XRP Price Analysis: XRP Steadies Above $2.42 as the Open Interest Stabilizes

0

0

Highlights:

- XRP price attempts recovery, as it trades above $2.42.

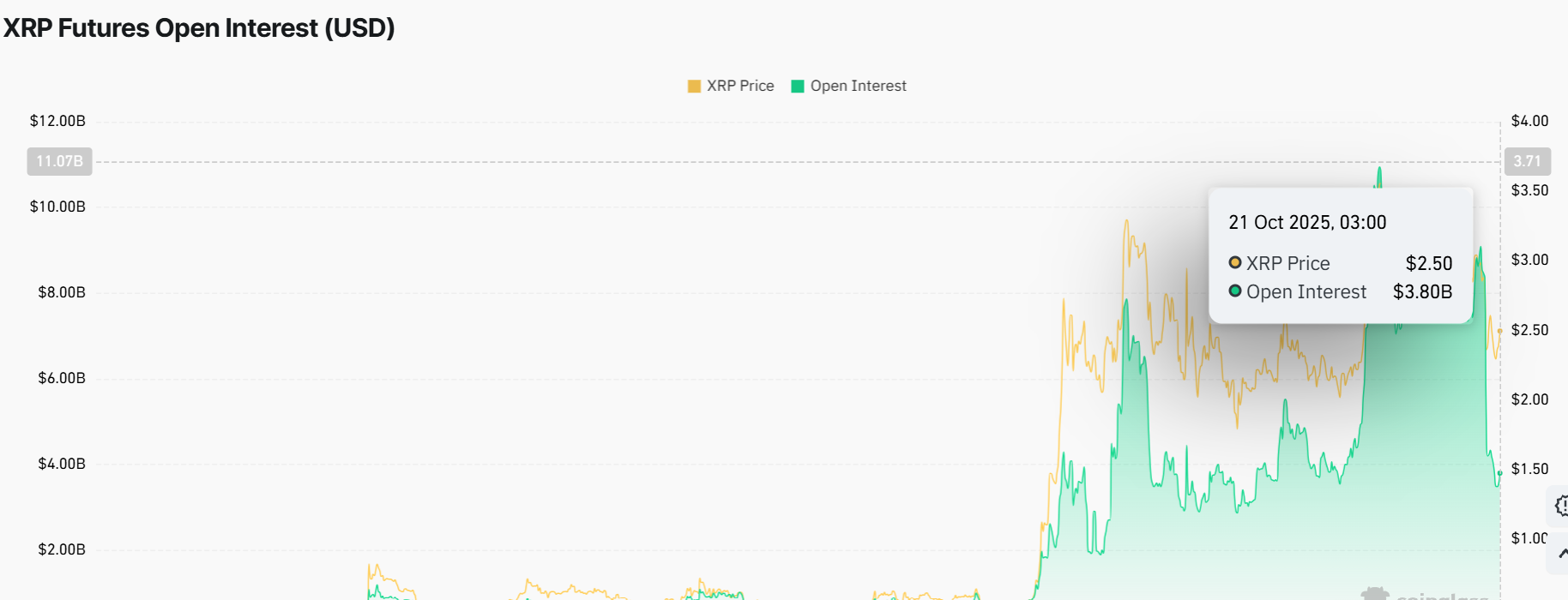

- XRP open interest dips to $3.80 as bulls struggle to regain control.

- Technical outlook shows a bearish bias, as bulls target $2.59 resistance.

The XRP price is on the path of recovery, trading above $2.42 today despite a 1% drop. The bulls’ tightening grip on the market was well-timed with the sell-off on Friday, which tested the market at 2.18 during last week’s turbulent period. Assuming the bullish mood stabilizes this week, XRP can expand the uptrend past the following significant barrier at $2.59.

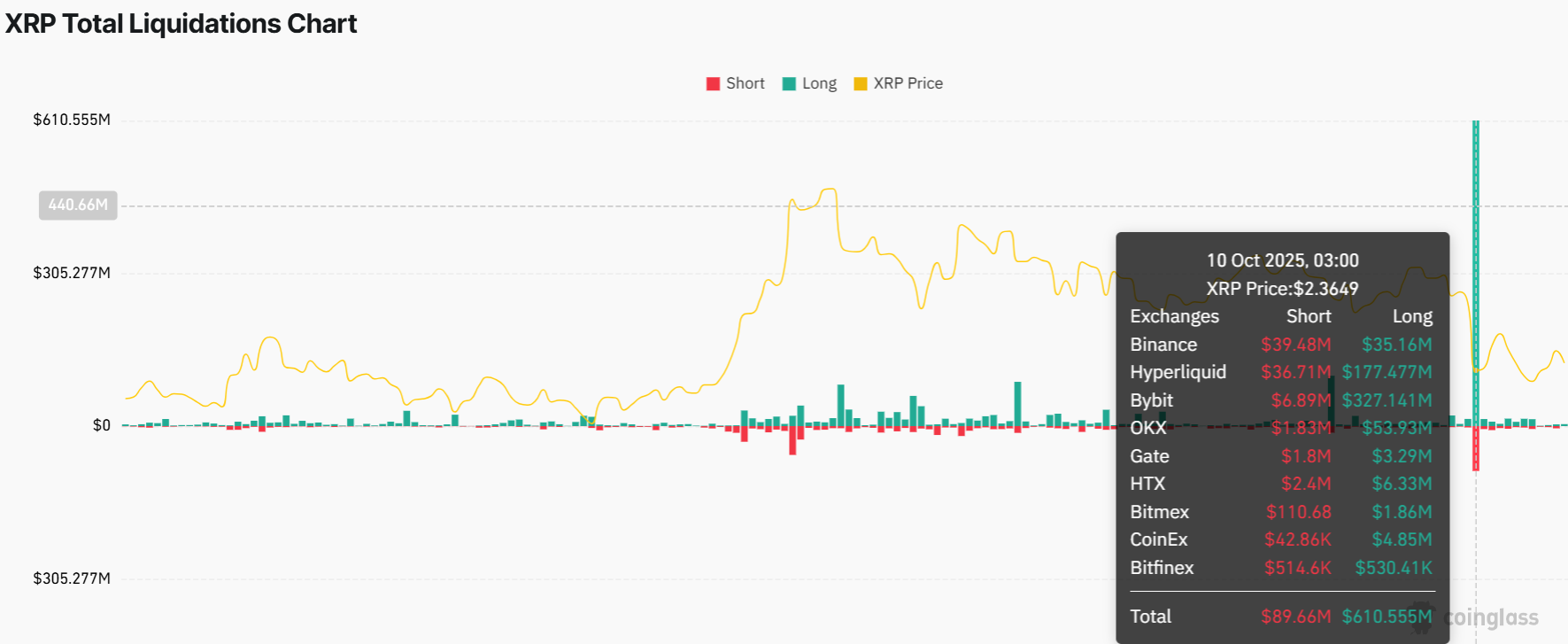

The market for XRP futures derivatives has been the weakest since April, even after the recent events of deleveraging. On October 10, long positions were sold for about $611 million and short positions for $90 million after United States (US) President Donald Trump indicated that he would impose a 100% increase in tariffs on Chinese products.

The trade war between China and the US is a sensitive issue, pointing to the current macroeconomic uncertainty. In the meantime, the larger cryptocurrency market is not subject to any catalysts for price changes, although the volatility is extremely high.

This volatility caused a second sell-off on Friday, causing investors to count their losses, with the price of XRP dropping to $2.18. The data provided by CoinGlass shows that the XRP futures Open Interest (OI) dipped to $3.80 billion on Tuesday.

OI is an outstanding indicator of future contract value. It hit a high point of 10.94 billion when XRP reached a new record of $3.66 in mid-July, based on CoinGlass data. Such a continuing decrease in OI indicates that the buyer base of XRP is becoming smaller as the number of bears grows. If the negative trend in OI continues, XRP price could find it challenging to maintain the uptrend. This will be due to low retail trading and a frozen risk-off mood.

XRP Price Bulls Battle to Regain Control

On the technical front, the crypto is currently trading near $2.41, just below the 50-day Simple Moving Average (SMA) at $2.80, and slightly under the 200-day SMA at $2.59. Those two averages have recently converged, creating a tight trading zone that often precedes a strong directional move. The 200-day SMA at $2.59 acts as immediate resistance, while the $2.30–$2.40 region offers near-term support.

Looking at the price structure, XRP recently rebounded from a sharp dip that briefly tested the $1.93 zone. The recovery from that area shows buyers aggressively stepped in to defend long-term trend support.

The Relative Strength Index (RSI) currently reads 39.62, suggesting that XRP is neither overbought nor oversold. The MACD line hints at a looming buy signal, which will manifest if it crosses above the orange signal line. A confirmed bullish crossover could attract fresh buyers targeting the $2.59-$2.80 resistance zone.

If buying pressure sets in the market, the XRP price could reclaim the $2.59 resistance. A close above this level will see the altcoin hit the $2.80 mark. On the downside, if the resistance zones prove too strong, the XRP price could plunge towards the $2.30 support zone.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.