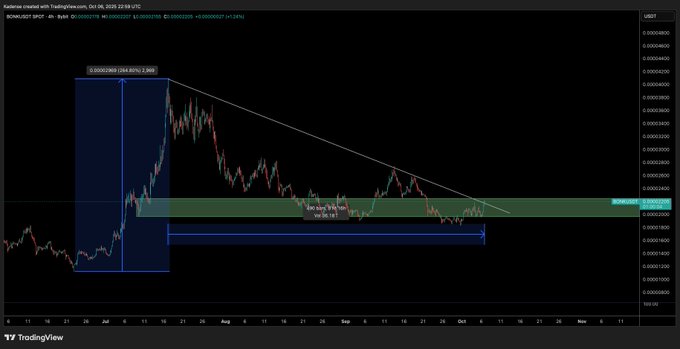

BONK has been in a tight consolidation range for weeks, trading between the $0.000027 support and $0.000052 resistance zones.

This phase of sideways movement followed a remarkable +260% rally earlier in the year and 81 days of consolidation, a setup that often precedes significant price swings.

According to analysts like Kadense Pengu, the longer the consolidation lasts, the more explosive the subsequent move could be.

Looking at the recent price action, BONK has defended lower support near $0.000019 and rebounded 3.36% in the last 24 hours to trade around $0.0000206.

Technical indicators are flashing early bullish signals, and a potential double-bottom pattern has formed after the token held its ground near the same support level twice in September, suggesting selling pressure may be waning.

In addition, the Relative Strength Index (RSI) has recovered from near the oversold territory, while the MACD histogram has turned positive, reinforcing the likelihood of strengthening buying momentum.

BONK ETF speculation fuels optimism

Adding to the bullish sentiment is growing excitement around Tuttle Capital Management’s recent filing for a Bonk Income Blast ETF.

Though approval from regulators remains uncertain, the news has amplified interest among both retail and institutional investors.

Leveraged ETF products, if approved, could expand BONK’s market reach and liquidity while increasing speculative inflows.

Open interest in BONK derivatives has surged by more than 10% to $27 million following the ETF filing, signalling a spike in trader anticipation.

Analysts draw parallels with BONK’s 75% rally in July 2025 after Grayscale added the token to its watchlist, noting that institutional exposure tends to catalyse strong market reactions.

Solana ecosystem drives renewed demand

BONK’s recent strength also reflects a broader resurgence within the Solana ecosystem.

As activity on Solana continues to climb, whale investors have been accumulating BONK, reportedly purchasing over $33 million worth of the token in the past week.

The trend coincides with challenges facing other Solana-based meme projects, prompting a rotation of capital toward BONK as traders seek safer bets within the network’s meme coin segment.

However, while BONK’s 24-hour trading volume of around $530 million highlights renewed market engagement, it remains well below the $2.4 billion peak seen in mid-2025.

Sustained trading activity above the $600 million mark could serve as confirmation of a stronger uptrend, suggesting that traders are still cautious despite improving sentiment.

BONK price outlook: confirmation needed above key resistance

For now, all eyes are on BONK’s short-term technical thresholds.

A daily close above $0.000022 could validate the double-bottom pattern and trigger momentum toward the breakout resistance at $0.000052.

If the token manages to $0.000052 on rising volume, analysts project a potential rally toward $0.000062, a price zone that could mark the beginning of a new bullish phase.

However, broader market dynamics remain a factor, especially seeing that the crypto Fear and Greed Index currently stand at 62, indicating mild greed and a potential for profit-taking if momentum stalls.

The post BONK price breakout: double-bottom pattern and ETF buzz fuel bullish outlook appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.