XRP Nears $3 as Fed Rate Cut Probability Hits 99%

1

0

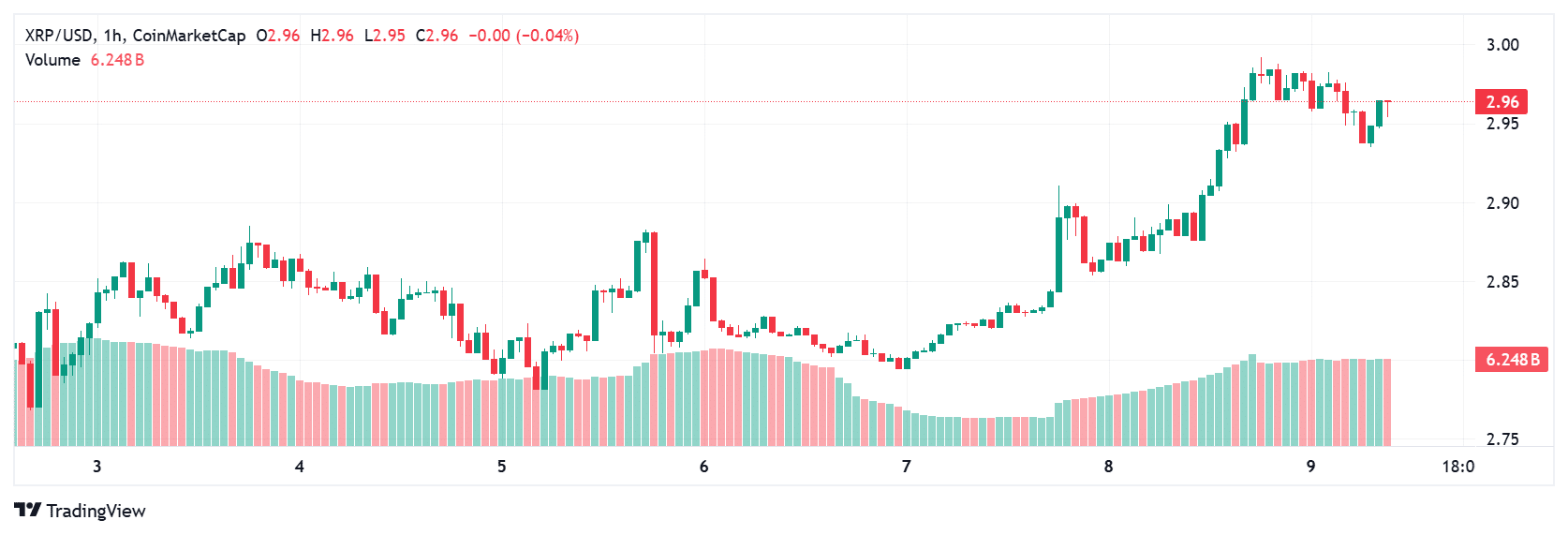

The crypto industry is booming as XRP price forecast trends rise with newfound confidence. The token increased by more than 4% this week, propelled by predictions of a Federal Reserve rate drop, which currently has a 99% possibility. Traders consider this as a watershed event that might propel XRP beyond the $3 threshold, which is carefully followed by both retail and institutional investors.

Fed Rate Cut Boosts Momentum

The Federal Open Market Committee is anticipated to lower interest rates by 25 basis points on September 17, reshaping global risk appetite. Lower interest rates frequently undermine the US currency, boosting alternative assets like cryptocurrencies. One X expert commented, “The Fed is hemmed in. If they cut, cryptocurrency wins. If they don’t, the markets will rebel. The feeling explains why digital assets such as XRP are rising in anticipation.

Institutional statistics reveal a significant influx into XRP during the recent surge. Whales allegedly bought 10 million XRP within minutes of the breakthrough, indicating increased confidence. The rise corresponds with exchange reserves reaching a 12-month high, suggesting that traders are preparing for a long rally rather than a short-term deal.

XRP Technical setup points amount to $3

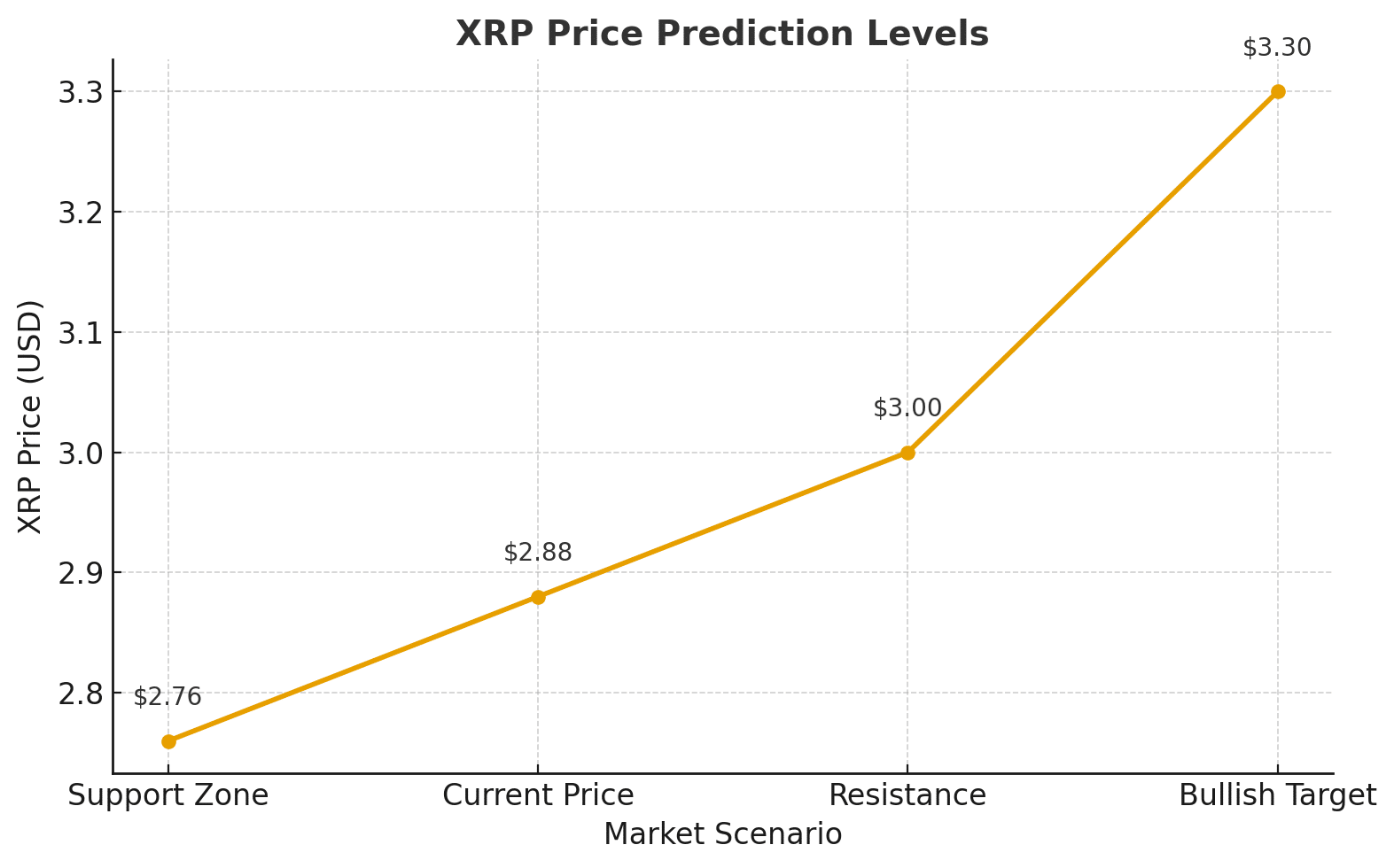

XRP price prediction models show a tighter triangular pattern. Support has been solidly held at $2.87, while resistance ranges from $2.95 to $2.99. A clear break over $3 might pave the way for a drive to $3.30 or possibly higher. Chart experts believe that momentum indicators are biased positive, with volume spikes increasing the chance of a breakthrough.

However, considerable concern persists. If resistance holds and selling pressure builds, XRP may return to the $2.76 range. However, the current euphoria, fueled by macroeconomic drivers, has many traders banking on an upside outcome.

ETF Buzz adds fuel to the rally

Another element influencing XRP price forecast is the increased demand for spot XRP exchange-traded funds. Six applications are being reviewed, with results due in October. Market experts feel that ETF certification might be a watershed event for XRP, comparable to how Bitcoin ETFs sparked institutional adoption earlier this year.

According to one fund manager, “ETFs provide institutional investors with an easy entry point.” If even a percentage of the $7 trillion languishing in money market funds is converted into XRP, the price might rise above previous highs.” This anticipation has enhanced XRP’s position as one of the best-performing assets in the coming months.

Macro and Real-World Adoption

On a macro level, the anticipated rate decrease reduces the cost of capital while simultaneously increasing demand for risk assets. According to Nasdaq statistics, volatile assets like as XRP benefit when safe-yielding alternatives lose attractiveness. Aside from speculation, XRP is still being adopted through Ripple’s On-Demand Liquidity platform, which may gain traction in a lower-rate market.

The year-over-year performance strengthens this positive thesis. XRP has already grown by more than 400% since September 2024, outperforming many other leading digital assets. The confluence of technicals, institutional flows, and policy moves has thrust XRP into the limelight.

Conclusion

The combination of Fed rate drop forecasts, technical momentum, whale activity, and ETF speculation has propelled XRP price prediction to the forefront of the cryptocurrency discourse. With resistance around $3 within striking distance, traders are waiting to see if the next FOMC decision and ETF approvals can spark a long-term surge. For investors, the following weeks might be one of the most defining moments in XRP’s history.

Glossary of key Terms

Whale Accumulation: Large-scale purchases by investors holding significant amounts of cryptocurrency.

ETF (Exchange-Traded Fund): A regulated investment product that allows exposure to assets like XRP.

On-Demand Liquidity (ODL): Ripple’s payment solution using XRP to enable fast cross-border transfers.

FOMC: The Federal Open Market Committee, responsible for setting U.S. interest rates.

Resistance Level: A price point where upward momentum typically faces selling pressure.

FAQs for XRP price prediction

Q1: Why is XRP rising now?

XRP is climbing due to strong bets on a Fed rate cut, whale accumulation, and growing anticipation of ETF approvals.

Q2: What is the next resistance level for XRP?

Analysts point to $3.00 as the key resistance. A breakout could target $3.30 or higher.

Q3: How could ETFs impact XRP price prediction?

ETF approvals could bring institutional inflows, potentially driving XRP well beyond current levels.

Q4: What risks remain for XRP?

If resistance holds or the Fed surprises with no cut, XRP could retrace toward $2.76 support.

Read More: XRP Nears $3 as Fed Rate Cut Probability Hits 99%">XRP Nears $3 as Fed Rate Cut Probability Hits 99%

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.