$120M Just Bridged to Solana—But Why Are Traders Still Nervous?

0

0

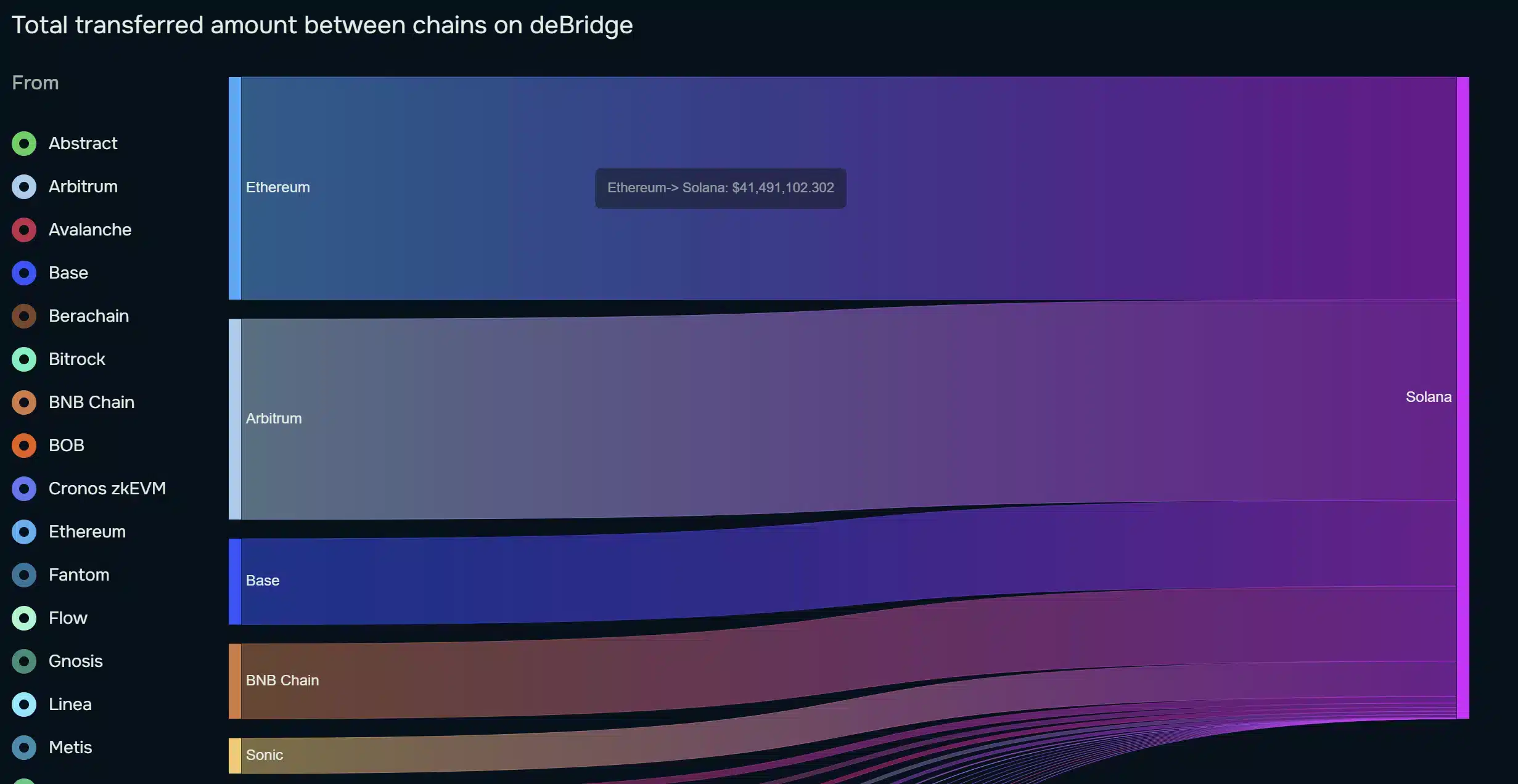

The Solana network has attracted significant financial activity during the past month after users bridged more than $120 million in digital assets to its network. A fresh wave of investment money returns to SOL after its investors left due to political issues and network problems.

Debridge reports Ethereum sent the most capital, with $41.5 million, entering SOL. Over the last 30 days, Arbitrum transferred $37.3 million to SOL when Base and BNB Chain delivered $16 million and $14 million. Sonic joined the event with $6.6 million total.

Solana Recovers From LIBRA Scandal Fallout

The Solana ecosystem recently received an influx of new funds after experiencing major instability. In March, the network suffered severe negative effects from Argentina’s LIBRA meme coin scandal, which led to $485 million draining to Ethereum and BNB Chain blockchain competitors.

Solana gains popularity through people’s enthusiasm for meme coins once again. During the last week, POPCAT gained 79%, FARTCOIN 51%, BONK 25%, and WIF 21%. People are showing renewed interest in the SOL platform due to its successful meme coin events.

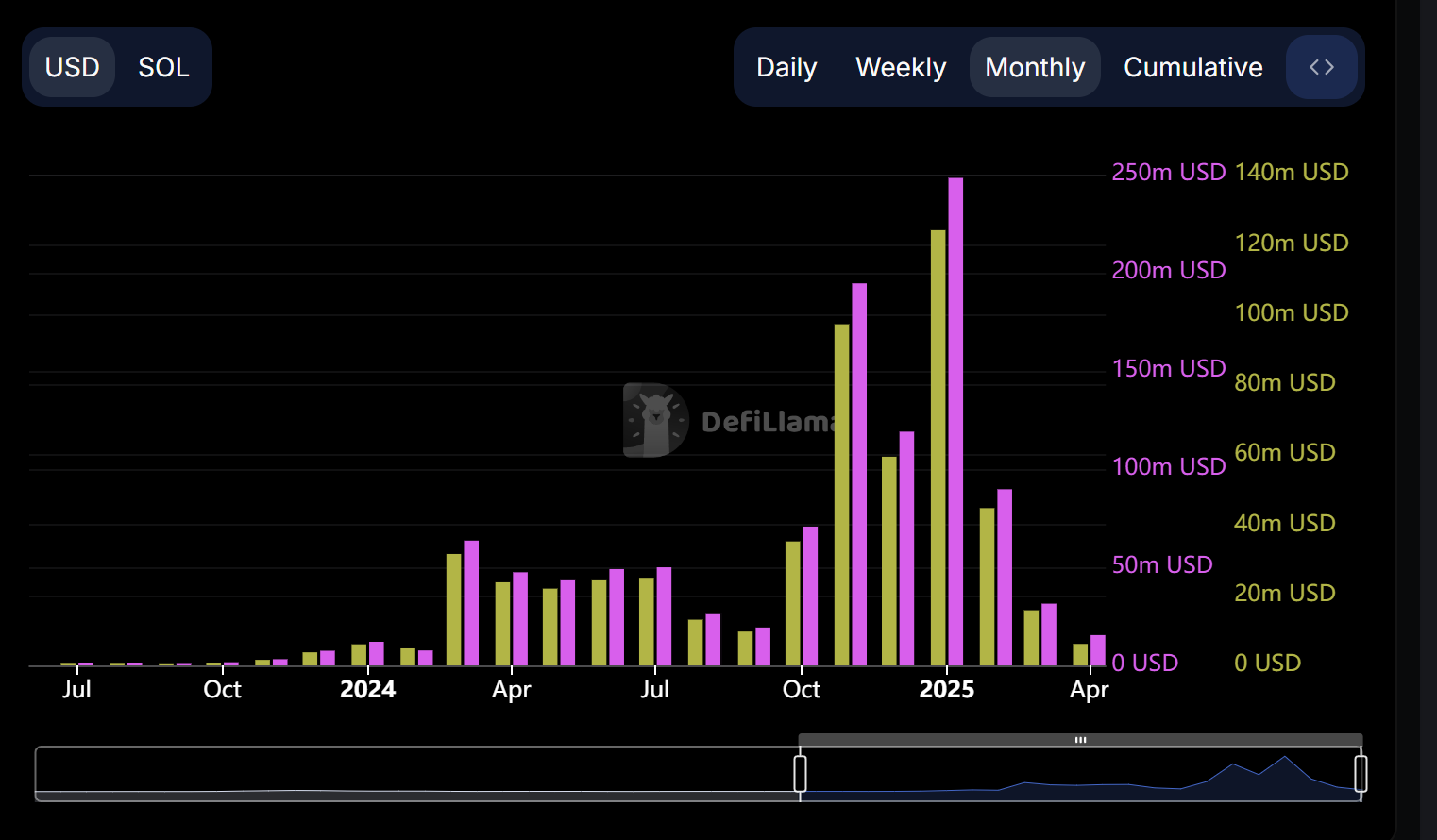

Solana Struggles Below Resistance as Fees Drop

The crypto market shows upward movement yet basic measures produce inconsistent results. The network processing fees for SOL dropped by 88% in March to $46 million after reaching $400 million in January. Network fees during the first three weeks of April have collected just $22 million since the beginning of the month.

Technical charts indicate that SOL stays in a downward direction. The cryptocurrency stays below $140 resistance on the daily chart while facing strong resistance from the 50-day exponential moving average. The market structure would shift to bullish when the daily session candlestick closes above $147.

SOL Price Faces Pressure From RSI Divergence

LTF analysis shows additional signs of risk in the market. The price of SOL shows usual trends in its movement with relative strength index (RSI) levels, which have often brought price dips before. SOL met technical tests with falling prices four times in 2025 following each hurdle.

The latest technical pattern shows up again as SOL spent only a short time above both 50-day and 100-day Exponential Moving Averages during its latest 4-hour chart move. According to past behavior, SOL will likely face fresh selling action in the next days. Market analysts identify the price range between $115 and $108 as a solid chance for market recovery, given heavy buying activity in this sector.

Solana Support Builds at $130 Amid Uncertainty

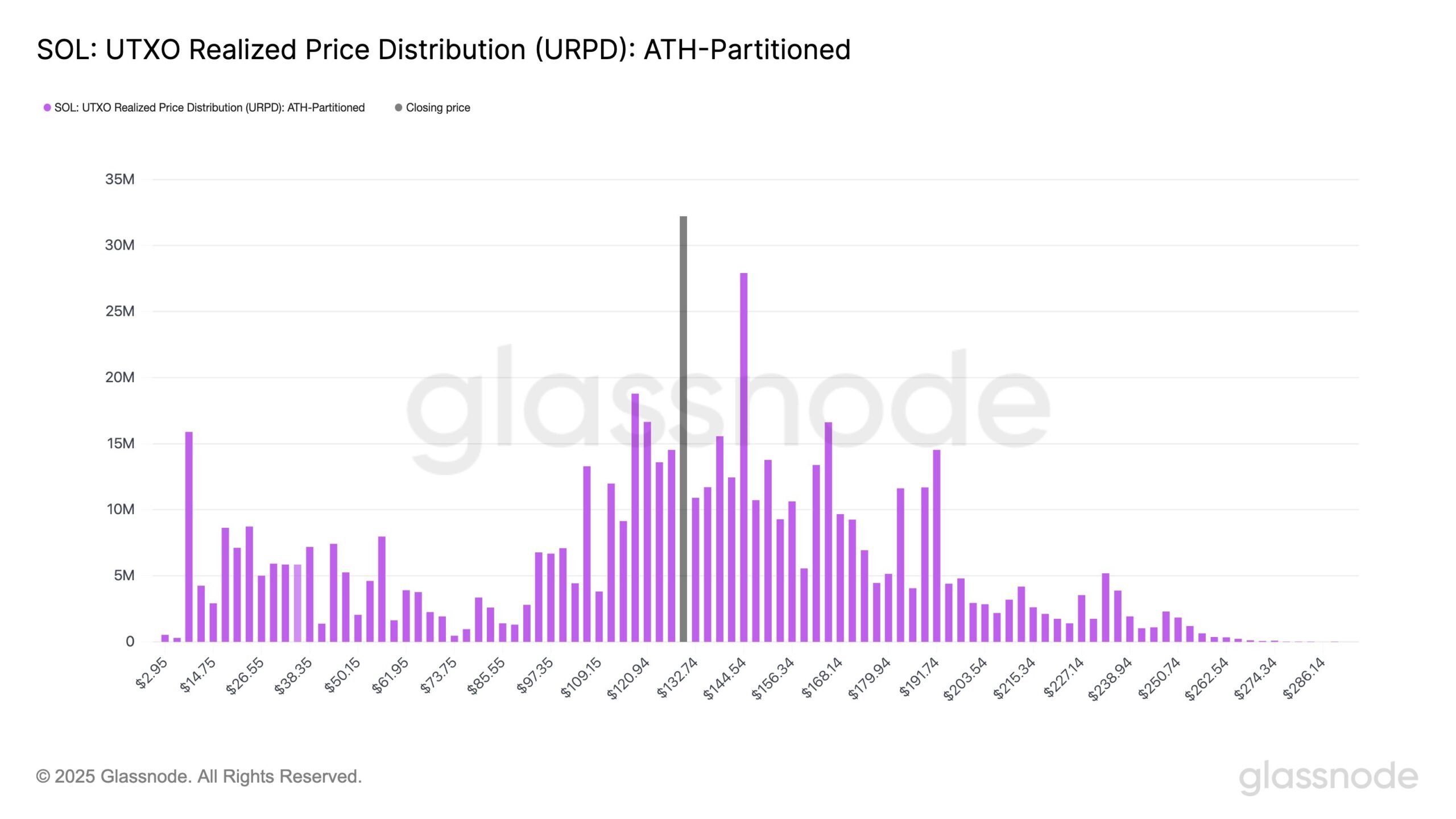

The impending bear market could still produce favorable outcomes. According to Glassnode data a substantial number of buyers made acquisitions at the $130 price level.

#Solana’s URPD shows a major shift in cost basis over the past two days, forming the largest supply cluster (>5%) at $129.79 with over 32M $SOL. This zone could act as a support during future drawdowns, reflecting high investor engagement at this price level. pic.twitter.com/mrunKSjKZL

— glassnode (@glassnode) April 15, 2025

The purchase of 32 million Solana from the total supply zone at 5% makes $130 an immediate support level for the near future. Glassnode noted in a recent X post:

“Below $129, we see 18M $SOL (3%) at $117.99, while above, 27M $SOL(4.76%) sit at $144.54. In the short term, $144 could act as resistance and $117 as the lower bound of the price range, with $129 serving as the key pivot zone.”

Conclusion

Solana’s recent $120 million liquidity boost highlights growing investor confidence, despite ongoing bearish signals and declining network fees. The market success of memecoins and support zones creates hope for SOL, but it needs to climb past key barriers before showing that this rally is genuine. People will now see if SOL will keep gaining adoption or if its success is temporary.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

Why is liquidity increasing in Solana?

Solana saw a $120 million liquidity boost from Ethereum and Arbitrum, reflecting renewed confidence.

How did the LIBRA scandal affect Solana?

The LIBRA scandal caused $485 million to leave SOL, but liquidity is now returning.

Is Solana bullish or bearish?

Solana remains bearish and needs to break $147 for a bullish shift.

Glossary of Key Terms:

- Liquidity

The ease of converting an asset into cash or another asset. - Arbitrum

A layer-2 solution for scaling Ethereum transactions. - Exponential Moving Average (EMA)

A moving average that prioritizes recent prices. - Bearish Divergence

When price rises but indicators suggest a decline is imminent. - Relative Strength Index (RSI)

An indicator measuring price momentum and overbought/oversold conditions. - 50-Day & 100-Day EMA

Moving averages showing medium to long-term trends.

References

Read More: $120M Just Bridged to Solana—But Why Are Traders Still Nervous?">$120M Just Bridged to Solana—But Why Are Traders Still Nervous?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.