UK inflation slows to 2.8% in February sparking rate cut hopes

0

0

The UK’s annual inflation rate edged down to 2.8% in February, slightly below the 2.9% forecast by economists polled by Reuters, according to data released by the Office for National Statistics (ONS) on Wednesday.

The decline follows a sharp rise to 3% in January, after inflation had unexpectedly fallen to 2.5% in December.

Core inflation, which strips out volatile items such as energy, food, alcohol, and tobacco, stood at 3.5% in February, down from 3.7% in January.

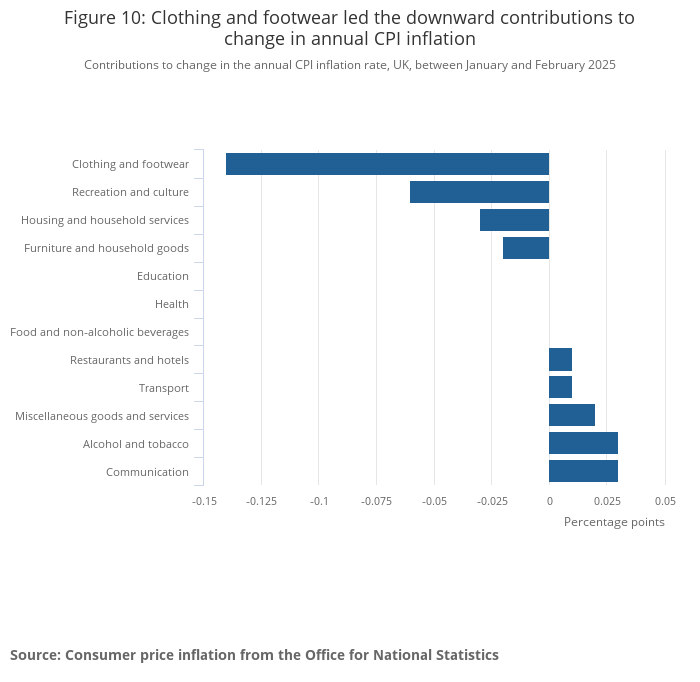

“The slowing in the rate into February 2025 reflected downward contributions from four divisions and upward contributions from five divisions. The largest downward contributions came from clothing and footwear, housing and household services, and recreation and culture,” the ONS stated.

Following the data release, the British pound slipped 0.1% against the US dollar, trading at 1.2925.

BOE’s next moves

The latest inflation figures add to the considerations for the Bank of England (BOE), which left interest rates unchanged at 4.5% in its recent policy meeting.

The UK economy continues to face uncertainty amid global trade policy concerns, potential tariffs, and a forecasted temporary rise in inflation later this year.

The UK economy has shown signs of weakness, contracting by 0.1% in January.

In a statement last week, the central bank noted that “global trade policy uncertainty has intensified, and the United States has made a range of tariff announcements, to which some governments have responded.”

It also highlighted rising geopolitical risks and increased financial market volatility.

The BOE had previously warned that inflation could temporarily rise to 3.7% in the third quarter, driven by higher energy costs.

It also halved its UK growth forecast for 2025 to 0.75%.

Govt’s action plan

The inflation data comes as Finance Minister Rachel Reeves prepares to present an update on government spending and taxation later on Wednesday.

Reeves is expected to outline measures to address a budget shortfall caused by higher borrowing costs since her last fiscal plan in the fall.

She has committed to adhering to her “fiscal rules,” ensuring that daily government spending is covered by tax revenues and that public debt declines as a share of economic output by 2029-30.

The Spring Statement, scheduled for 12:30 p.m. London time, will be delivered alongside updated economic forecasts from the Office for Budget Responsibility (OBR).

Reports indicate that the OBR may lower the UK’s growth forecast for 2025, potentially cutting its previous 2% estimate in half.

A weaker economic outlook is expected to add pressure on government borrowing and may require spending cuts of around £10 billion ($12.96 billion).

The post UK inflation slows to 2.8% in February sparking rate cut hopes appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.