Bitcoin Cash Price Surges 5% with Potential for 100X Gains – Bulls Eye $800 in the Long Term

0

0

Highlights:

- The price of Bitcoin Cash is up 5%, breaking key $500 resistance with strong support at $390–$435.

- Technical indicators flash bullish sentiment with potential for further upside.

- If support holds, BCH could rally to $600, with potential long-term gains toward $800.

The Bitcoin Cash price is trading in the green, despite various altcoins bleeding in the red. As of 1 July, BCH is up 5% to $518, with its daily trading volume increasing by 71%. With the bullish momentum building, the altcoin could be poised for further upside if the conviction holds.

Bitcoin Cash Price Breaks Above 2-Month Resistance

The bullish outlook is evident in the BCH daily chart timeframe, as the token has broken above the $500 major resistance. Currently, the bulls have established strong support at $390 and $435, giving them hind wings for further upside. BCH token is trading well within the confines of a rising parallel channel, reinforcing the bullish grip. If the support zones in the daily chart hold, Bitcoin Cash price will continue the upside movement, potentially to $600.

The RSI is now at 66.86, which is at the border of overbought, but still indicates that buying power is strong. Additionally, the Moving Average Convergence Divergence (MACD) exhibits a strong bullish cross, with the MACD line (22.18) positioned above the signal line (19.14), further strengthening the momentum of the bulls.

Meanwhile, various crypto analysts, including Crypto Patel, have noted a potential breakout towards higher zones. According to Patel, breaking the $540-$580 resistance would trigger a huge bullish breakout. On his chart, he considers this a critical level for the breakout, and BCH can potentially rise to the $1,800-4,000 range if the $640 zone holds. However, before rallying, he expects the price to dip to around $250-$210.

$BCH 10x Setup? Only 1 Level Stands in the Way

#BitcoinCash is forming a Massive bull flag on the weekly chart — a pattern that often leads to explosive upside.

The key resistance is at $550–$580. This zone will decide whether #BCH breaks out or pulls back once more.

I… https://t.co/53Jfq6WNBD pic.twitter.com/hziuW2LH5y

— Crypto Patel (@CryptoPatel) July 1, 2025

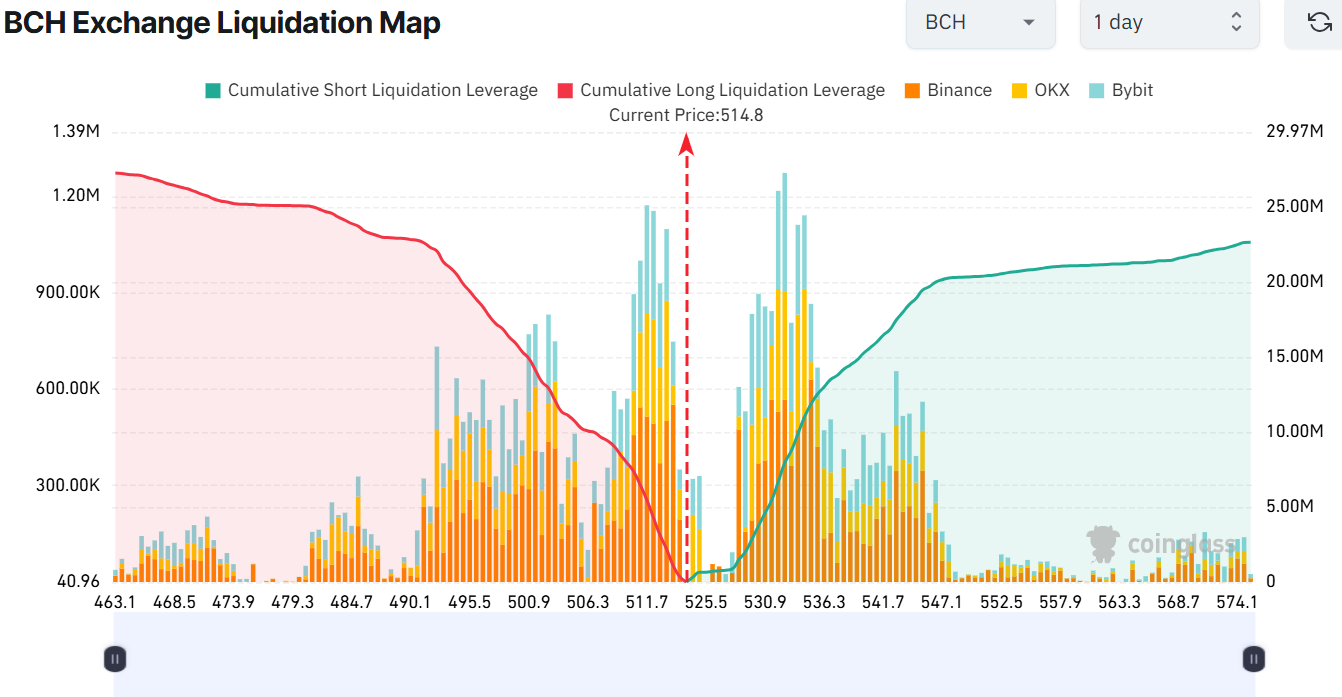

The consideration of the BCH Exchange Liquidation Map provides a deeper understanding of the market processes. The map indicates that the current price of 514.8 is at a critical level of pivotal points. Meanwhile, the cumulative long liquidations are dropping dramatically, and short liquidations are increasing. This leveraging area at the same time zone between $500 and $530 is highly crowded with leveraged spots.

In other words, there is more cumulative long liquidation leverage ($27.25 million) compared to shorts ($22.61 million) in the last 24 hours. This imbalance suggests that some bullish sentiment is building in the Bitcoin Cash market, which may cause a surge to $550-$640 in the short term. However, caution is needed, as the long liquidations are dropping, which may cause a slight dip.

Is a Rally to $800 Plausible in the BCH Market

The Bitcoin Cash price is boasting a splendid bullish grip, with the bulls eyeing $600 in the medium term. If the conviction sustains and the support zones hold, a break above the $540 resistance may signal further upside $580-$600.

On the flip side, the lower support zones range at $489- $434 may act as a cushion against further downside. A break below the $434 mark will prompt the bulls to seek safety at the $391 support area. However, if the RSI spills into the overbought region, a slight pullback could be plausible. In the long term, only a close above $800 will be a game changer for Bitcoin Cash price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.