Solana Whale Activity Surges: $836M in SOL Moves to Binance, $54M to Coinbase

0

0

Solana price has been making waves in the crypto world with large whale activity. Whale Alert tracked over 2.5 million SOL moving to Binance in massive transfers. The total value of the transfers reached $836 million, drawing attention to possible market shifts.

Large transfers often signal sell pressure, leaving traders on edge. Meanwhile, $54 million worth of Solana moved to Coinbase Institutional, hinting at strategic portfolio adjustments. This contrast has traders questioning whether Solana is poised for a major market move.

Solana Whales Signal Shift in Strategy

Whale Alert tracked several large transfers, with over 2.5 million SOL moving to Binance. This massive liquidity influx raised concerns about potential sell-offs. The large volume of Solana tokens being transferred suggests that whales might be preparing to liquidate positions.

Also Read: Why Analysts Say Solana Could Explode Past $300

At the same time, $54 million worth of Solana was moved to Coinbase Institutional. This suggests that whales may not be preparing to sell, but rather reposition their holdings. The duality of these moves has left traders uncertain about Solana’s next move.

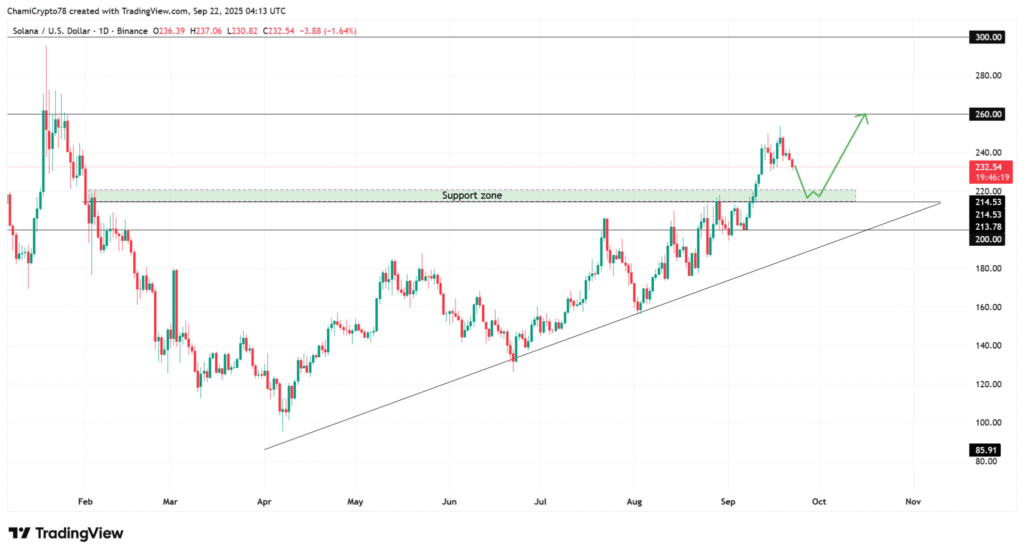

Solana Action: Consolidating Above Support

Solana has been consolidating above the $214–$220 support zone. This support has acted as a foundation for the recent uptrend. The daily chart shows Solana price holding steady despite the large whale movements.

The trendline stretching back to April continues to provide bullish support. However, Solana has faced repeated rejections near the $240 resistance level. This suggests a lack of buying momentum and raises questions about Solana’s ability to break higher.

Market Volatility and Whale Influence

Whale activity is a key factor in Solana’s market movement. Large transfers to Binance often indicate a potential sell-off. However, Solana price could also see a rebound if the $214–$220 support zone holds. The next few days will be crucial for Solana as whale activity continues to drive market sentiment.

Traders are watching the price closely to see if it can hold the critical support. A breakdown below the $214–$220 zone could open the door for more volatility. On the other hand, holding above this level could signal a potential move toward $260.

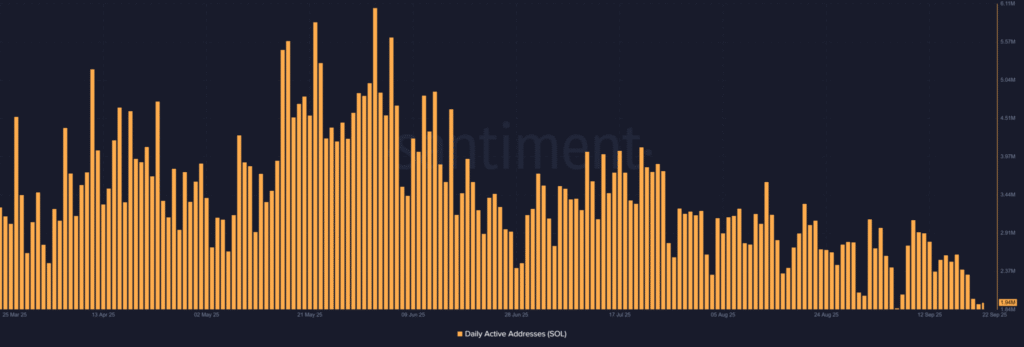

Diverging Signals: Price vs. Activity

While Solana price has remained stable, there are concerns about declining user activity. Solana’s Daily Active Addresses (DAA) dropped nearly 27% in just one week. The number of active users fell from 2.6 million to 1.9 million.

Fewer active users could mean reduced transaction volumes and slower ecosystem development. For a blockchain to remain bullish, strong participation is key. A drop in activity may indicate waning interest in the Solana ecosystem, putting the bullish narrative at risk.

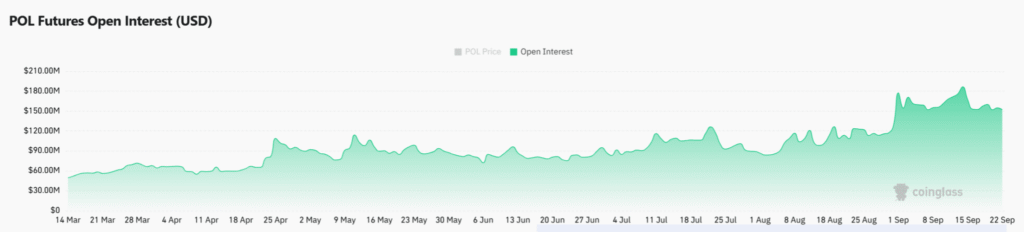

Solana Whale Activity and Perpetual Futures

The perpetual futures market adds another layer to the current sentiment. The OI-Weighted Funding Rate for Solana is slightly positive at +0.0074%.

This indicates that traders are willing to pay a premium to maintain long positions. Despite this optimism, the rate also increases the risk of sudden liquidations if the market turns.

Solana price stability relies heavily on speculation. If the sentiment shifts or momentum weakens, traders holding long positions may be forced to liquidate, causing further volatility.

Solana’s Path Ahead: Key Support Zone

Solana’s next moves depend heavily on the $214–$220 support zone. If the price holds above this level, it may rebound toward $260. However, a breakdown below support could lead to further downside. Traders are eyeing the $190–$200 range as the next possible support.

Solana price is also approaching the Gaussian channel. If the price reaches the lower bands, it could face further bearish pressure. The channel’s influence may keep Solana’s price suppressed in the short term.

RSI and Market Indicators

The Relative Strength Index (RSI) for Solana is currently at 47, indicating a shift from overbought conditions. This suggests that the asset is entering a phase of consolidation or possible downside.

A cooling RSI highlights the lack of strong momentum, which could keep the market in a holding pattern.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Sep 2025 | $ 218.35 | $ 222.25 | $ 225.40 |

2.22%

|

| Oct 2025 | $ 227.02 | $ 235.49 | $ 242.07 |

9.78%

|

| Nov 2025 | $ 238.49 | $ 243.15 | $ 245.08 |

11.15%

|

| Dec 2025 | $ 242.75 | $ 243.58 | $ 244.46 |

10.87%

|

Solana Whale Activity and Future Outlook

For now, Solana’s fate is tied to whale activity. The influx of liquidity to Binance suggests that some whales may be preparing for sell-offs. However, the institutional transfers to Coinbase show that strategic repositioning is also taking place.

Conclusion

Whale activity on solana continues to be a driving force in the market. And similar large inflows in Binance next to big potential sell-ins, and institutionals send to Coinbase offers a more strategic view.

The $214–$220 support area will play a crucial role in deciding the direction of Solana price action. With whale-induced volatility persisting, traders are looking for clues of a stabilization or more downside.

Also Read: Crypto Price Prediction Today: What’s Next for XRP, Solana, and AVAX as Bulls Return?

Summary

Solana (SOL) is registering heavy whale activity with more than 2.5 million SOL on the move to Binance, hinting at potential dumps. Meanwhile, $54 million in Solana left for Coinbase Institutional — a hint of strategic reallocation.

As Solana price struggles to maintain the support, decreasing user activity and whale-led volatility cast doubts on its future. Price action near the $214–$220 region will dictate whether Solana can maintain its upward momentum or succumb to selling pressure.

Appendix: Glossary of Key Terms

Whale Activity – Big crypto holders are appearing to move tokens around in ways that could affect the market.

Binance: Cryptocurrency exchange with high volume world wide.

Coinbase Institutional: A business unit serving the needs of institutions, providing tools and services to institutional clients involved in investing in or with digital assets.

Support: A price level where the asset seems to temporarily or permanently find buying interest, prevents it from falling further.

Resistance: Price level at which it is difficult for the asset to trade above, due to selling pressure.

RSI (Relative Strength Index): A momentum oscillator that measures the speed and change of price movements, see it here, which can help traders identify overbought or oversold conditions.

Gaussian Channel: A price channel tool to compare trends and reversals in the market.

Frequently Asked Questions about Solana Price

1- How does whale activity affect the Solana price?

Whale activity, such as large transfers to exchanges, can influence the price of Solana (SOL) by creating potential sell pressure or signaling strategic repositioning, leading to price fluctuations.

2. How does Solana whale activity affect the market?

Whale activity can create sell pressure or indicate strategic repositioning, potentially leading to major price movements, either upward or downward.

3. What does a decline in Solana’s Daily Active Addresses mean?

A decline in active addresses could indicate weakening user participation, possibly affecting network growth and transaction volumes.

4. How do Solana’s whale movements impact price prediction?

Whale movements, especially large transfers, significantly influence Solana’s price, as they can lead to sell-offs or strategic rebalancing.

Read More: Solana Whale Activity Surges: $836M in SOL Moves to Binance, $54M to Coinbase">Solana Whale Activity Surges: $836M in SOL Moves to Binance, $54M to Coinbase

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.