Crypto Price Prediction Today: XRP, Pi Coin and PEPE’s Turn of Fate

0

0

The crypto market faced turbulence today. With broad macro-headwinds and token-specific pressures, XRP, Pi Coin (PI), and PEPE are in the spotlight. This article delivers a detailed, credible crypto price prediction today for all three, using the latest data and technical indicators.

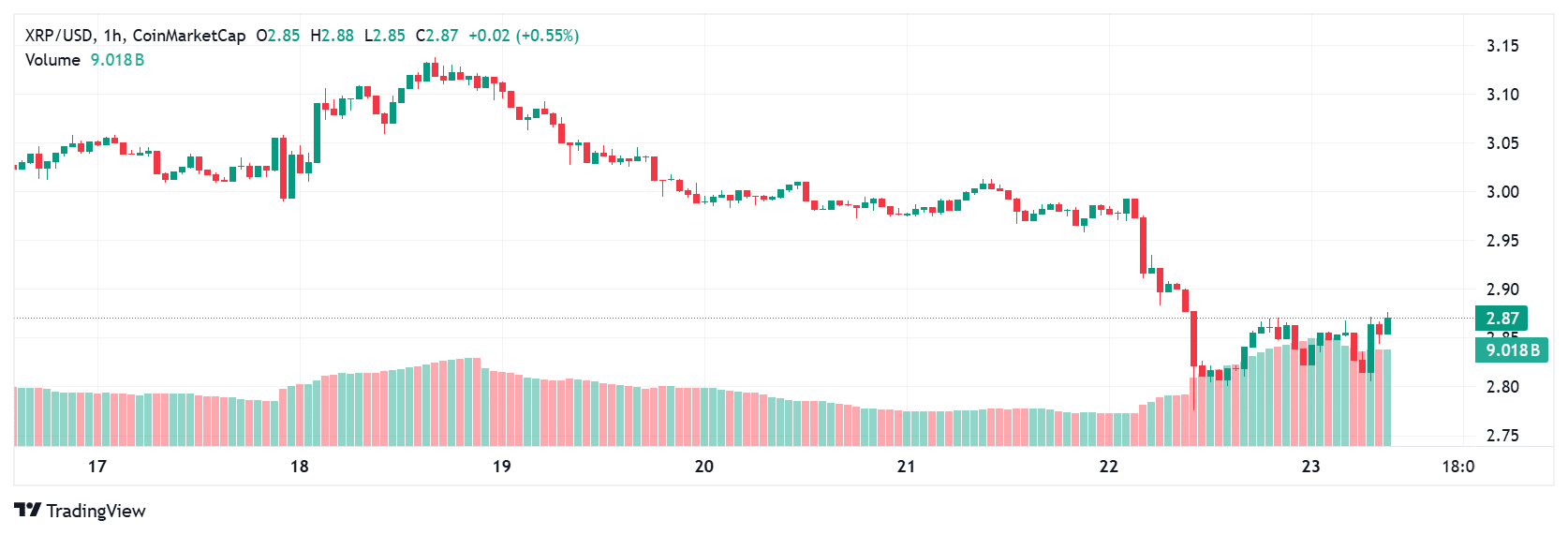

XRP: Teetering Near Resistance but Under Threat

XRP trades today around $2.87 USD, with market capitalization near $172 billion. It is ranked #4 among all cryptos. Its 24-hour change is flat to slightly negative, hinting at a critical moment.

The Relative Strength Index (RSI) is neutral, hovering near 40-45, showing neither overbought nor oversold conditions. The Moving Average Convergence Divergence (MACD) suggests weakening momentum.

Whale accumulation remains strong, more than 1 billion XRP held by large addresses, but notable inflows to exchanges pose near-term downside risk. Resistance levels are clustered at about $3.20, with solid support between $2.70 and $2.80.

In summary, the crypto price prediction today for XRP indicates a neutral-bearish tilt unless it breaks above $3.20 with volume. If support near $2.70 fails, XRP could slide toward $2.50.

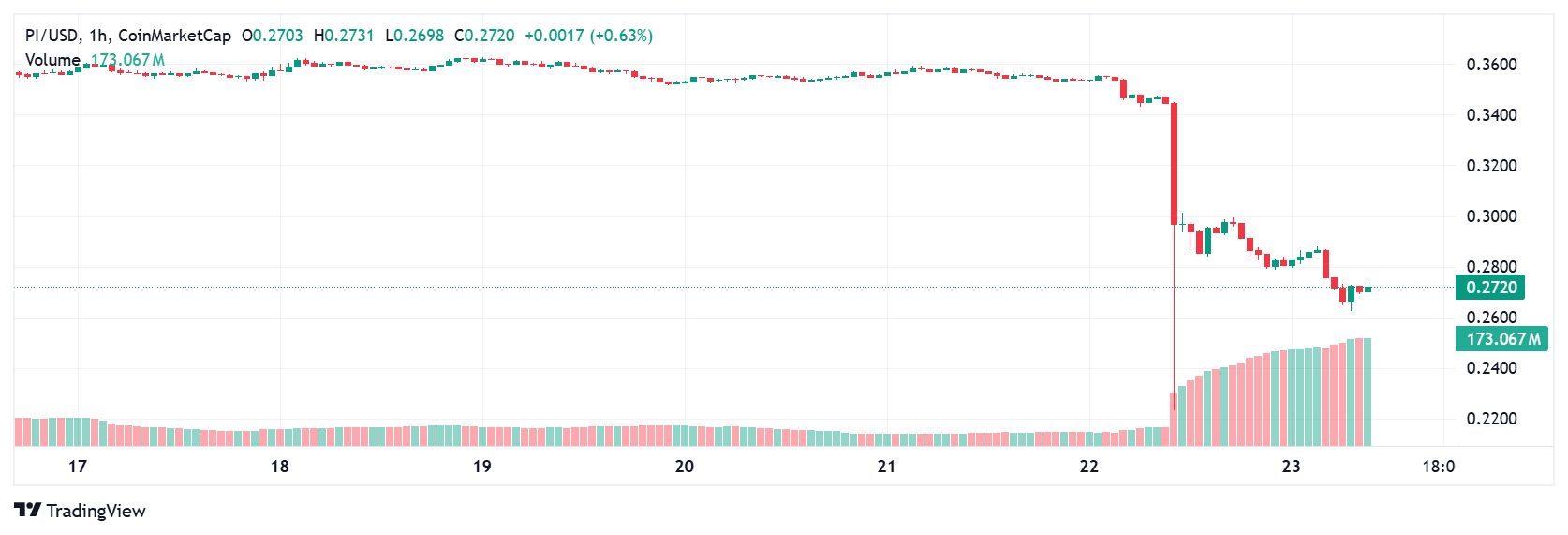

Pi Coin (PI): Volatile Drop, Unlock Pressure, and Utility Gaps

Pi Coin is trading near $0.27 USD, ranking around #48 by market cap. Circulating supply is about 8.20 billion PI, with a market cap just over $2.2 billion. Its 24-hour trading volume is roughly $170-180 million, but its price has dropped over 20% in a single day amid strong selling pressure.

PI’s drop is amplified by token unlocks: hundreds of millions of PI are entering circulation, weakening scarcity. Technical indicators show breakdowns below major support zones (including Fibonacci retracement levels), and oversold conditions could prompt a short rebound. Meanwhile, delays in its ecosystem’s development and limited integration in major exchanges undermine bullish sentiment.

The crypto price prediction today for Pi Coin suggests a possible bounce back toward $0.30 if buyers step in, but unless utility improves, downward risk remains. Support around $0.25 will be crucial.

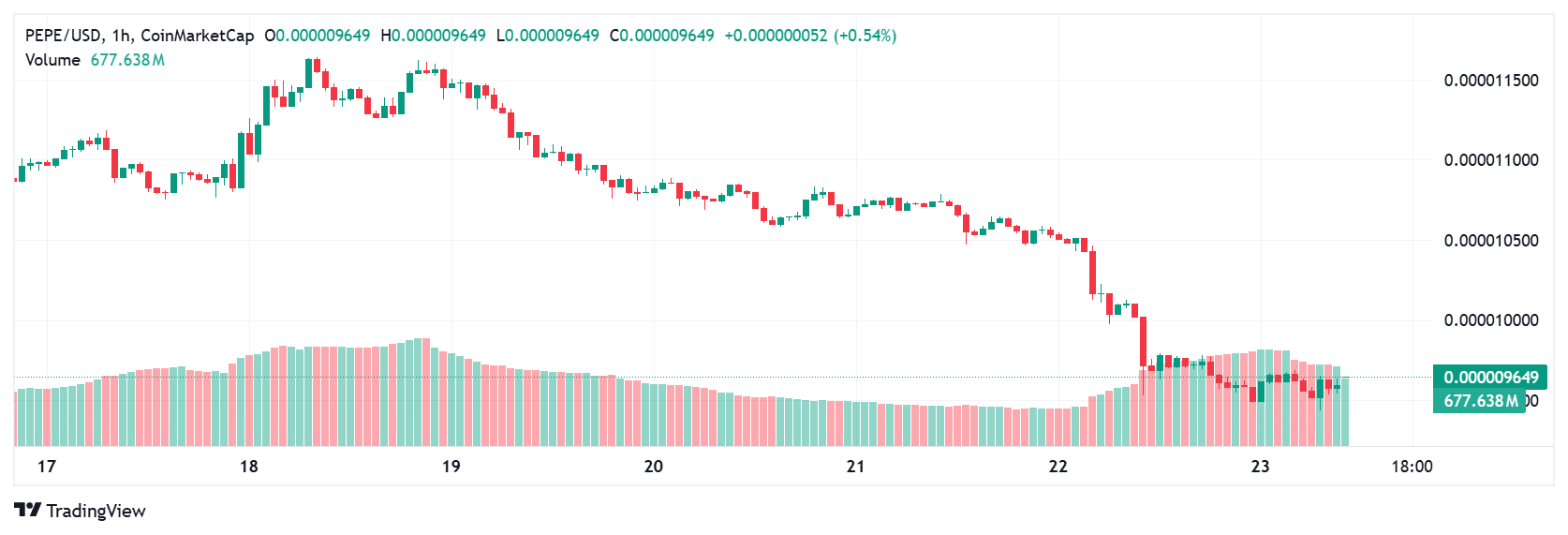

PEPE: Meme-coin Squeeze, Liquidity Stress, and Price Risk

PEPE trades at about $0.000010 USD per token, with a large circulating supply and a full market cap in the billions. It has been losing value, declining 5–6% in the past 24 hours. Ranking sits in the lower dozens, but its volatility draws attention.

Technical indicators for PEPE show oversold territory: the RSI is low, volumes are thinning, and support levels are fragile. Because of its huge token supply, even modest selling pressures can push the price sharply lower. PEPE’s resistance is weak above $0.000011, and the risk is a further slide toward $0.000008 if broader market weakness continues.

The crypto price prediction today for PEPE is cautious: no strong rebound is expected without renewed community interest or major exchange activity.

Key Indicators Explaining What’s Happening

Three technical tools are especially useful in understanding these moves:

-

RSI (Relative Strength Index): Measures speed and change of price movements. Levels above 70 suggest overbought (risk of pullback); below 30 suggest oversold (possible bounce).

-

MACD (Moving Average Convergence Divergence): Tracks trend momentum. When the MACD line crosses below its signal line, that signals weakening momentum (bearish); crossing above suggests rising strength.

-

Support and Resistance Zones: These are price ranges where demand or supply historically increases. Breaching support (downside) often triggers more selling; breaking resistance (upside) can trigger bullish breakouts.

These indicators frame the basis of this crypto price prediction today.

Conclusion

Today’s outlook for XRP, Pi Coin, and PEPE reveals a market under pressure. XRP is holding its ground, but requires a push past resistance to tilt bullish. Pi Coin is bleeding value from unlock overhangs and utility delays. PEPE remains speculative and fragile, relying on volume and sentiment.

Overall, the crypto price prediction today for these tokens leans conservative: sideways to slightly bearish unless catalysts emerge. Investors should watch support zones, tokenomics, and external drivers closely before entering new positions.

FAQs about crypto price prediction today

Q1: What might trigger a rebound in XRP?

Buyers pushing through the $3.20 resistance level, positive regulatory news, or stronger enterprise usage on the underlying ledger could spark a rebound.

Q2: How deep can Pi Coin fall if current trends continue?

If support at about $0.25 breaks, Pi could slip toward $0.20. But gasps of relief may occur at oversold technical levels even before that.

Q3: Is PEPE’s large supply the main factor in its drop?

Yes. Its enormous circulating supply makes price more sensitive to selling pressure and reduces chances of rapid gains without strong demand.

Q4: Should traders rely solely on technicals?

No. Technical tools like RSI, MACD, support/resistance are helpful but incomplete. Tokenomics, utility, exchange listings, macro news must also be considered.

Glossary of Key Terms

RSI (Relative Strength Index): A momentum oscillator measuring speed and change of price movements; helps spot overbought/oversold conditions.

MACD (Moving Average Convergence Divergence): A trend-following indicator showing relationship between two moving averages; signals momentum shifts.

Support Level: A price point where demand historically increases, preventing further declines.

Resistance Level: A price point where selling historically increases, preventing price from rising further.

Token Unlocks: Scheduled release of previously locked tokens into circulation; often increases supply and can pressure price.

Read More: Crypto Price Prediction Today: XRP, Pi Coin and PEPE’s Turn of Fate">Crypto Price Prediction Today: XRP, Pi Coin and PEPE’s Turn of Fate

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.