Best Cryptocurrencies to Invest in Today, February 9 – Tron, Ethereum, Stellar

0

0

Highlights:

- TRX is holding steady near $0.28 as treasury buying supports the price and signals strong long-term confidence.

- ETH is trading above $2,080 after buyers defended the $2,050 support, while resistance near $2,200 caps upside.

- XLM has stabilized near $0.16 as selling pressure fades and oversold signals hint at a short-term rebound.

The crypto market has made a U-turn today after a very heavy, volatile week, with BTC falling to the $60,000 mark. Key regulatory developments and institutional buying have stabilized the market. According to sources, the White House is set to host the second round of crypto industry leaders to address stablecoin regulation. Meanwhile, hedge fund manager Jim Cramer noted in a recent interview that the US government bought some BTC during the dip for its strategic Bitcoin reserve.

Despite the optimism, the crypto market may face a pullback this week. The odds for a government shutdown by February 14 have risen to 75% on Polymarket. The recent rally seems fragile for now, and a major bullish trigger will help validate the current momentum.

As of press time, the overall market cap is up 1.55% to $2.4 trillion. However, the trading volume is down 29.55% to $93.55 billion. The total liquidations in the last day totaled $351.75 million, according to Coinglass data. Meanwhile, the fear and greed index stands in the extreme fear zone at an index of 9. With major developments set to strengthen the current rally, here are the best cryptocurrencies to invest in today.

Best Cryptocurrencies to Invest in Today

1. TRON (TRX)

The native coin of the TRON blockchain is trading at $0.2784, a 0.71% increase in the past day. However, its trading volume is down by 22.61% to $524.5 million. Meanwhile, the market cap stands at $26.37 billion.

TRX is set to rally due to strong buying from its own blockchain treasury. Tron recently acquired 179,408 TRX at an average price of $0.28. This purchase pushed the total treasury holdings to 680.7 million TRX.

Tron Inc. (NASDAQ: TRON) acquired 179,408 TRX tokens today at an average price of $0.28, further increasing its TRX treasury holdings to more than 680.7 million TRX in total. The company aims to further grow its Tron DAT holdings to enhance long term shareholder value. For live…

— Tron Inc. (@TRON_INC) February 9, 2026

Moreover, Justin Sun publicly supported the strategy with a clear endorsement. His message strengthened market sentiment around the token. As a result, TRX rebounded after several weeks of weakness. The continued treasury buying is set to reduce the available supply. Over time, this structure will support a sustained price recovery for TRX.

2. Ethereum (ETH)

ETH is trading at $2,080, representing a 0.54% increase over the past 24 hours. The market cap stands at $251.16 billion, while the trading volume has decreased by 41.47% to $21.06 billion.

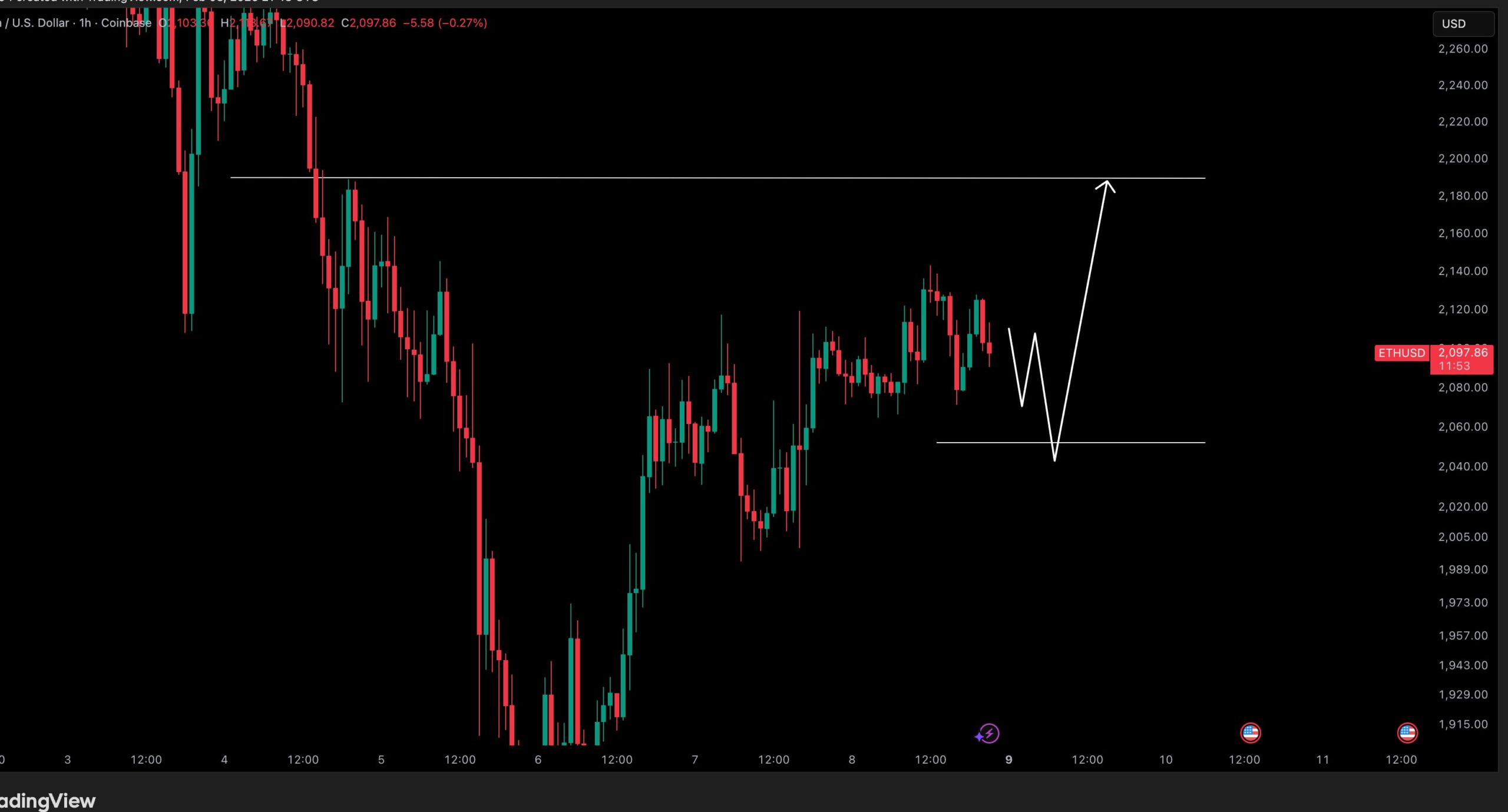

Ethereum is trading inside a clear short-term range after a sharp rebound from recent lows. The price found strong support near the $2,050 zone. Buyers defended this level and pushed the price higher. As a result, Ethereum is now holding above the 2,080 area, but sellers have capped any move near $2,180 to $2,200. This zone acts as the main resistance.

A brief pullback toward $2,050 remains possible first. If support holds, the momentum can rebuild, and a clean break above $2,200 would confirm strength.

3. Stellar (XLM)

XLM, the native token of the Stellar network, is currently trading at around $0.1610, with a 0.6% increase in the past day. The trading volume of the coin is down by 25.69% to $104.2 million, while the market cap stands at $5.26 billion.

Stellar Lumens is trading at a key inflection point after an extended daily downtrend. The price is now resting near the $0.16 support zone. This area has repeatedly attracted buyers in the past. For now, bulls are attempting to stabilize the price action. However, a clear descending trendline is still capping any recovery attempts. Sellers previously defended the $0.26 region and forced sharp pullbacks.

Meanwhile, momentum indicators are showing early exhaustion. The RSI remains near oversold levels, and selling pressure is fading. This shift hints at a possible short-term base. A firm hold above $0.16 could fuel a rebound toward $0.2.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.