Why Is the Crypto Market Down Today?

0

0

The total crypto market cap (TOTAL) and Bitcoin (BTC) have remained virtually unmoved over the last 24 hours. However, the uncertainty had mixed reactions from altcoins as some rallied while other dipped. SPX6900 (SPX) fell in the latter category as the meme coin declined by 6.5% today.

In the news today:-

- Sui Network has committed $10 million to enhance ecosystem security after a $223 million exploit targeted the Cetus Protocol. The investment will fund smart contract audits, bug bounty programs, and collaborations to strengthen decentralized application (dApp) security.

- The latest Binance report reveals that the US has seen the highest number of crypto kidnapping cases since 2019, with Europe still leading globally. North America recorded 48 cases, while Asia reported 62, mainly concentrated in Southeast Asia.

The Crypto Market Stands Still

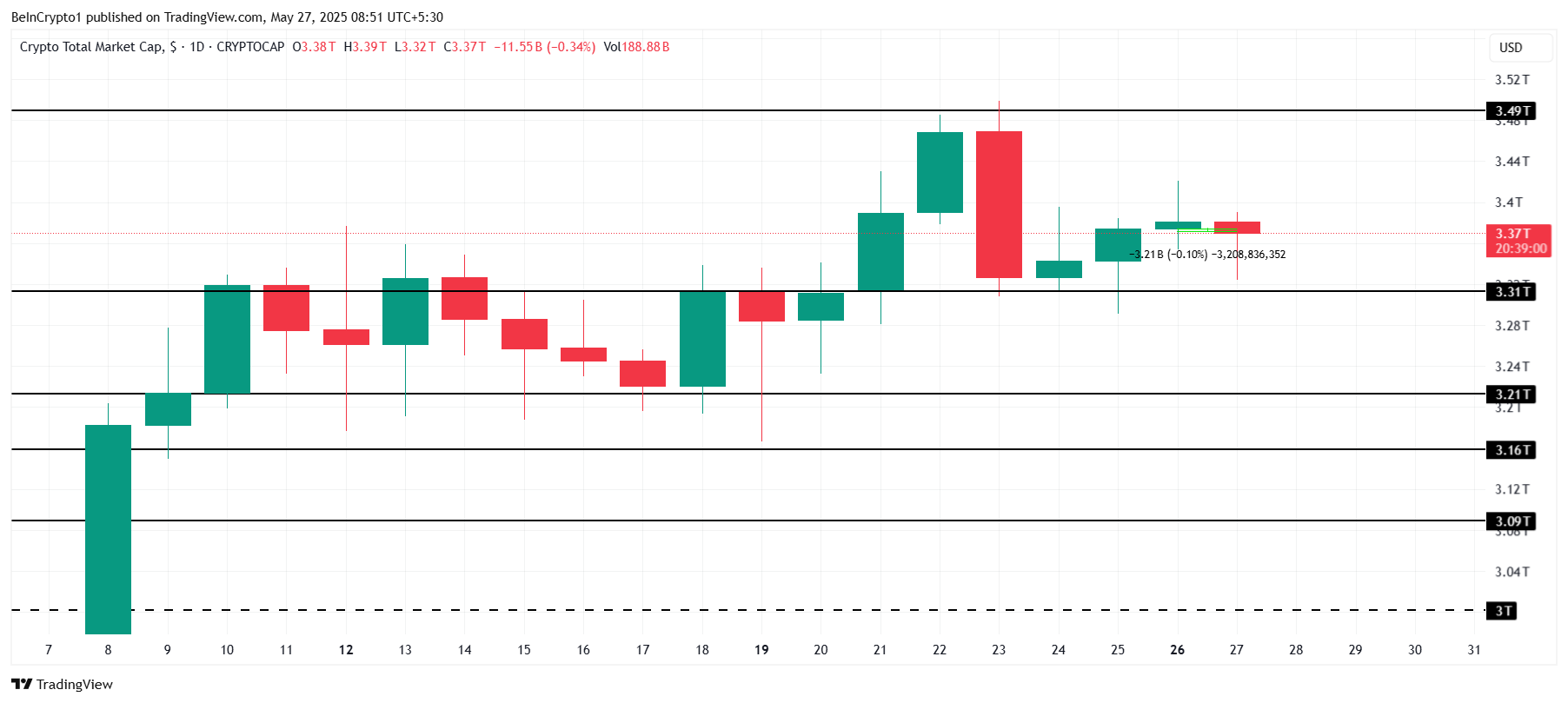

The total crypto market cap has dropped by $3.2 billion in the last 24 hours, standing at $3.37 trillion. This small decline indicates minimal changes in the broader market. Overall, market stability remains, with investors showing resilience despite the minor adjustment in market value.

The market appears to be stabilizing, with support holding at $3.31 trillion. As long as this level remains intact, the market cap is likely to continue its sideways movement. However, if selling pressure intensifies, TOTAL could fall further, potentially reaching $3.21 trillion, signaling a deeper downturn.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

A shift in market sentiment towards bullishness could propel the total crypto market cap higher. If momentum turns positive, TOTAL may break resistance and move toward $3.49 trillion. This potential growth would signal renewed confidence among investors and further market expansion.

Bitcoin Recovered From Intra-Day Lows

Bitcoin’s price fell 1.3% over the last 24 hours, dipping to the intraday low of $107,516. However, the cryptocurrency managed to recover, trading at $109,052 at the time of writing. This rebound shows some resilience, but the market remains cautious in light of recent volatility.

BTC is currently stuck under the key resistance of $110,000. The biggest concern for Bitcoin’s price is its ability to maintain recent gains. Long-term holder (LTH) selling could trigger a decline, pushing the price below the crucial $106,265 support level, signaling potential weakness in the market.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

If investors maintain composure and avoid sharp sell-offs, Bitcoin could manage to hold above $109,000. Securing $110,000 as support would provide the momentum needed to push toward the all-time high (ATH) of $111,980, marking a potential breakout and renewed bullish sentiment.

SPX6900 Notes A Dip

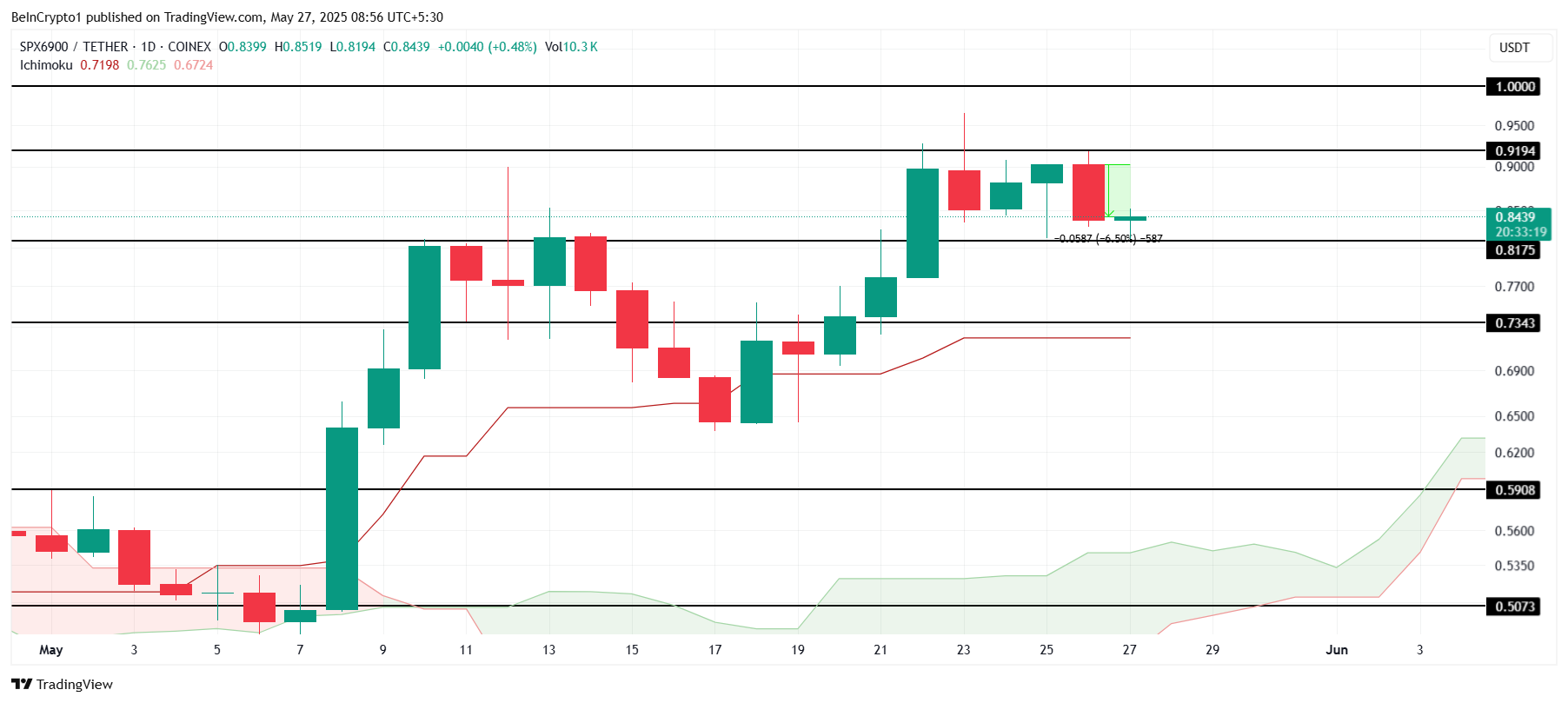

SPX saw a modest decline of 6.5% among altcoins, but the overall market has experienced minimal significant changes. Despite the drop, the meme coin’s movement remains relatively stable, showing resilience during this period of volatility. The broader market remains largely unchanged, limiting the impact on altcoins.

Currently trading at $0.843, SPX is holding above the support level of $0.817. Even if the price dips below this level, the next support lies at $0.734, limiting downside risk. Investors should watch for these key support levels to determine potential price action.

SPX Price Analysis. Source: TradingView

SPX Price Analysis. Source: TradingView

The Ichimoku Cloud lies far beneath the candlesticks, signaling bullish momentum for SPX. This technical setup suggests the altcoin is poised for a rebound, potentially pushing the price toward $0.919. A successful breach of this resistance could lead to a rise to $1.000, supporting further price growth.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.