Bitcoin Touches $104K After U.S.-UK Trade Deal, ETFs Fuel Bull Stampede

0

0

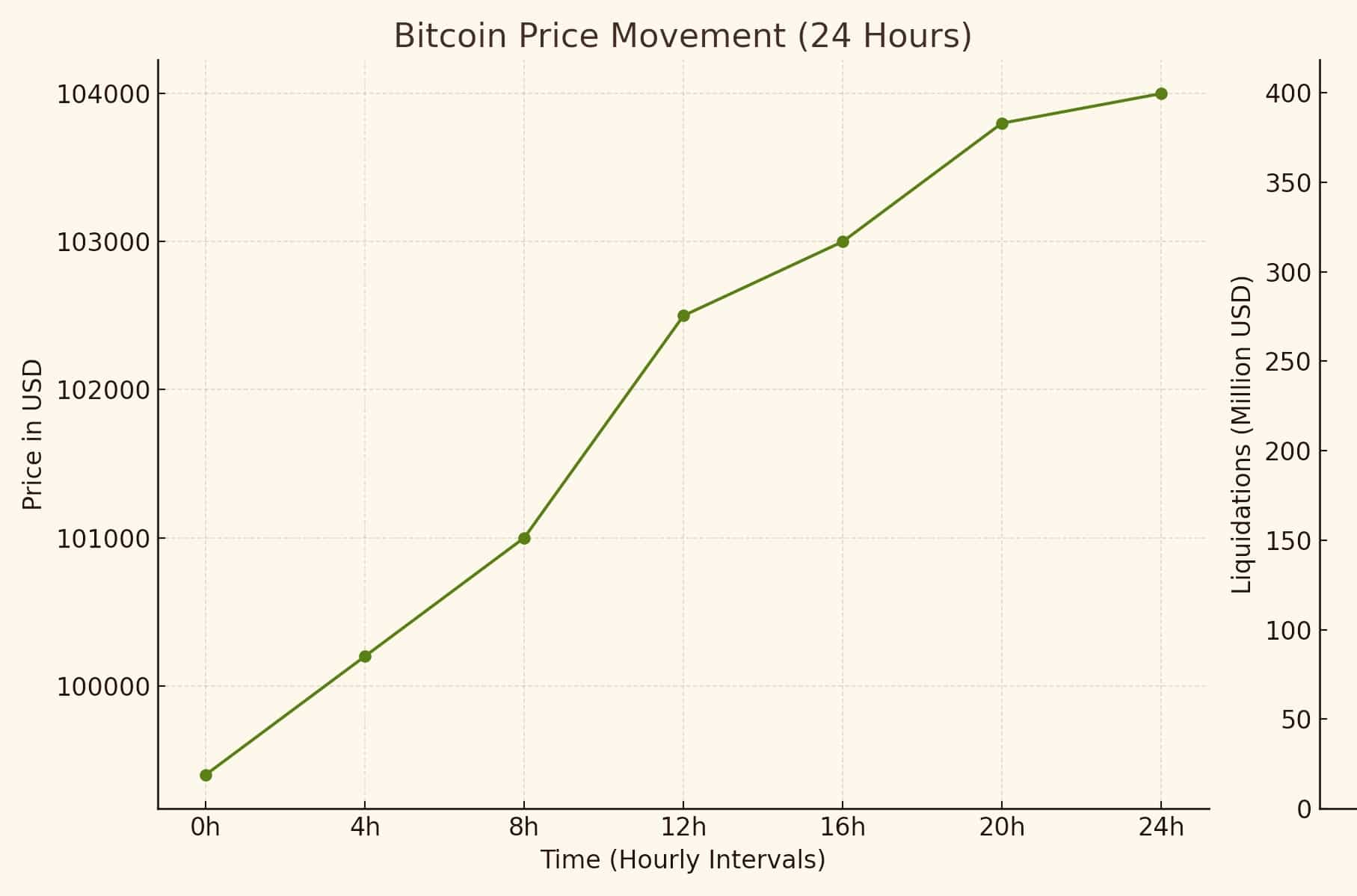

Bitcoin price surge to $104K liquidates nearly $400M in bearish BTC bets, driven by a U.S.-UK trade deal and ETF inflows exceeding $40 billion. The price shot more than 3% higher over the space of 24 hours from $99,400 up to a peak of $104,000; its highest level since January 31, 2025. Then drops down to $103,813.

There were two big catalysts that underlaid this rally: a new U.K.-U.S. trade deal and record inflows to spot Bitcoin exchange-traded funds (ETFs), which reached $40 billion for the first time, according to Coinglass and Bloomberg ETF data.

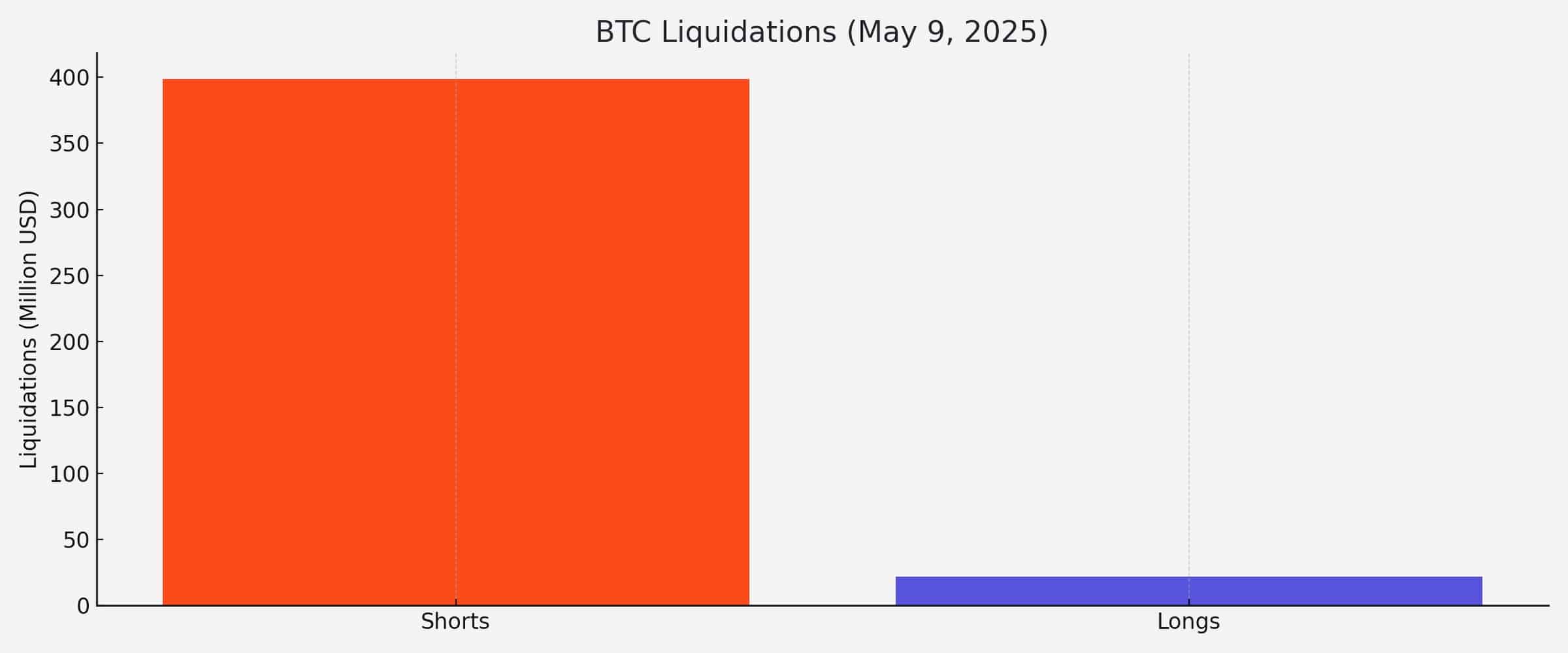

As a consequence almost $400 million of bearish BTC positions got liquidated and that contributed to the volatility and optimism in the market. Analysts say this robust push north could set the stage for more gains in the near future, particularly given accelerating global crypto and ETF momentum.

Trade Deal Sparks Market Optimism

On May 8, 2025, President Donald Trump and UK Prime Minister Keir Starmer announced a comprehensive trade agreement, reducing tariffs on British vehicles, steel, and aluminum, while increasing U.S. agricultural exports to the UK. This development alleviated market uncertainties stemming from earlier tariff increases and contributed to a positive shift in investor sentiment. Bitcoin’s current price stands at 103,813 as of May 9th.

Key Market Data – Bitcoin Surge Snapshot (May 9, 2025)

| Metric | Value | Source |

| Bitcoin Price (24h high) | $104,000 | TradingView |

| Bitcoin Price Change (24h) | +3.2% | TradingView |

| Total Short Liquidations (24h) | $398.7 million | Coinglass |

| Long Liquidations (24h) | $22 million | Coinglass |

| Total ETF Inflows (Cumulative) | $40.1 billion | Bloomberg ETF Data |

| Global Crypto Market Cap (Ex-BTC) | $1.14 trillion (up 10%) | TradingView |

| Last Bitcoin Peak (Before May 9) | $105,200 (Jan 31, 2025) | TradingView |

ETF Inflows Exceed $40 Billion

The surge in Bitcoin price was further bolstered by record inflows into spot exchange-traded funds (ETFs), exceeding $40 billion according to Coindesk. This incoming tide of institutional investors is a sign of increasing confidence in Bitcoin to be a viable asset class.

Top ETF Inflows Contributing to Bitcoin Rally

| ETF Name | Net Inflow (7 Days) | Cumulative Inflow | Issuer |

| iShares Bitcoin Trust | $2.1 billion | $12.5 billion | BlackRock |

| Fidelity Wise Origin BTC | $1.7 billion | $10.2 billion | Fidelity |

| ARK 21Shares Bitcoin ETF | $890 million | $6.4 billion | Ark Invest / 21Shares |

| VanEck Bitcoin Trust | $460 million | $3.2 billion | VanEck |

Massive Liquidation of Bearish Positions

The rapid increase in Bitcoin price led to the liquidation of nearly $400 million in short positions over a 24-hour period, marking the highest single-day total since at least November. Such a disproportionate imbalance implies that there was a great leverage bias towards the bearish, rapid liquidation of shorts, which could mean more gains for the market.

Analyst Perspectives

Market analysts attribute the rally to a combination of geopolitical developments and increased institutional participation.

Geoffrey Kendrick, head of FX research at Standard Chartered, remarked, “Bitcoin’s ascent reflects a confluence of favorable trade policies and growing institutional interest.” Reuters

Tony Sycamore, market analyst at IG Markets, noted, “The rapid appreciation in the value of Bitcoin reflects still growing investor confidence in addition to wider adoption of digital assets.” analyticsinsight.net

Conclusion

Bitcoin price recent surge to over $104,000 underscores the cryptocurrency’s sensitivity to macroeconomic factors and institutional investment trends. The combination of a favorable U.S.-UK trade agreement and substantial ETF inflows has not only propelled Bitcoin price but also led to significant market reconfigurations, particularly among bearish investors.

As the market continues to evolve, stakeholders will closely monitor these developments for future investment strategies.

FAQs

Q1: What caused the recent surge in Bitcoin price?

A: The outbreak was mainly fuelled by an announcement of a U.S.-UK trade agreement and a spate of record inflows in Bitcoin ETFs worth over 40 billion dollars.

Q2: How should one interpret the $ 400 million in short liquidations?

A: It indicates that many investors betting against Bitcoin price increases were forced to close their positions, suggesting a potential shift in market sentiment towards bullishness.

Glossary of Key Terms

- Bitcoin (BTC): A disinterested digital currency that is not centralized by a central bank or a single administrator.

- Exchange-Traded Fund (ETF): A Trading of investment fund in stock exchanges with asset in stocks, commodities or cryptocurrencies. en.wikipedia.org

- Short Position: A sell-and-repurchase, or repurchase agreement, where the investor sells a security with intentions to repurchase the same security later at a cheaper price.

- Liquidation: An exit strategy used in a financial market to close a position usually as a result of margin calls or stop loss triggers.Holder+1mint+1

References

Reuters: “Bitcoin retakes $100,000 on global trade deal optimism” Reuters

AP News: “Trump agrees to cut tariffs on UK autos, steel and aluminum in a trade deal” Barron’s+2AP News+2Reuters+2

Barron’s: “Bitcoin Price Crosses $100,000 for First Time Since February Following U.S.-U.K. Trade Deal”Barron’s+1Reuters+1

Bitcoin Magazine: “$111 Billion: Bitcoin ETFs See Record Inflows In March” The Block+2Bitcoin Magazine+2CoinMarketCap+2

Reuters: “Japanese stocks jump, dollar firms on trade hopes; bitcoin soars” Reuters

Analytics Insight: “Bitcoin Price Surges Towards $100K Amid $4 Billion ETF Inflows and Pro-Crypto Sentiment”analyticsinsight.net

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

Read More: Bitcoin Touches $104K After U.S.-UK Trade Deal, ETFs Fuel Bull Stampede">Bitcoin Touches $104K After U.S.-UK Trade Deal, ETFs Fuel Bull Stampede

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.