ASTER’s High-Stakes: Can MrBeast’s Bet Ignite a Real Recovery?

0

0

As the crypto world watches with bated breath, ASTER finds itself at a dramatic crossroads. What began as a speculative flurry over celebrity backing has morphed into a technical battleground, one where $1.45 support, whale behavior, and market sentiment now duel for dominance.

With a $1.53 million stake by MrBeast recently surfacing, can ASTER ride that momentum back above $2.00? Or will the strain of repeated tests drag it back to $1.30?

MrBeast’s Mounting Position and the Spotlight It Casts

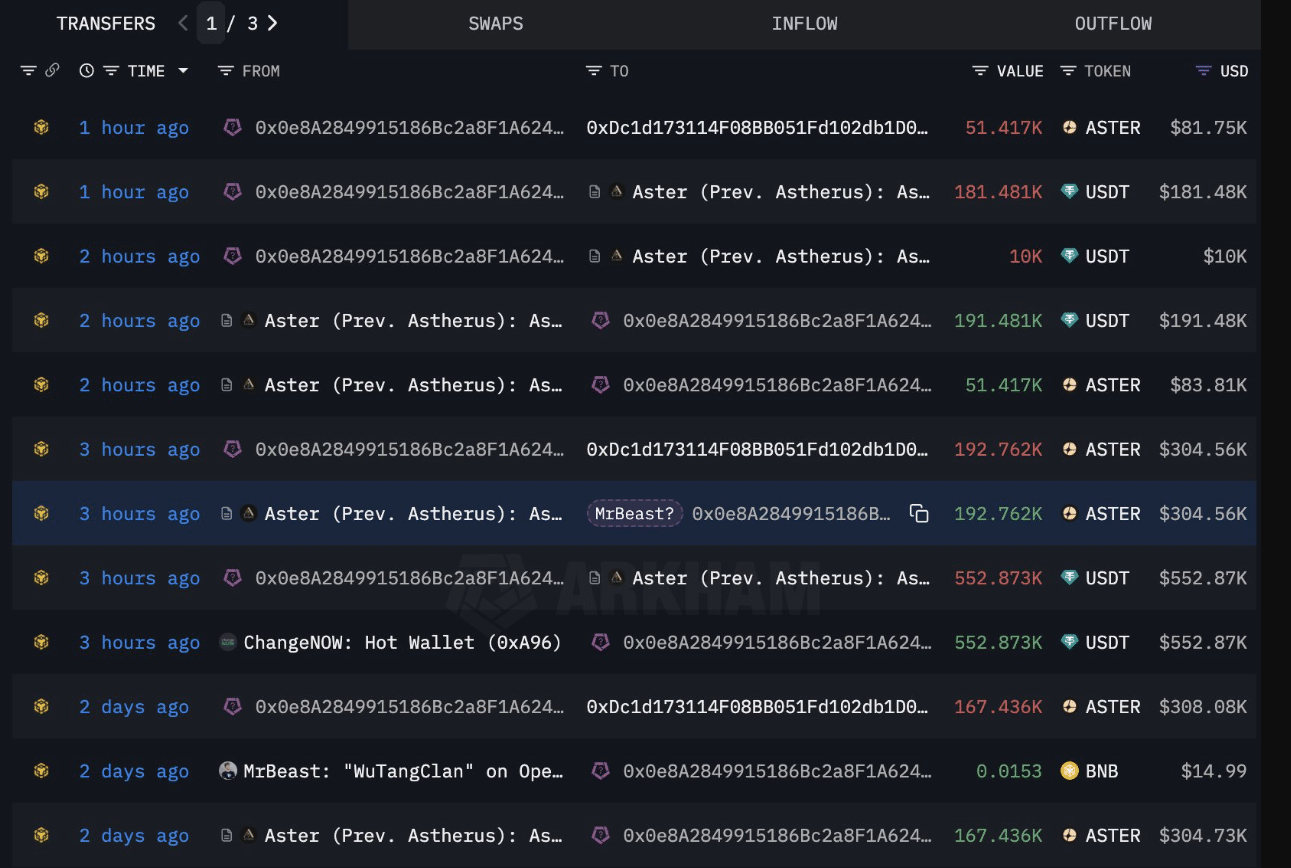

Blockchain trackers report that Jimmy Donaldson, better known as MrBeast, added 244,179 ASTER tokens worth about $386,000 to his holdings, bringing his total to 949,999 ASTER, valued at around $1.53 million. This move marks at least the third high-value accumulation in a short span, strengthening the narrative of intentional, long-term participation over headline “drip buys.”

Across X and on-chain commentary, observers debate whether this purchase signals conviction or the kind of hype that precedes a reversal. “Whale stacking or social proof?” one user asked. The answer may lie in how the token weathers its upcoming tests.

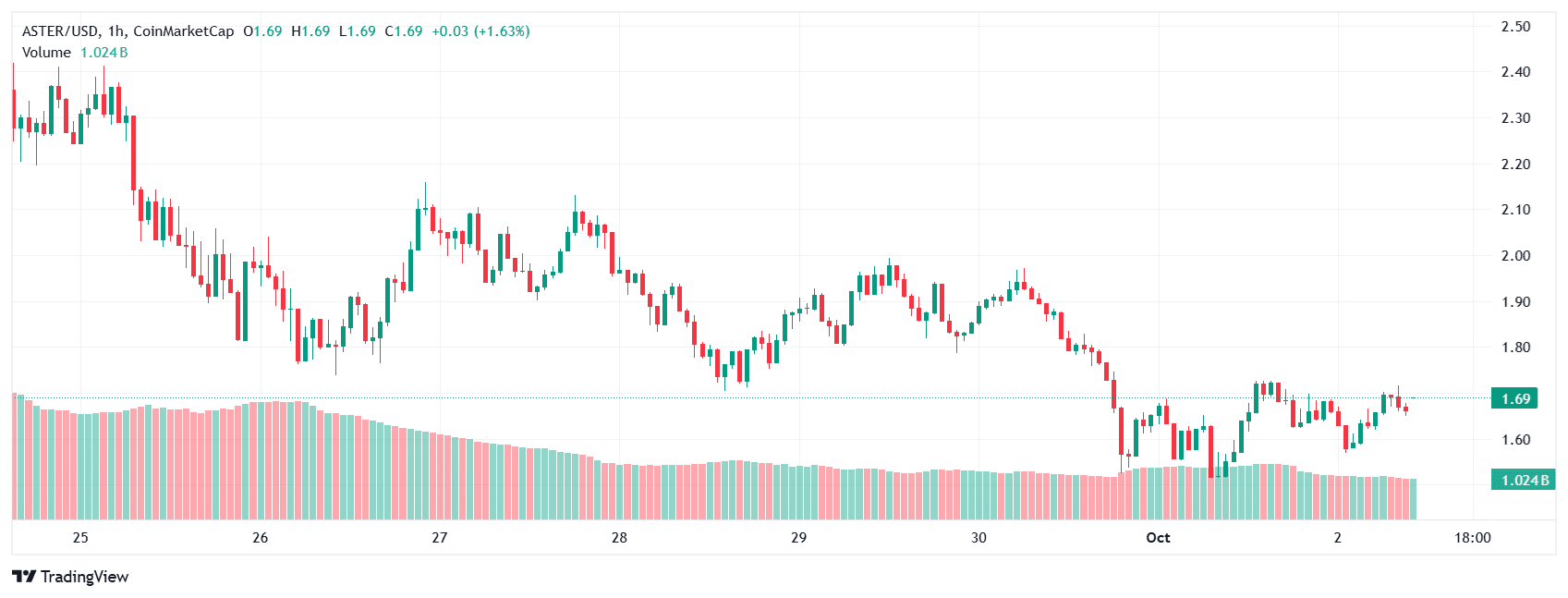

Key Technical Zones: $1.45 Demand, $2.00 Resistance

The $1.45–$1.50 range has turned into a battlefield: it has repeatedly absorbed downside pressure, but each successive retest chips away at its structural integrity. Below that, analysts warn of a slide toward $1.32, which would undermine the optimistic narrative.

On the upside, breaking $2.00 is a psychological and technical inflection point. Surpassing $2.43 would reinforce a recovery narrative, though that is a steeper climb requiring true trading force. Some analysts see a potential 35 % bounce if ASTER firmly defends a “hot support” range near $1.60–$1.80, with upside toward $2.22–$2.45. But if support cracks, a drop to $1.25–$1.30 is possible.

Other technical indicators lend mixed signals: RSI and MACD are beginning to creep out of oversold territory, hinting at room for a bounce, if momentum accompanies. But heavy leverage in the ecosystem could magnify losses if seller pressure grows. In short: ASTER sits in a “make or break” zone.

Fundamentals vs. Hype: Can ASTER Sustain?

The background numbers are compelling. ASTER recently eclipsed its rival Hyperliquid in daily fee generation, pulling in tens of millions over 24 hours and jumping ahead of stablecoins like Tether and Circle in protocol revenue rankings. Its derivatives volume, tens of billions daily, underscores deep trader engagement and liquidity depth.

But high reward comes with high risk. Reported token concentration is a concern: a small number of wallets hold a disproportionate share of supply, opening the door to abrupt liquidations or sell-offs.

There’s also the looming specter of token unlocks and airdrop cycles, which historically introduce supply pressure. And while ASTER has backing from Binance’s YZi Labs, its relatively short track record means its resilience is not yet battle-tested.

In a recent bullish twist, Binance’s CZ commented that the token’s dip was part of “shaking out weak hands,” a phrase that reassured some and worried others about volatility churn.

Outlook: Recovery in Sight, But Only With Proof

If ASTER maintains support above $1.60, pushes past $2.00 with conviction, and sustains volume, a rally toward $2.30–$2.45+ is plausible in the coming weeks. But that path is narrow. A failure to hold the $1.50–$1.45 zone could lead to a re-test of $1.25–$1.30, which might fracture bullish sentiment.

MrBeast’s accumulation adds narrative muscle, but hype alone won’t sustain price. The market is a harsh referee: without broad demand, technical strength, and decent decentralization, ASTER may struggle to shed its speculative tag.

Conclusion

ASTER is in the spotlight for more than just celebrity backing. Its dizzying trading volumes and fee dominance separate it from many recent altcoin stories. But now the real test begins. The next few days will tell whether MrBeast’s bet was a turning point or a last gasp of hype.

If ASTER can defend $1.45, score a clean break above $2.00, and keep whales from pulling triggers, it might just carve a path to recovery. If not, the pullback could sting harder than most expect. Traders and holders alike will be watching every candle, every wallet move.

FAQs

Q1: What is ASTER and why is it gaining attention?

ASTER is the native token of a decentralized perpetual exchange. It’s gaining attention for its explosive trading volumes, high protocol fees, and backing from crypto heavyweights.

Q2: Why is the $1.45 support area so important?

That zone has repeatedly stemmed sell pressure. If it breaks, it could trigger deeper corrections, exposing weak hands to losses.

Q3: Can MrBeast’s buying influence the price long term?

It can influence sentiment and bring eyeballs, but lasting price action depends on real demand, exchange listings, and balanced token distribution.

Q4: What are key risks investors should watch?

Risks include token concentration, large wallet sell-offs, upcoming unlocks/airdrops increasing supply pressure, and the possibility that current momentum is purely speculative.

Glossary of Key Terms

Support / Demand Zone: A price range where buying interest historically absorbs selling pressure.

Resistance: A price barrier where sellers often outnumber buyers, stalling upward momentum.

RSI (Relative Strength Index): A momentum indicator that measures overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator showing the relationship between two moving averages.

Token Unlock / Airdrop: Scheduled release of locked tokens or distribution to holders; may increase circulating supply and pressure price.

Whale: A crypto investor (often holding large amounts) whose trades can significantly influence market moves.

Read More: ASTER’s High-Stakes: Can MrBeast’s Bet Ignite a Real Recovery?">ASTER’s High-Stakes: Can MrBeast’s Bet Ignite a Real Recovery?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.