#Ethereum / $ETH

— K A L E O (@CryptoKaleo) August 6, 2024

Still believe we have a bit of chop in the lower bounds of this range before we send to new highs, but if you're asking yourself "Is this a good place to start bidding?"

My answer is yes. pic.twitter.com/K1Nm2t7NTH

Crypto: Ethereum ETFs Captivate Investors Amid Crisis

2y ago•

bullish:

0

bearish:

0

Share

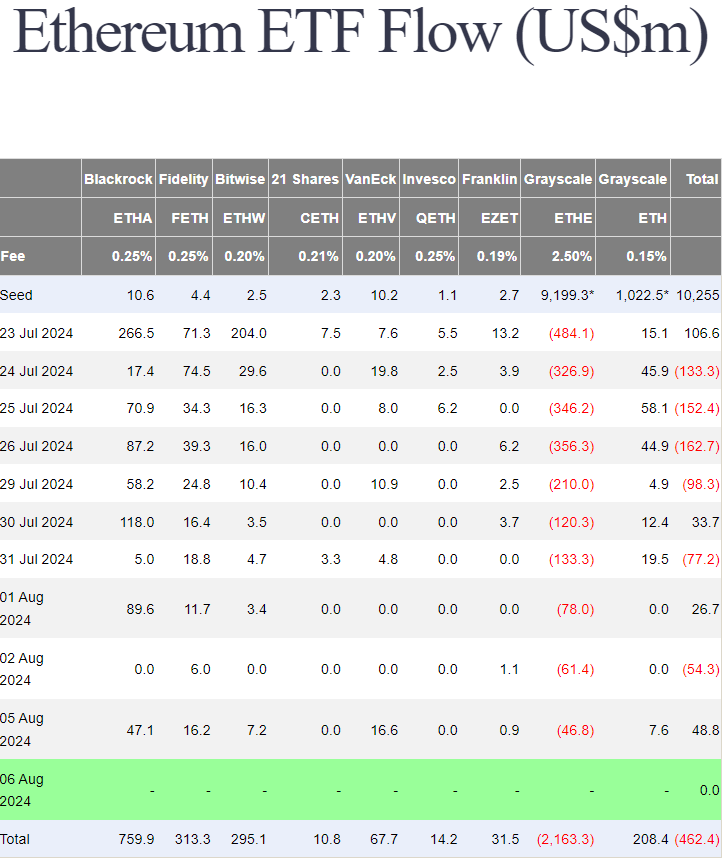

Patience is crucial in crypto trading, especially in the face of unpredictable market fluctuations. Savvy investors know that with the recently launched Ethereum ETFs, the start may seem slow, but it is surely promising. While spot Ethereum ETFs ended July in green and started August with impressive results, recent statistics confirm a well-supported rise.

Ethereum ETFs: A Market Crisis Paradox

While the crypto market experienced a spectacular drop this weekend, crystallized by a $500 billion plunge, the Ethereum ETFs defied expectations. Despite a nearly 20% drop in ether’s price on August 5th, ETF investors just injected approximately $49 million, marking their second-best inflow day since their launch on July 23rd.

Big winners include BlackRock’s ETHA with $47.1 million, followed by VanEck’s ETHV and Fidelity FETH. Even smaller ETFs like Grayscale’s mini ether ETF, Bitwise’s ETHW, and Franklin Templeton’s EZET recorded positive inflows.

This dynamic illustrates the unwavering confidence of institutional investors in ether’s fundamental value, despite short-term volatility.

Ethereum ETFs show remarkable resilience, capable of turning a crisis into an opportunity.

The Stability of ETH: A Beacon of Hope in Chaos

Despite market turmoil, the price of ETH has managed to stabilize. At the height of the panic, ETH briefly plunged to $2,100 before bouncing back to around $2,500, a 19% rise.

Technical analysts like “CJ” and “CryptoKaleo” agree that ETH might move sideways before another bullish impulse.

However, some remain cautious, suggesting a possible drop to $1,800 and $1,900 if macroeconomic conditions worsen.

- Net inflows of Ethereum ETFs: $49 million

- Minimum ETH price reached: $2,100

- Current ETH price rebound: $2,500

In sum, the Ethereum ETFs, which already started August with $26.7 million, demonstrate that even in times of crisis, there are pockets of stability and growth. The ability of ETFs to attract funds even on the worst market days underscores lasting confidence in ether and its long-term future.

2y ago•

bullish:

0

bearish:

0

Share

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.