BTC Price At Risk Of Sliding Below $100,000 As Demand Slows Down

0

0

Key Insights:

- Bitcoin dominance takes a dive to a 61.87% low after BTC price’s sizable slide in the last 7 days.

- Institutional demand signal declining interest in Bitcoin.

- Exchange flows signal rising sell pressure

Bitcoin demonstrated waning demand above $104,000 as evident by its sideways price action in the last 6 days. As a result, investors were concerned about the risks of price potentially dipping below $100,000.

Among the key reasons for those concerns was the steady drop in Bitcoin dominance in the last 7 days. Dominance peaked at 65.38% on Wednesday last week and has since tanked to 6.86% in the last 24 hours.

The sliding Bitcoin dominance was confirmation that liquidity flow in the crypto segment shifted in favor of altcoins. As a consequence, the bullish momentum that previously fueled its rally past the $100,000 milestone last week disappeared.

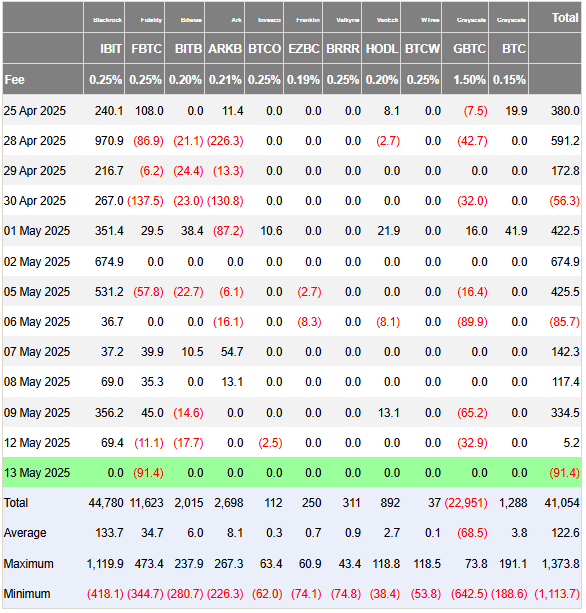

Weak ETF demand for BTC signaled higher risk of a bearish pivot

Bitcoin’s rally in the first week of May was characterized by healthy institutional inflows. However, things have since shifted as evident by the weak ETF flows this week, which also pointed towards growing directional uncertainty.

Bitcoin ETFs collectively experienced $86.2 million worth of outflows between Monday and Tuesday. This was indicative of some profit-taking perhaps in anticipation of some downside. However, it is also worth noting that the outflows were still relatively low, meaning ETFs may have been testing the markets.

Institutional activity has previously been a decent measure of the level of attention that Bitcoin received from the big players. However, it may not always be the case especially when whale activity moves differently. That might be the case with the market this week and it may explain why the king of the cryptocurrencies was still resisting the downside.

Bitcoin order book data on Coinglass revealed that whale activity contributed roughly $30.24 million worth of net spot inflows in the last 24 hours. This meant whales were still buying BTC despite rising concerns of a pullback.

This is to mean that whales have been shielding BTC from more downside and could be the reason why it still traded above the $100,000 price level at press time. This as in line with a recent analysis which revealed that whales and institutional traders led the recent rally.

According to the analysis, the retail segment retail participation in the latest rally was weak. They arrived to the conclusion after evaluating retail activity from the South Korean market. The latter is predominantly driven by retail and was recently characterized by low activity.

The weak retail demand may explain why whales were not in a rush to take profits. Retail often provides exit liquidity, and therefore whales might not be incentivized to sell.

In addition, the analysis noted that retail activity usually shows up towards the late cycle of a bullish phase.

Will Bitcoin bulls hold on longer or cave in to BTC price’s sell pressure?

The analysis on institutional, whale and retail activity may explain why whales have a vested interest in maintaining BTC above $100,000. And with the market sentiment pushing more into greed, it is likely that FOMO may force retail to jump back in soon.

Bitcoin exchange flows were almost evenly matched in the last 24 hours. Inflows slightly edged out the outflows, reflecting the sideways activity underscored by uncertainty regarding its next move.

BTC and the rest of risk-on assets at large owed their recent recovery to the improving macro-economic conditions. The fact that the markets were coming off one of their biggest crashes may still lend credence to the bullish momentum in the second half of May.

That momentum will likely be driven by whale and institutional activity. If this plays out, then we could potentially observe Bitcoin pushing into price discovery. At which point FOMO will be rise and trigger more retail participation.

While the bullish prospects could play out, it is also worth keeping an eye out for unexpected outcomes that could potentially lead to different outcomes.

The post BTC Price At Risk Of Sliding Below $100,000 As Demand Slows Down appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.