Aave Earns $6 Million in Fees Overnight as Crypto Market Experiences Major Crash

0

0

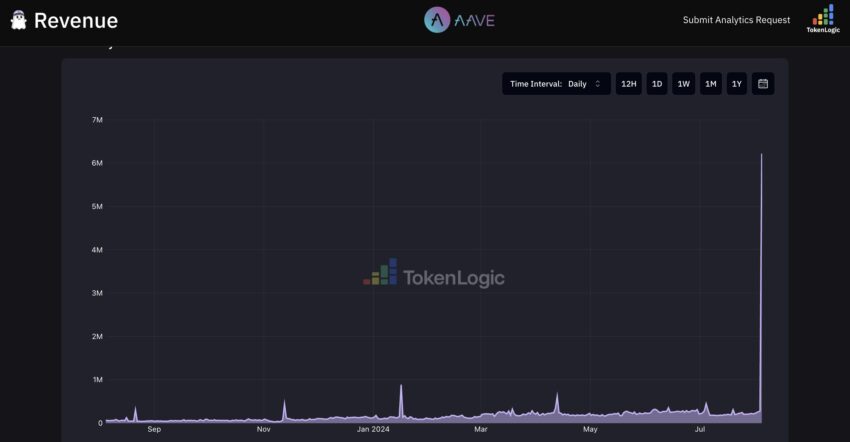

Yesterday’s market downturn brought unexpected gains for the decentralized finance protocol Aave.

Stani Kulechov, Aave’s founder, announced on X (formerly Twitter) that the Aave Treasury had generated $6 million overnight from liquidations.

Aave’s Token Rebounds 15% as User Activity Hits New Highs

Aave allows liquidators to sell a user’s collateral when their positions become risky. This usually happens when someone uses a volatile asset like Ether as collateral and borrows stablecoins or other cryptocurrencies against it. If the value of the collateral drops, Aave lets liquidators sell it to cover the debt.

Renowned crypto analyst Michaël van de Poppe also noted Aave’s achievement during the recent downturn. He even referred to it as one of the “significant events” in the market yesterday.

“DeFi is likely taking off,” Van de Poppe noted.

Read more: What Is Aave?

Aave’s Revenue During the Crypto Market Downturn. Source: TokenLogic

Aave’s Revenue During the Crypto Market Downturn. Source: TokenLogic

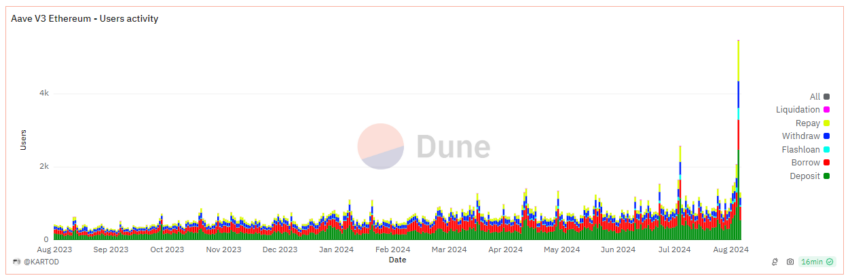

Data from a Dune dashboard confirmed the activity, showing 17 liquidation events on August 5. Additionally, there were 2,127 deposits, 985 repayments, and 614 withdrawals. These figures mark the highest user activity on Aave V3 Ethereum since August last year.

Aave V3 Ethereum Users Activity. Source: Dune/KARTOD

Aave V3 Ethereum Users Activity. Source: Dune/KARTOD

Aave’s native token price performance mirrored its operational success. Despite dropping to $79.15 on August 5, AAVE’s price rebounded to $103.92 within 24 hours, reflecting a 15.1% increase.

Crypto analyst Javon Marks noted Aave’s strength. He highlighted its breakout from a key resistance trend and predicted a potential surge to $628.5.

“With this target, an over 513% uphill run to reach it can take place, and pullbacks may only support this process,” Marks elaborated.

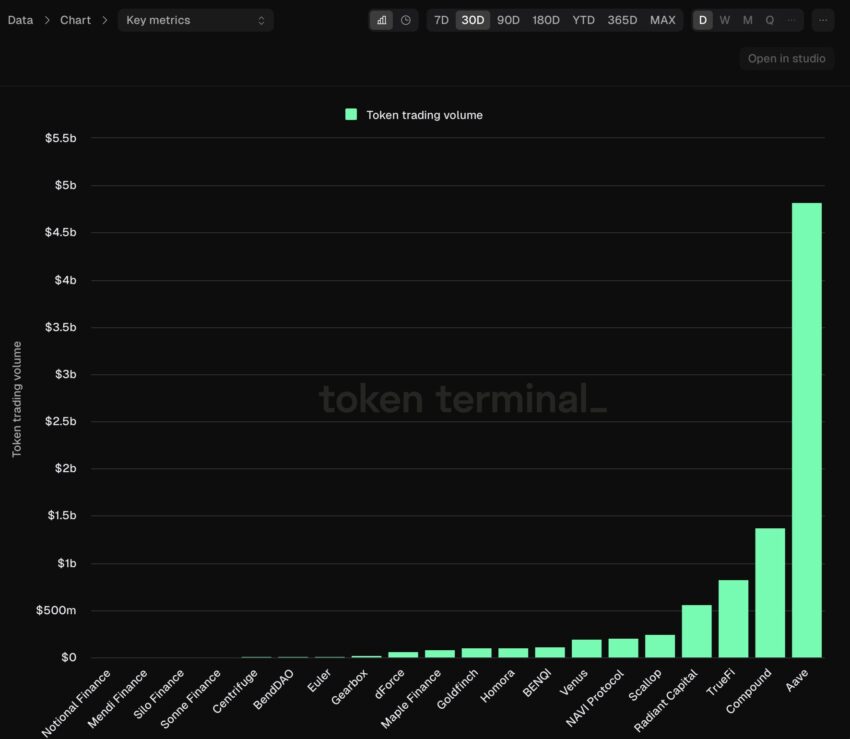

Additionally, data from Token Terminal shows that Aave has had the most interest among traders and investors for the last 30 days. This is evident in the crypto lending market sector’s monthly trading volume among governance tokens. Token Terminal’s chart shows that AAVE’s monthly trading volume almost reached the $5 billion mark over the reporting period.

Read more: Aave (AAVE) Price Prediction 2024/2025/2030

AAVE’s Monthly Trading Volume. Source: X/tokenterminal

AAVE’s Monthly Trading Volume. Source: X/tokenterminal

However, Aave’s total value locked (TVL) is slightly decreasing. Based on DefiLlama data, it is now $10.59 billion, compared to $11.57 billion yesterday.

0

0