Coinbase Debuts on NYSE as Stock Price Jumps 16% | US Crypto News

0

0

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we delve into what the day holds for Coinbase, the largest US-based exchange based on trading volume metrics. Despite the exchange’s Q1 earnings underperforming expectations, Coinbase made history by joining the S&P 500, and new developments are in the pipeline later today.

Crypto News of the Day: Coinbase’s COIN Stock To Open on the NYSE After Joining S&P 500

BeInCrypto reported Coinbase Exchange’s landmark ascension to the S&P 500. Specifically, Coinbase Global Inc. will replace Discover Financial Services on the S&P 500, effective before the market opens on Monday, May 19.

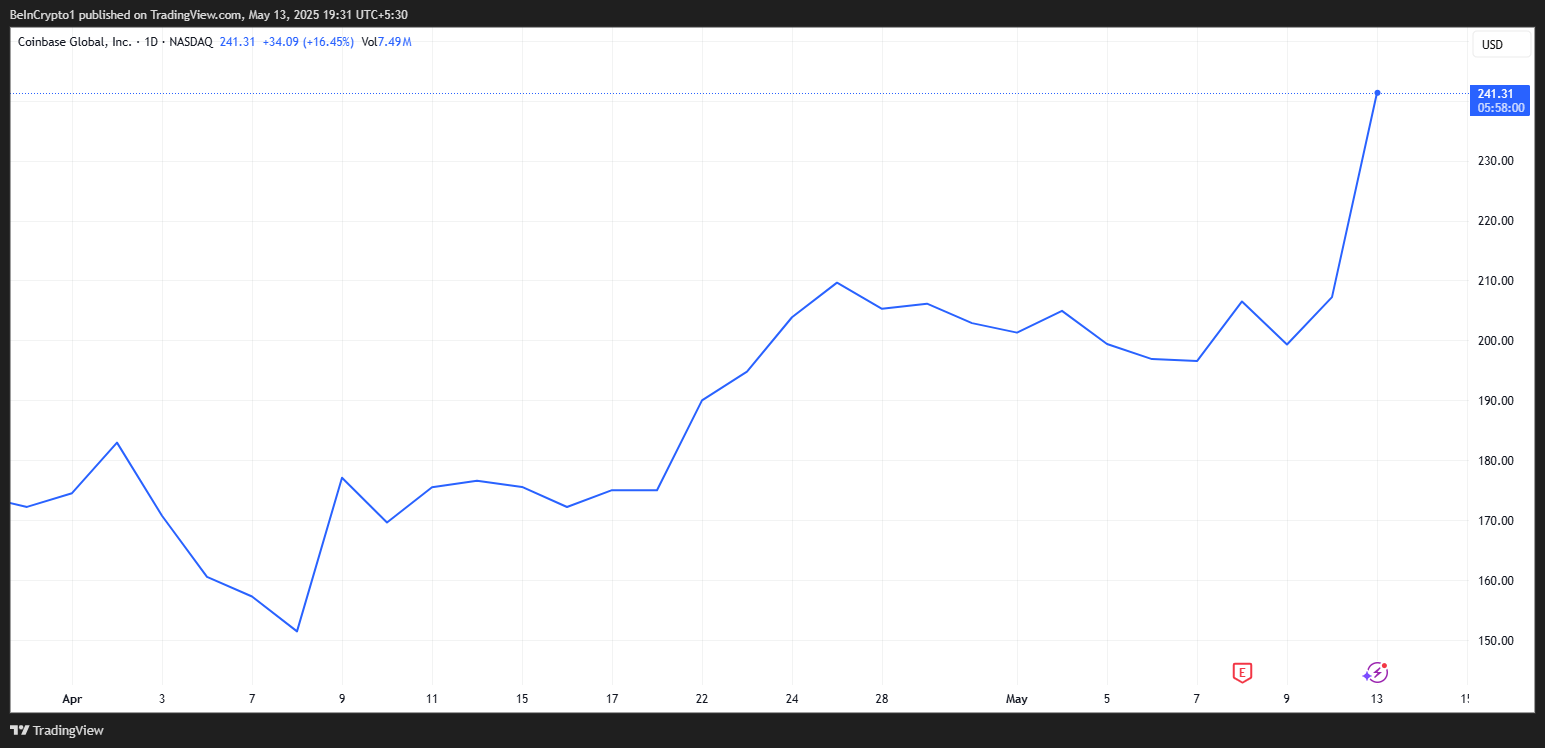

The report had sent Coinbase stock, COIN, up nearly 10% on May 12, and now the crypto equity has another bullish fundamental providing a tailwind on Tuesday.

COIN opened on the New York Stock Exchange (NYSE) at 9:30 AM ET today, May 13, fresh off its inclusion in the S&P 500. Following the debut, the COIN price is up by over 16% and is trading for $241.23 as of this writing.

Coinbase (COIN) Stock Performance. Source: Google Finance

Coinbase (COIN) Stock Performance. Source: Google Finance

The NYSE is one of the world’s largest stock exchanges, offering a marketplace for trading stocks, bonds, and other securities.

Notably, the NYSE has strict listing requirements, meaning COIN stock trading there signals Coinbase Global Inc.’s stability and could attract more institutional investors.

Being in the S&P 500 and the NYSE means index funds and ETFs tracking the index will buy COIN shares, increasing demand and potentially boosting the stock price.

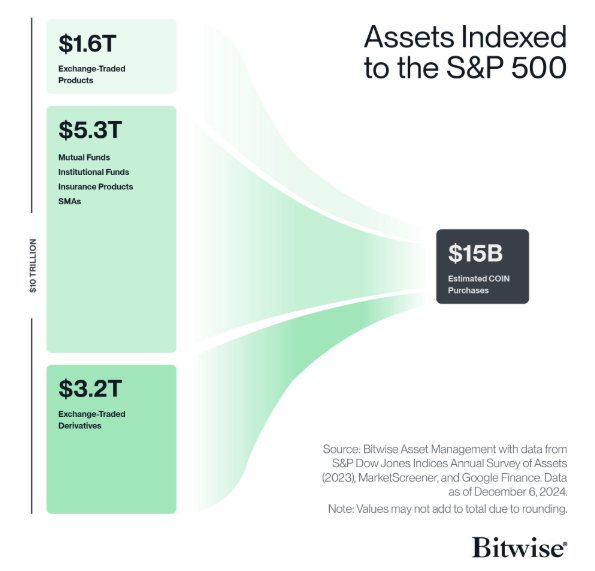

Why Coinbase’s COIN entering the S&P 500 matters. Source: Bitwise head of research Ryan Rasmussen on X

Why Coinbase’s COIN entering the S&P 500 matters. Source: Bitwise head of research Ryan Rasmussen on X

The Bitwise data highlights that $5.3 trillion from institutional investors and $1.6 trillion from ETFs will contribute to the $15 billion in estimated Coinbase purchases. This reflects the growing mainstream acceptance of crypto-related companies in traditional finance (TradFi).

BeInCrypto’s recent US Crypto News coverage elaborated on how ETFs (exchange-traded funds) continue to increase institutional access to crypto.

Chart of the Day

Coinbase (COIN) Stock Price Performance. Source: TradingView

Coinbase (COIN) Stock Price Performance. Source: TradingView

Wall Street Firms Revise Fed Interest Rate Cut Projections

Elsewhere, the Bureau of Labor Statistics (BLS) has just released its latest CPI data, showing inflation slowed at an annual rate of 2.3% in April.

Based on this, major Wall Street firms have pushed back their forecasts for the Federal Reserve’s next interest‐rate cut.

- JPMorgan now anticipates the first reduction in December, a shift from its prior September projection. The bank also reports that the probability of a US recession has fallen below 50%.

- Citigroup economists have likewise delayed their call, moving the expected cut to July from June.

- Goldman Sachs, buoyed by optimism over a temporary US–China tariff truce, has deferred its penciled‐in July cut to December while trimming its 2025 US recession odds to 35% from 45%.

- Barclays, too, now sees its first move in December, revising back from an earlier July forecast.

Taken together, these revised outlooks reflect growing confidence that the economy can withstand current policy settings longer than previously thought.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.