Why These Altcoins Are Trending Today — March 13

1

0

Trading activity in the crypto market has continued to pick up, with overall market capitalization on the rise. As investor sentiment improves, several altcoins are seeing increased traction, drawing attention from traders and analysts alike.

Among today’s trending altcoins are Neiro (NEIRO), RedStone (RED), and Sui (SUI).

Neiro (NEIRO)

NEIRO is one of today’s trending altcoins. It is up 6% amid the broader market recovery of the past 24 hours

Its rising Relative Strength Index (RSI) on a four-hour chart reflects the buying activity around NEIRO. At press time, the key momentum indicator, which measures an asset’s oversold and overbought market conditions, rests above the 50-neutral line and is in an upward trend.

When an asset’s RSI is above 50, buying momentum is stronger than selling pressure, suggesting a bullish trend. If this buying pressure strengthens, NEIRO could extend its rally to $0.00031.

NEIRO Price Analysis. Source: TradingView

NEIRO Price Analysis. Source: TradingView

However, if the bears regain market control and selloffs spike, it could trigger a decline toward $0.000018.

RedStone (RED)

RED’s Tuesday listing on leading exchange Coinbase is why it is a trending coin today. Currently trading at $0.58, the token’s price is up 18% in the past day.

On an hourly chart, RED’s rising Accumulation/Distribution (A/D) Line reflects the growing demand among spot market participants.

This indicator tracks the cumulative flow of money into or out of the asset by measuring the relationship between price movement and trading volume. When an asset’s A/D Line climbs, buying pressure outweighs selling pressure. This suggests strong demand for RED and hints at a sustained price rally if buying activity strengthens.

If this happens, RED could rally to $0.64. If it establishes a strong support floor at this level, its price could climb further to $0.71.

RED Price Analysis. Source: Gecko Terminal

RED Price Analysis. Source: Gecko Terminal

Conversely, if the market trend becomes bearish, RED could shed its recent gains and fall below $0.55.

Sui (SUI)

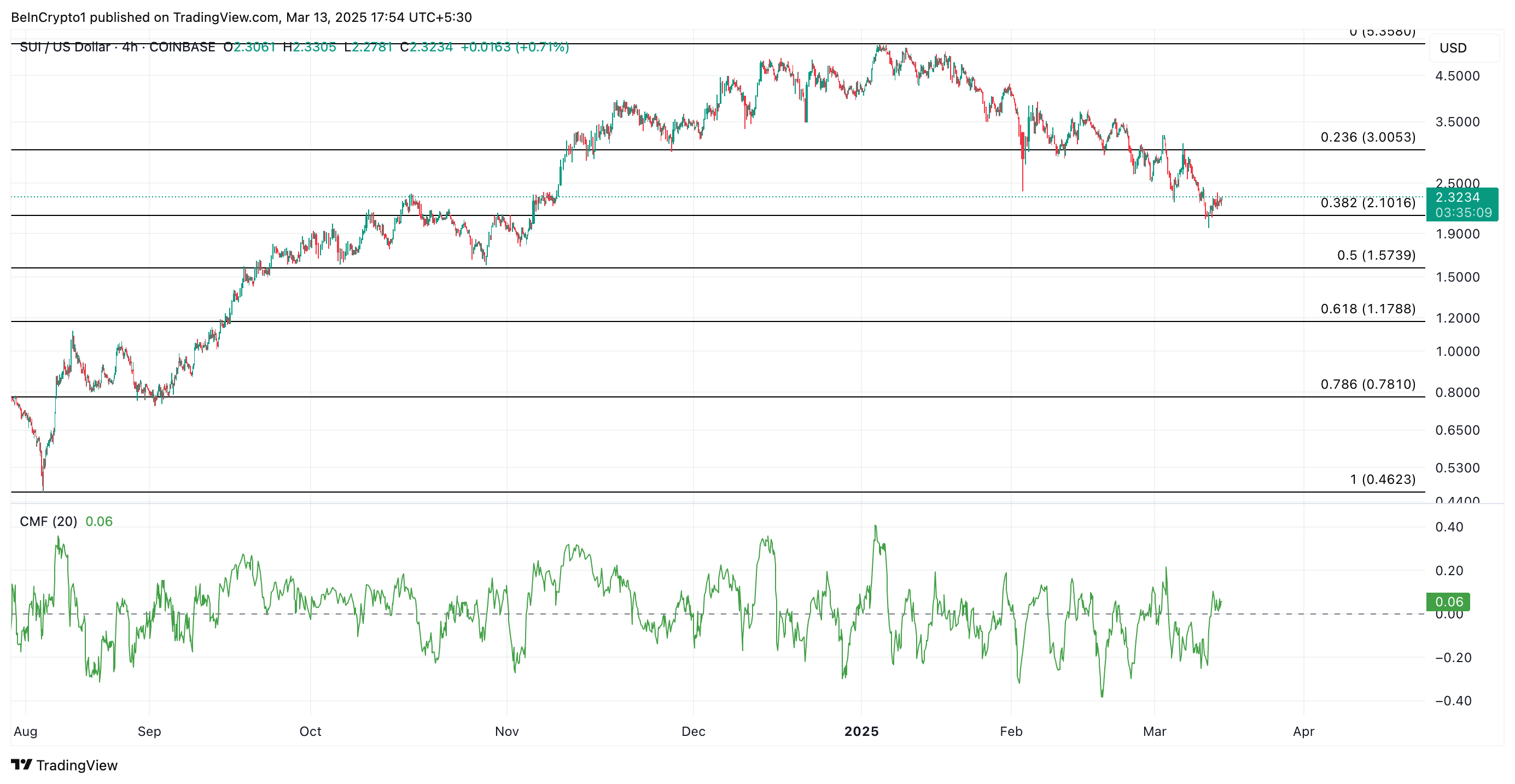

Layer-1 coin SUI is a trending coin today. At press time, it retails for $2.302, and its value has risen slightly by 1% in the past 24 hours.

Also enjoying the bullish pressure in the broader market, SUI’s Chaikin Money Flow (CMF) rests above zero at 0.06 as of this writing.

This indicator measures how money flows into and out of an asset. A positive CMF reading like this indicates that SUI buying pressure is stronger than selling pressure. This points to an accumulation trend and hints at further price gains.

If demand soars, SUI’s price could rally to $3.

SUI Price Analysis. Source: TradingView

SUI Price Analysis. Source: TradingView

On the other hand, if selloffs resume, SUI’s price could fall to $2.10, reversing recent gains.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.