Ethereum Price Nears Key CME Gap at $4.1K–$4.26K

0

0

Ethereum price is inching closer to a critical technical level as it targets a key CME (Chicago Mercantile Exchange) gap on the weekly chart. This gap, ranging from $4,092 to $4,261, has become a focal point for traders who anticipate the potential for Ethereum price to rise further and fill it.

What is a CME Gap?

CME gaps arise when the futures markets used will close between the weekend to resume on Monday at a new price. Such gaps tend to become the magnet of price action in that they can pull the market back to the gap levels as time goes by. Ethereum has not occupied the gap between $4092-$4261 but it is approaching closer.

Traditionally, the CME gaps have been adequate indicators of future prices. The traders pay much attention to these gaps to foresee price directions. They generally hope the price will enter into the gap, “filling” the gap, and to move on to the important resistance or support levels.

Why CME Gaps Matter

CME gaps are an important technical tool for traders. These gaps often represent an area where price action could return to fill the difference. When the price fills the gap, it indicates a potential continuation of the trend. Traders often use these gaps to make informed decisions about when to enter or exit a position.

In Ethereum’s case, if ETH can close above $4,100, it may fill the gap completely. This could spark a bullish rally, pushing Ethereum price back toward its previous highs of 2021, igniting renewed momentum for the cryptocurrency.

Positive Sentiment Boosts Ethereum

Ethereum price action has been buoyed by positive market sentiment in recent weeks. The broader recovery in the cryptocurrency market, alongside upgrades within the Ethereum ecosystem, has provided further momentum.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| August | $4,250.34 | $4,651.87 | $5,053.39 |

28.6%

|

| September | $3,670.98 | $4,391.96 | $5,112.94 |

30.1%

|

| October | $3,400.18 | $3,788.59 | $4,176.99 |

6.3%

|

| November | $3,072.75 | $3,297.91 | $3,523.06 |

-10.3%

|

| December | $2,938.52 | $3,940.86 | $4,943.19 |

25.8%

|

As Ethereum continues to strengthen, the market is optimistic about its ability to maintain upward pressure. Developments like Ethereum 2.0 and growing adoption of decentralized finance (DeFi) applications have led to increased demand for ETH, further supporting bullish expectations.

Whale Addresses Decline: Impact on Ethereum Price?

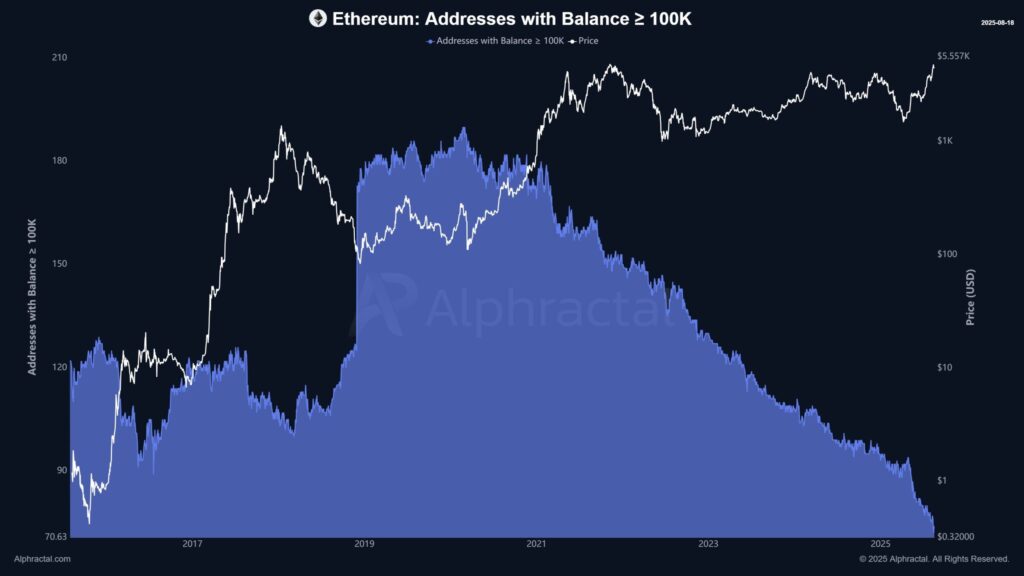

The number of whale addresses, or wallets with over 100,000 ETH has also subsided in Ethereum. Alphractal data indicate that such addresses went down to approximately 70 in 2025 when they were in excess of 200 in 2020.

Although this drop in whale activity might appear troubling, it has had very little effect on the price of Ethereum. Reduction in whale activity looks like one of the possible market maturity to some analysts. The actual moves, however, seem to be by mid-sized addresses (or sharks), those having 10,000 to 100,000 ETH.

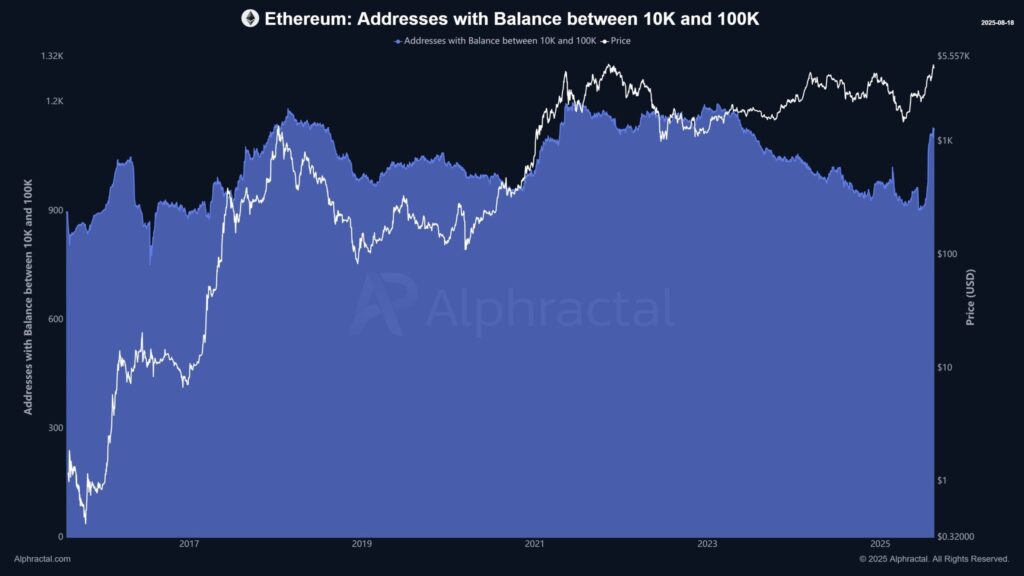

Rise of “Sharks”: Mid-Sized Investors Shaping Price Movement

Unlike whales, shark wallets have been expanding at a very high rate. These are medium-level investors who are gaining control over the matter of the Ethereum price. Shark wallets consisting of between 10,000 to 100,000 ETH also rose by about 100 in August, to over a thousand.

Joao Wedson, the founder of Alphractal noted that the current price action of Ethereum is driven by mid-sized addresses, and not large whale wallets. Such investors are hoarding ETH in a more strategic manner, which implies their increased confidence in the long-term potential of Ethereum.

Institutional Interest: A Strong Foundation for Ethereum

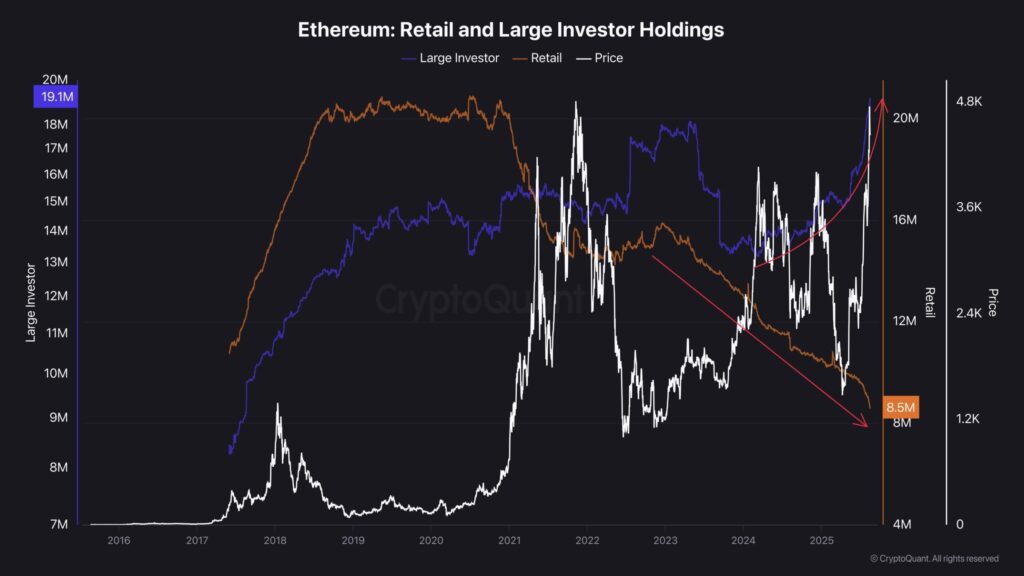

Ethereum price momentum is also being fueled by strong institutional interest. Publicly listed companies and Ethereum-based ETFs have been increasing their ETH holdings. Data from the Strategic ETH Reserve reveals that institutions have accumulated over 10.2 million ETH, valued at $39.48 billion, since July.

The continued institutional investment suggests that Ethereum’s future is being shaped by larger players in the market. Demand from both retail and institutional investors may drive Ethereum price upwards as these institutions add more ETH to their portfolios.

Conclusion

The price of Ethereum will be inching closer to the key CME gap of $4,092 to $4,261. Ethereum might then enter into a massive rally because of being able to fill the gap and continue upward momentum. Ethereum will continue having positive prospects due to a high institutional support provided and the emergence of mid-sized investors.

Also read After 7 Failed Attempts, Ethereum Smashes $4K: What is Next for ETH?

Summary

Ethereum is also about to reach an important technical level with it reaching a key CME gap between 4,092 and 4,261. The speculators are hopeful that Ethereum would step up to fill this gap and this might trigger a rising bull run to 2021 levels.

The increased hype among the mid-sized shark wallets and institutional investments is setting positive trends in Ethereum. But the market is also not stable, and traders should take precautions. In case Ethereum manages to fill it, the latter could be on the path to a positive price movement.

Frequently Asked Questions (FAQ)

1- What is a CME gap in Ethereum price?

A CME gap occurs when the price of Ethereum differs between the time the futures market closes for the weekend and when it reopens at a different price.

2- Will Ethereum fill the $4,092–$4,261 gap?

Many traders believe Ethereum is likely to fill this gap, potentially pushing the price toward its 2021 highs, especially if Ethereum can close above $4,100.

3-How do whale addresses impact Ethereum price?

Whale addresses, those holding over 100,000 ETH, can significantly influence Ethereum price due to their ability to move large amounts of the asset.

4- Is Ethereum price trend bullish or bearish?

Despite some short-term volatility, the overall trend for Ethereum remains bullish, driven by strong institutional interest and increasing accumulation from mid-sized wallets.

Appendix: Glossary of Key Terms

CME Gap: A price gap that occurs when Ethereum futures markets close over the weekend and reopen at a different price, often acting as a technical indicator for future price movements.

Whale Addresses: Ethereum wallets holding more than 100,000 ETH, often associated with large investors or institutions.

Shark Wallets: Ethereum wallets holding between 10,000 and 100,000 ETH, typically representing mid-sized investors with significant market influence.

ETH (Ethereum): A decentralized platform that runs smart contracts on a blockchain, used for creating and executing decentralized applications (dApps).

Institutional Investors: Large financial entities, such as companies or funds, that invest in assets like Ethereum.

DeFi (Decentralized Finance): A movement within the blockchain ecosystem focused on building decentralized financial systems without intermediaries.

References

Coinomedia – coinomedia.com

BeInCrypto – beincrypto.com

Read More: Ethereum Price Nears Key CME Gap at $4.1K–$4.26K">Ethereum Price Nears Key CME Gap at $4.1K–$4.26K

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.