Fed Rate Cut Reignites Crypto Rally as Bitcoin Surges

0

0

This article was first published on The Bit Journal.

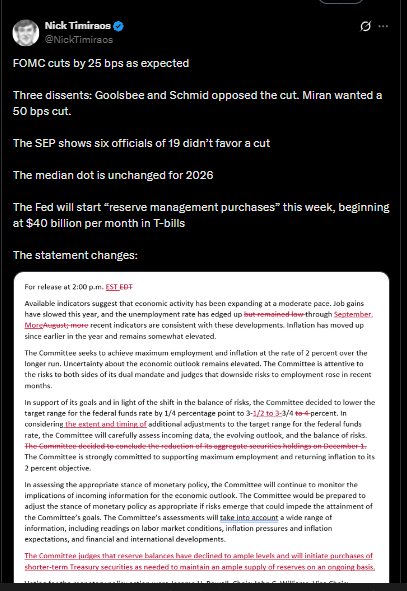

Fed rate cut sent ripples through global finance as investors scrambled to read between the lines. According to the source, markets responded almost immediately with a wave of buying that lifted risk assets.

A quiet nod from regulators turned into a loud signal for crypto traders. With fresh liquidity in sight, eyes in the crypto market sharpen.

Rate Cut Meets Risk Appetite

The Federal Reserve’s decision to lower its benchmark rate revived interest in many assets. The cut boosted investor confidence in risky bets that had languished under tighter monetary policy.

As yields on secure instruments fell, assets such as Bitcoin regained attention as speculative plays. Real-time data from an official source shows Bitcoin trading near $91,267.40 following the move.

In parallel, major altcoins also picked up momentum. Ethereum traded around $3,282.17, reflecting renewed appetite across the crypto market.

Liquidity, easy money that flows freely, often fuels risk assets. The drop in borrowing costs made investors re-evaluate their allocations. That made volatile assets like crypto more tempting once again.

Investor Mood Swings and Price Action

Soon after the rate cut, digital-asset traders sent prices higher. Bitcoin’s rapid recovery showed how sensitive the crypto market remained to macroeconomic signals. The move also drew in new money from speculative traders and institutional watchers.

Nonetheless, caution lingered. Some analysts said the boost may be short-lived. With its spike in unemployment and yawning fiscal deficits, economic stress appears unlikely to recede. Should conditions deteriorate, crypto may lose its luster as investors turn to safe havens.

In that sense, the rally could be a respite and not an assurance of continued gains. Trading surged, but there were fundamental questions that remained unanswered.

Forecast Models Point to Cautious Optimism

Advanced forecasting research offers a nuanced view. A recent academic study applied a hybrid model combining Variational Mode Decomposition (VMD) and long-short-term memory (LSTM) networks to predict Bitcoin closing prices over 30-day windows.

The model outperformed simpler methods, suggesting crypto price shifts may still be traced with some accuracy but only under stable macro conditions.

That means the present rally could extend into early 2026, if macro conditions remain supportive. Otherwise, the fragile balance may tip.

Key Market Clues Shaping the Road Ahead

Developers may see rising activity across decentralized platforms as fresh liquidity encourages more on-chain experimentation. Elevated transaction volume can imply returning confidence, especially with significant networks like Ethereum remaining active.

Economists are still closely watching measures of the underlying economy, such as inflation, unemployment and government spending. Such considerations affect the course of future policies and create the market’s backdrop in terms of general investor mood.

Traders, meanwhile, are closely tracking prices swings. Larger liquidity can give fast chances, but it also can assist in vast reversals. The recent turn of events leaves room to change the stance, but the way forward remains contingent on incoming data.

Conclusion

The Fed rate cut has opened the door for the crypto market to take on some new life. Yet for now, Bitcoin and altcoins are at a crossroads. And assuming the macro doesn’t catastrophically implode, cryptos may see a much longer-term upswing.

If not, the recent growth could prove as fleeting as it came. The coming weeks and months will tell whether this trend represents anything in the way of a true turning point or simply a spurt.

Glossary of Key Terms

Fed rate cut: A reduction in the interest rate set by the Federal Reserve, intended to lower borrowing costs and stimulate economic activity.

Crypto market: Collective term for trade and investment in digital currencies and related assets.

Liquidity: The supply of cash or easily sellable securities, affecting how much capital washes into markets.

VMD + LSTM model: A new method for financial time series prediction using both signal decomposition (VMD) and machine learning technique (LSTM).

FAQs About Fed Rate Cut

1: Why does a Fed rate cut affect cryptocurrency prices?

Low interest rates mean lower returns on safe assets. Investors typically allocate money into the riskiest assets, such as crypto, boosting demand and sending prices higher.

2: Could crypto remain stable even if inflation rises?

It makes a difference only if appetite to take risk remains high High inflation with weak growth generally hurts risky assets including crypto.

3. Is this crypto surge driven by fundamentals or speculative money?

Mostly speculative, driven by liquidity and investor sentiment. Fundamental growth needs steady adoption and stronger blockchain use.

4. Does forecasting (like VMD + LSTM) guarantee price predictions will be accurate?

No. Models only work under stable conditions. Unexpected macro shifts can invalidate even the best forecasts.

Sources

Read More: Fed Rate Cut Reignites Crypto Rally as Bitcoin Surges">Fed Rate Cut Reignites Crypto Rally as Bitcoin Surges

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.