Bitcoin vs. Altcoins: Is the Shift in Market Behavior Limiting Altcoin Season?

0

0

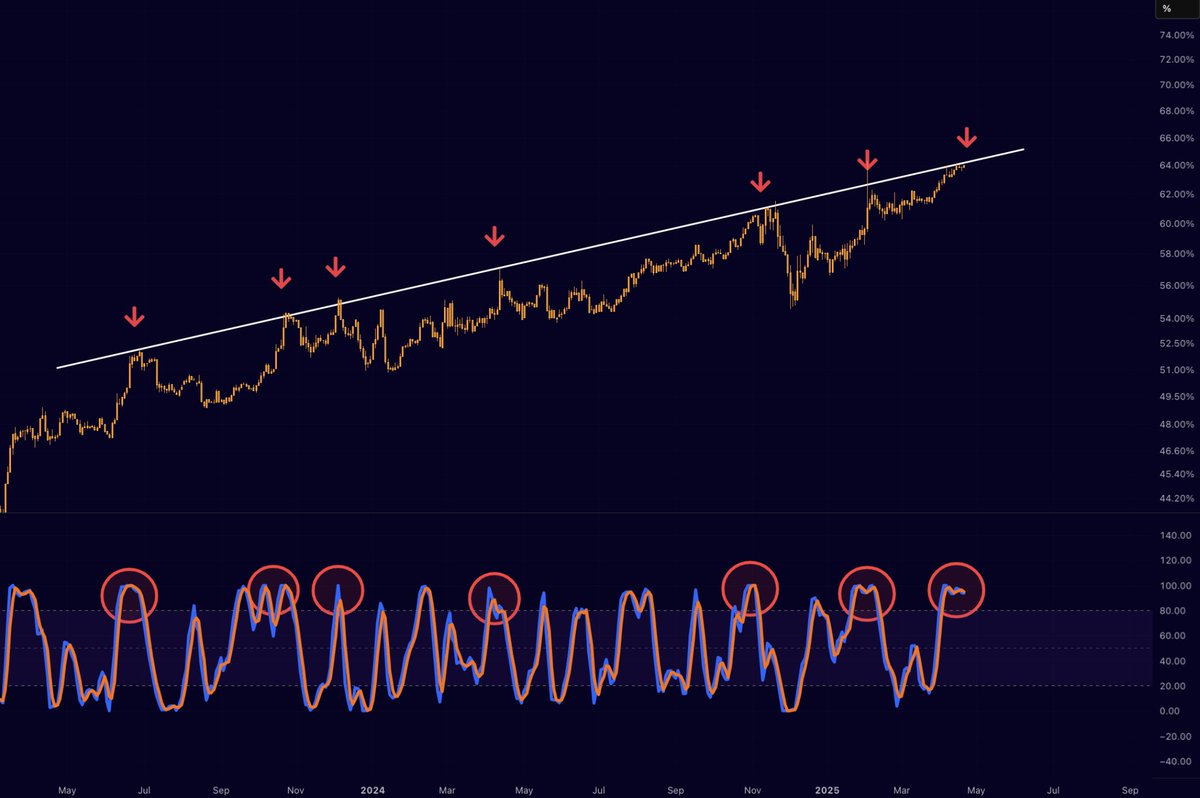

The persistent increase in Bitcoin Dominance (BTC.D) has fueled speculation about the potential for an altcoin season. While some analysts anticipate a correction in BTC.D that could open the door for altcoins to gain traction, a market expert has raised caution.

He argues that the current cycle may differ from previous patterns, with Bitcoin holders unlikely to sell their positions to shift into altcoins.

Is Bitcoin’s Rise Limiting the Potential for Altcoin Growth?

BeInCrypto reported last week that Bitcoin Dominance reached its highest level in over four years. According to the latest data, BTC.D stood at 64.5%, an 11% increase since the beginning of the year.

Bitcoin Dominance Performance. Source: TradingView

Bitcoin Dominance Performance. Source: TradingView

Many analysts are forecasting an incoming pullback in the metric. Mister Crypto, for instance, noted that BTC.D appears poised for rejection at a major trendline. This resistance level is significant because, historically, Bitcoin dominance has struggled to break through it.

“Bitcoin dominance is about to get rejected here. As soon as this happens, altcoins will rally hard!” he wrote.

BTC.D Historical Trends. Source: Mister Crypto

BTC.D Historical Trends. Source: Mister Crypto

Another analyst shared his optimistic outlook, suggesting an imminent shift.

“Bitcoin Dominance is collapsing. Altseason is coming this year. You just need patience,” Merlijn The Trader posted.

BeInCrypto has also reported similar market predictions, highlighting traders’ anticipation of an altcoin season. Yet, not all agree. Experts remain divided on when exactly an altseason might materialize.

Meanwhile, Scott Melker, Host of The Wolf Of All Streets Podcast, took a stronger stance, contending that the current cycle is fundamentally different.

In the latest post on X (formerly Twitter), Melker explained that in previous market cycles, investors rotated their investments between Bitcoin and altcoins, which caused shifts in Bitcoin’s dominance.

“This time, new money is flowing into Bitcoin from retail, institutions, and even governments – and it’s not trickling down to altcoins. It can’t go from an ETF into a meme,” Melker remarked.

Melker emphasized that the decline of altcoins against Bitcoin is largely driven by holders selling their altcoins out of necessity rather than moving capital into Bitcoin. According to him, this represents “capitulation,” where investors abandon their altcoins due to financial pressures rather than market strategy.

Nonetheless, the same isn’t the case for BTC. Unlike altcoin holders, Bitcoin investors are not selling their Bitcoin to buy altcoins. Thus, Melker’s analysis suggests that altcoins may require an influx of external capital to recover rather than relying on the traditional flow of funds from Bitcoin.

This shift in market behavior aligns with broader trends in the cryptocurrency space. Bitcoin is increasingly being viewed as a store of value amid inflation concerns.

“This cycle may change Bitcoin from a risk asset to an inflation hedge since there is nowhere else but gold and BTC to park money,” an analyst commented.

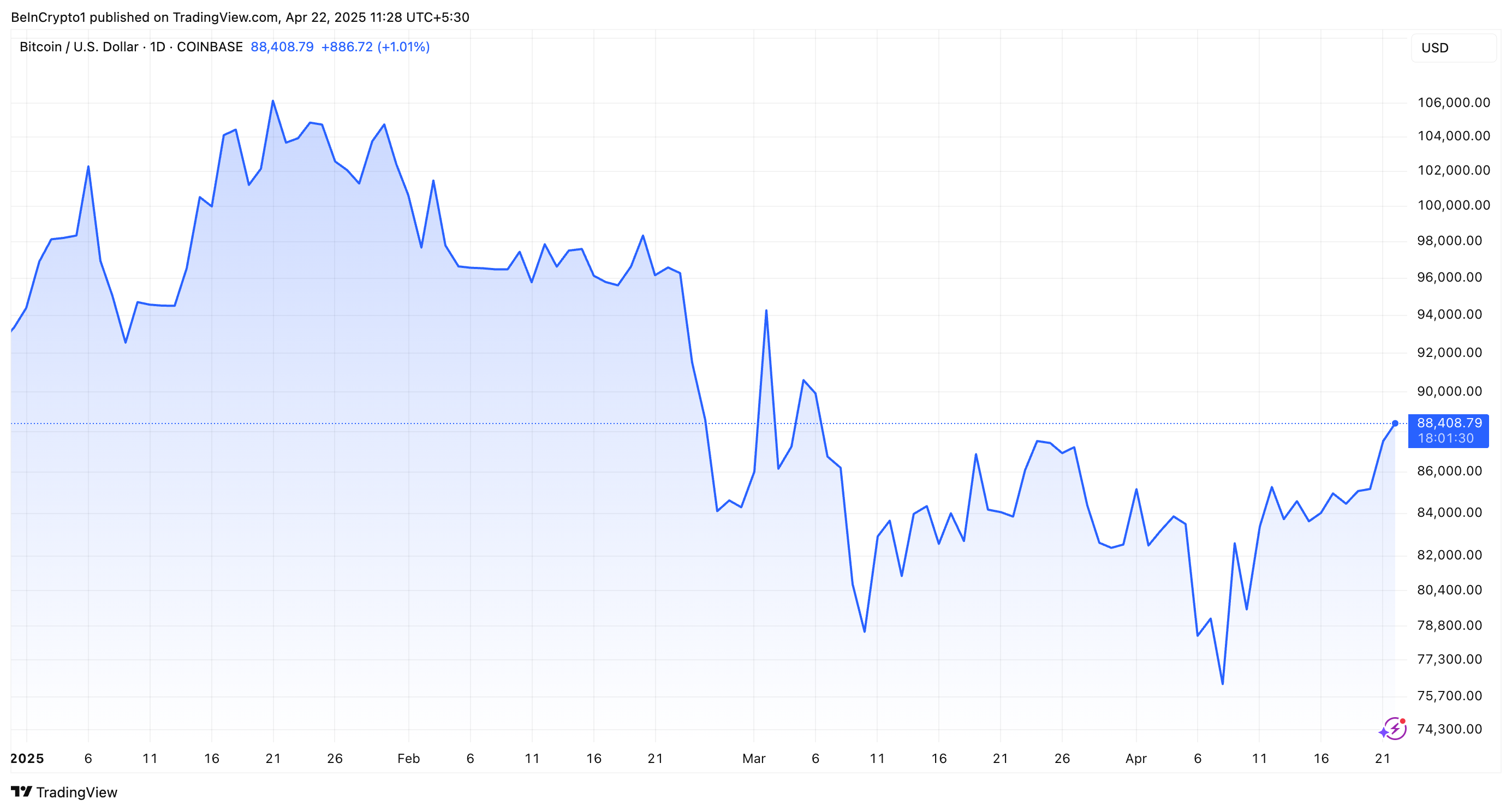

Furthermore, BeInCrypto noted yesterday that the US Dollar Index (DXY) plunged to a three-year low. The decline triggered a rally in Bitcoin.

It surged past $87,000 yesterday, marking highs last seen on Liberation Day. In addition, the rally has continued.

Bitcoin Price Performance. Source: TradingView

Bitcoin Price Performance. Source: TradingView

Over the past day, the largest cryptocurrency has seen a 0.91 % increase. At the time of writing, it was trading at $88,408.

Notably, the dollar’s decline has also benefited gold. The precious metal surged to a new all-time high (ATH) of $3,456 today.

“Gold prices are now up +47% over the last 12 months,” The Kobeissi Letter revealed.

The contrasting performances have reinforced the narrative of Bitcoin as a reliable investment, positioning it alongside gold. With increasing economic concerns, both assets are emerging as key safe havens.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.