What Does Open Interest Mean For Uptober As Market Recovers?

0

0

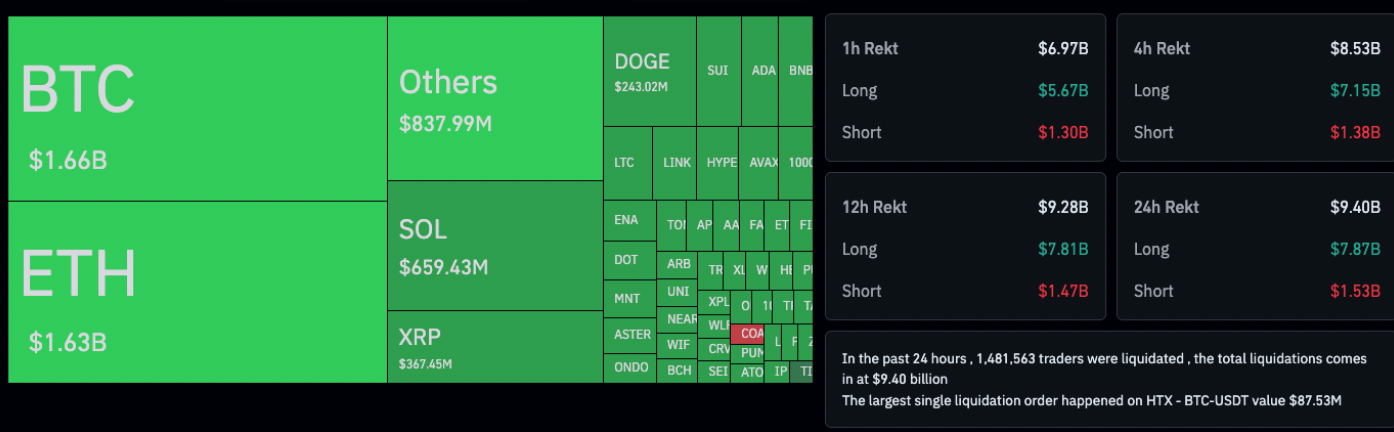

As the dust settles over a dramatic mass liquidation weekend, crypto prices are recovering, but with open interest already rising – what does it mean for Uptober?

Leverage is quietly returning to the crypto market just as “Uptober” begins, a month known for strong Bitcoin rallies.

Over the past 24 hours, derivatives traders have started rebuilding their positions after the weekend’s massive wipeout. Bitcoin’s futures open interest has bounced, and funding conditions are stabilizing across major exchanges.

This rebound on October 13 comes as Bitcoin price steadies near $115,000.

Rising leverage during a bullish seasonal trend can magnify both profits and losses as traders position for October’s historical strength.

After last week’s $500 billion market drawdown and record liquidations, sentiment improved.

Will Uptober’s Historic Trend Push Bitcoin and Ether Even Higher?

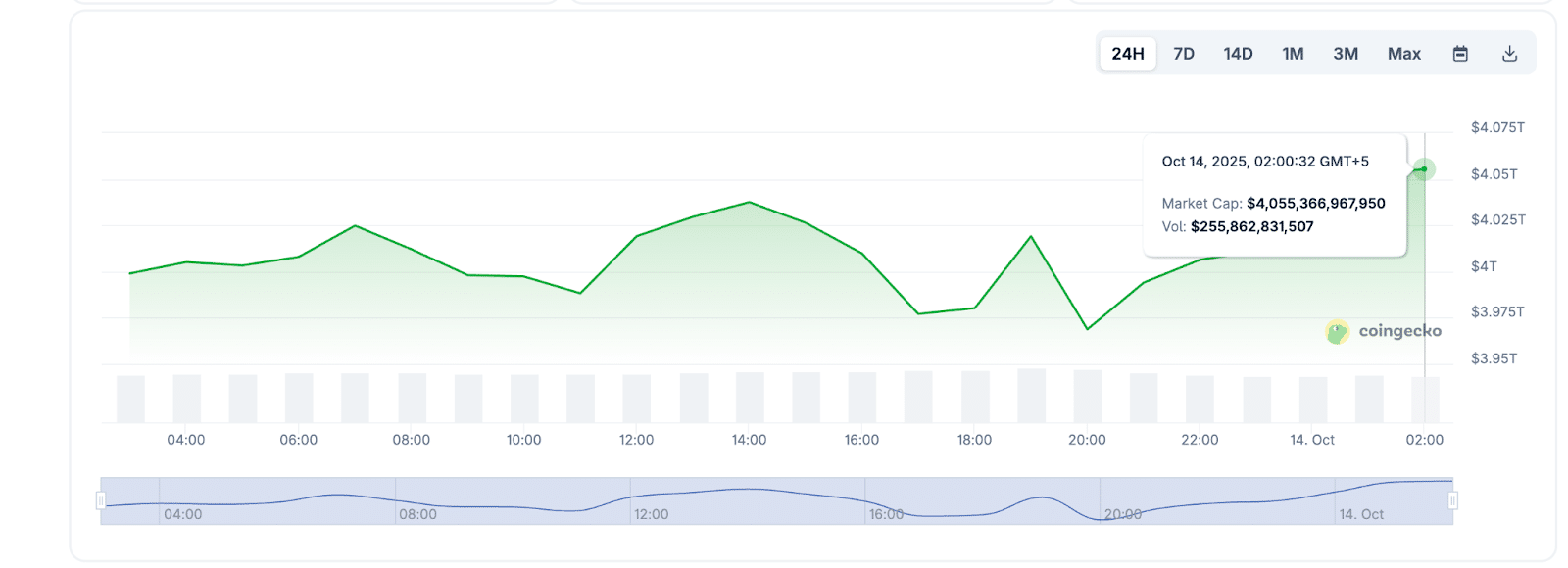

Spot prices and overall market capitalization climbed back above $4 trillion, supported by calmer macro conditions and bargain hunting.

The earlier $19 billion wipeout, which hit more than 1.6M traders, explains why leverage is rebuilding slowly.

The largest liquidation event in crypto history.

In the past 24 hours, 1,618,240 traders were liquidated, with a total liquidation amount of $19.13 billion.

The actual total is likely much higher — #Binance only reports one liquidation order per second.… pic.twitter.com/tvMCILVgU0

— CoinGlass (@coinglass_com) October 10, 2025

Seasonal trends are also helping sentiment. Since 2013, October has been one of Bitcoin’s strongest months on average, a pattern traders call “Uptober.”

History doesn’t guarantee outcomes, but it often gives buyers more confidence after sharp corrections like this one.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

A Glance at Open Interest: Is the Uptober Rally Backed by Sustainable Market Activity?

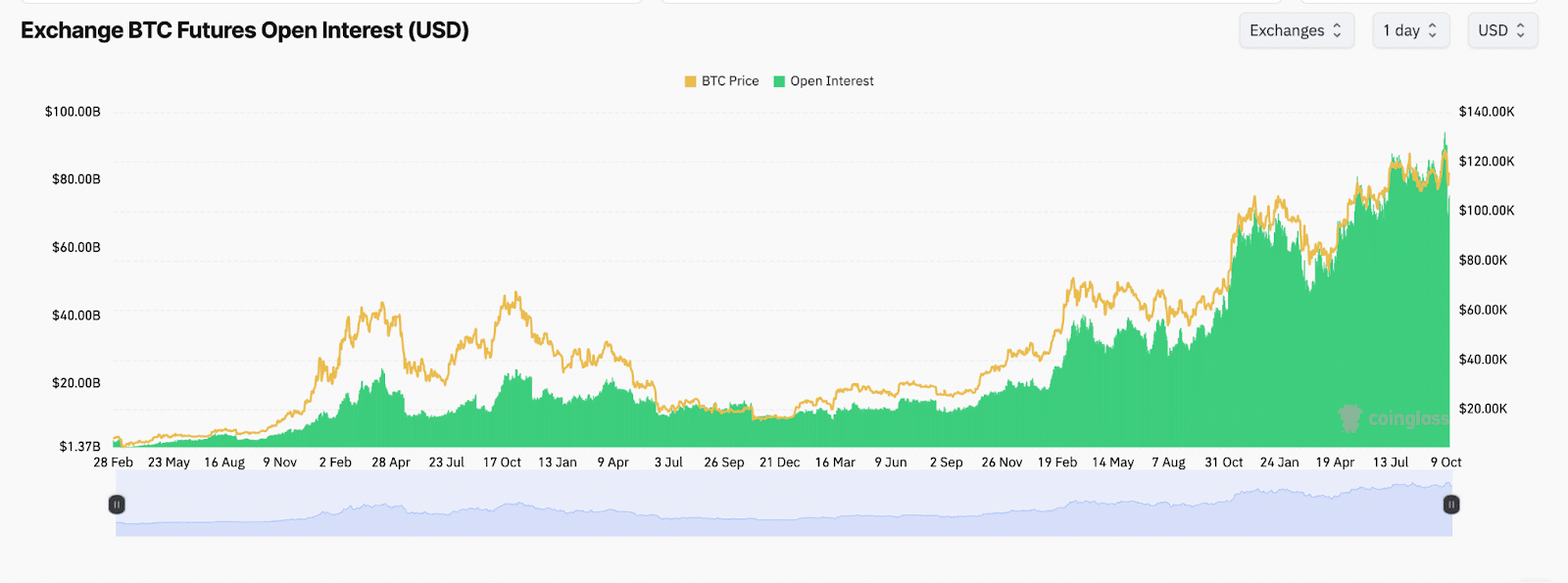

Data from Coinglass shows Bitcoin’s futures open interest rising again after the early-month liquidations.

The recovery in OI signals that traders are cautiously adding positions, a typical sign at the start of “Uptober,” when leverage begins to return to the market.

From early October, open interest (OI) has climbed back toward the $26-$28 billion range, tracking Bitcoin’s rebound above $115,000.

The chart shows a close link between rising OI and Bitcoin’s upward momentum, suggesting that traders are reopening long positions as confidence returns.

This occurred after the price dropped sharply in late September, resulting in one of the largest OI declines of the year.

The consistent increase in the OI when prices are stable is usually an indication of renewed faith in the market, as opposed to excessive speculation.

However, when OI grows too rapidly without corresponding spot demand, it can indicate that it is over-leveraging a structure that can regularly result in yet another round of liquidations.

The Uptober activity is currently gaining momentum, as evidenced by measured OI and price increments, indicating that the Uptober activity is catching on with measured derivatives trading.

The next few days will confirm whether this leverage accumulation can help the market continue its upward trend or not.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post What Does Open Interest Mean For Uptober As Market Recovers? appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.