Solana Sees Stablecoin Supply Surge as SOL ETF Inflows Cross $150M

0

0

Solana SOL $186.4 24h volatility: 3.1% Market cap: $102.43 B Vol. 24h: $6.66 B price rebounded 2% to $190 on Friday, October 31, buoyed by improved sentiment around the US-China trade talks. Market data shows Solana ETF inflows are beginning to influence on-chain activity, marking a crucial moment for the asset’s institutional adoption story.

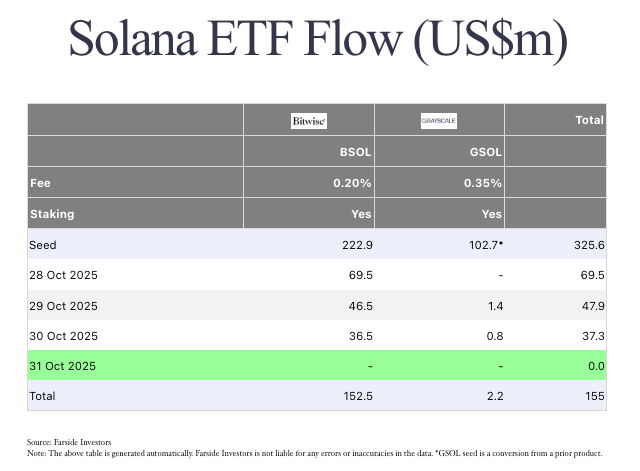

Solana ETFs, which began trading on October 28, have now attracted over $155 million in total inflows within the first three days, according to data from FarsideInvestors. Bitwise’s BSOL leads the market with $152.5 million, while Grayscale’s GSOL controls roughly $2.2 million worth of SOL at press time.

Solana ETFs Net Inflows as of Oct 30, 2025 | Source: FarsideInvestors

After a brief sell-the-news dip to $179 on Thursday, Solana price now appears to be responding to direct liquidity effects from these institutional inflows.

🚨NEW: @Solana leads all chains in stablecoin net inflows over the past 24 hours. pic.twitter.com/hXoMcLdevB

— SolanaFloor (@SolanaFloor) October 31, 2025

Further supporting this sentiment, data from Solana analytics hub Solana Floor revealed that Solana now leads all Layer-1 blockchains in stablecoin supply growth. According to Artemis data cited in the report, Solana’s stablecoin supply increased by $152 million in 24 hours, surpassing Ethereum $140 million. Polygon and Plasma followed distantly, with roughly $22 million each.

This spike in stablecoin inflows reflects a link between ETF inflows and fresh stablecoin deposits on Solana. The increased market liquidity could support higher price stability amid broader market turbulence.

Grayscale CEO Sees Solana ETFs Reaching $5 Billion in Two Years

Crypto markets remain volatile, with Bitcoin BTC $109 602 24h volatility: 2.5% Market cap: $2.19 T Vol. 24h: $64.22 B intraday gains capped under 2% as bulls struggle to sustain momentum above $110,000. Yet, Solana’s position appears increasingly resilient, buoyed by both ETF inflows and rising stablecoin liquidity.

Grayscale’s Head of Research, Zach Pandl, sees strong growth potential for Solana’s new exchange-traded products. Speaking to DL News, he noted that Solana could mirror the adoption trajectory seen in Bitcoin and Ethereum once they entered regulated ETP markets.

Pandl explained that within one to two years, roughly 5% of the total Solana token supply could be absorbed. At current valuations, that projection implies Solana ETF holdings would exceed $5 billion, a 3,000% surge from current $155 million holdings.

Solana Price Forecast: Bulls Eye Recovery Toward $210 Resistance

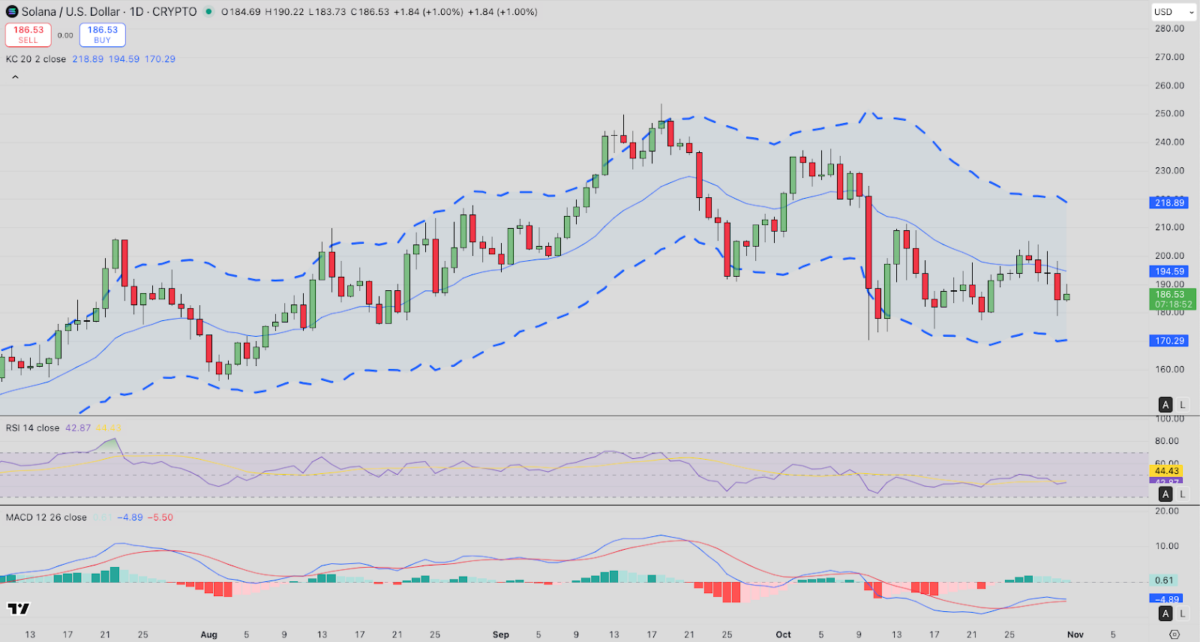

Solana’s price action has stabilized near $186.50, rebounding from weekly lows around $179. The chart shows the price consolidating within the mid-band of the Keltner Channel (KC 20), with upper resistance near $218.89 and lower support at $170.29.

The Relative Strength Index (RSI 14) currently reads 44.43, indicating mild bearish momentum but significant room for an upside recovery. Meanwhile, the MACD histogram has begun printing light green bars, signaling a potential momentum shift toward the positive zone if buy volume strengthens.

Solana (SOL) Technical Price Analysis | Source: TradingView

If Solana sustains a daily close above $194.50, bulls could eye a push above $210, aligning with the upper Keltner boundary and previous local highs. A breakout above this level would validate bullish continuation, potentially clearing the path toward the next target at $240.

Conversely, failure to defend $180 could trigger a retest of the $170 support base, invalidating near-term bullish setups.

The post Solana Sees Stablecoin Supply Surge as SOL ETF Inflows Cross $150M appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.