The Crypto Market Finally Gives In: Over 200 Million Dollars Liquidated Today

0

2

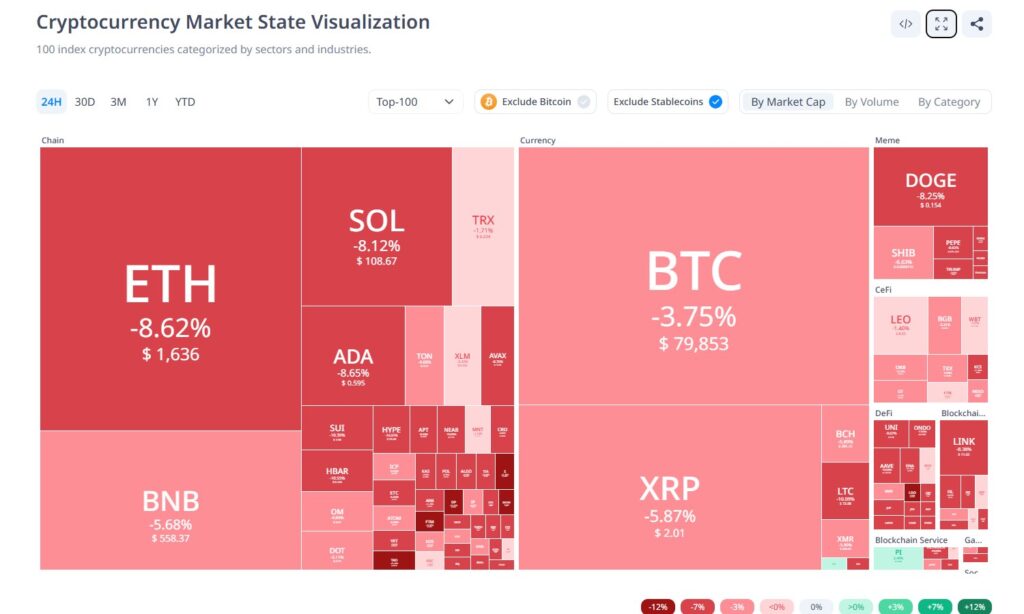

The crypto market is currently experiencing one of its most violent crashes. While it had been resilient against the Trump storm until now, it has finally given way! In just 60 minutes, over 200 million dollars have been liquidated, taking with them the hopes for a short-term rebound. As a result: the total market drops to 2.51 trillion dollars, showing a loss of more than 5% in less than 24 hours.

Crypto crash: 200 million dollars evaporated in 60 minutes

Just a few days ago, an analysis predicted with 70% probability of an imminent market collapse before June. This scenario seems today to be materializing, confirming fears of a major correction on the main digital assets. Bitcoin (BTC) falls to 79,853 dollars, down by -3.75%, dangerously flirting with the 79,000 dollar threshold.

Ethereum (ETH), on the other hand, records a spectacular drop of -8.62%, reaching 1,636 dollars, and threatens to break the psychological support of 1,600 dollars. Solana (SOL), for its part, plummets by -8.12%, returning to 108 dollars, very close to the symbolic barrier of 100 dollars. On the altcoin side, Cardano (ADA) loses -8.65%, XRP drops -5.87%, and Dogecoin (DOGE) crashes by -8.25%. It is a digital bloodbath, illustrated by an overwhelming dominance of red across all assets.

A designated culprit

The reasons for the crypto crash? An explosive combination of macroeconomic tensions, speculation around Donald Trump’s policies, and a strong domino effect triggered by the massive sale of futures contracts before the US markets opened.

But the main factor behind this drop would be Donald Trump and his new tariffs deemed explosive. JPMorgan had even sounded the alarm not long ago, reassessing the risk of recession at 60%. These economic tensions have plunged Wall Street’s stock indices into the red, and today it’s crypto’s turn to take a hit.

The ongoing crypto crash could be just a simple jolt in a broader bullish trend held in the hands of Bitcoin whales. Or the signal of a deeper correction. One thing is for sure: volatility is back, and the coming days are likely to be decisive, and some even see it as a strategic buying opportunity.

0

2

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.