Ethereum Surges as Big Money Pours In—106K ETH ETF Inflow Sparks Frenzy

0

0

Ethereum is back in the spotlight after a sharp price rebound and a wave of institutional activity. The asset jumped from $2,200 to $2,500 last week, triggering one of the most prominent spot ETF inflows in recent months.

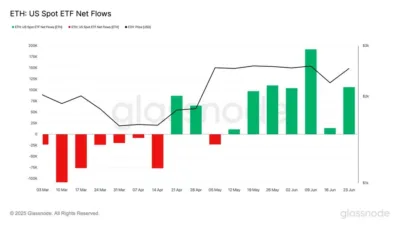

According to Glassnode, Ethereum ETFs recorded net inflows of 106,000 ETH during the week. This marks the seventh straight week of positive flows, pointing to renewed.

Earlier in March, there were massive outflows of Ethereum funds, with the weekly outflow moving to about 100,000 ETH. The reverse of that trend started in April when the market conditions stabilised and investor sentiment was lifted.

Momentum has taken a new turn, as revealed by the charts, with red bars denoting outflows, which are now replaced by rising green bars that indicate unswerving net inflows. This increasing demand means the aggressiveness of institutions.

Also, an Exchange-traded fund is a primary mechanism available to these investors that exposes them to the tokens without possessing them. They have become more widespread, with more organizations seeking a safe way to enter crypto markets.

Source: Glassnode

Also Read: Powell’s July 1 Speech Could Spark Major XRP Rally, Analysts Warn

Consistent Inflows Spark Hopes of Long-Term Strength

The 106,000 ETH inflow recorded last week is one of the largest so far this year. It stands out as a significant signal of growing institutional trust and marks an apparent change in tone from earlier in the year.

Ethereum’s price chart supports this shift, showing steady upward movement since April. Although temporary steps back have occurred, the overall trend has been bullish and justified by growing interest.

According to analysts, this rate of inflows may lead Ethereum to test the resistance levels. Others cite pending network enhancements as other reasons why they could increase long-term value, too.

Ethereum has undergone a dramatic market change since the beginning of 2025. The asset has become stronger since it declined drastically in the early part of this year, due in part to steady ETF activity and rising institutional demand.

With big money flowing in and ETFs drawing steady interest, Ethereum is regaining its footing. If this momentum continues, the second half of 2025 could see even stronger performance.

Also Read: Beware of this XRPL Application, XRP Explorer and Validator Warns Community

The post Ethereum Surges as Big Money Pours In—106K ETH ETF Inflow Sparks Frenzy appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.